From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEurope Steel Market Downturn: Sluggish Demand, Rising Costs Threaten Supply

The European steel market faces continued headwinds as demand weakens and rising energy costs pressure producers, particularly in Italy. According to “Italian long steel market remains quiet amid price pressure” and “European longs market remains sluggish, higher energy costs may boost Italian rebar prices,” the Italian long steel market is experiencing a quiet period, while rising electricity costs may drive up rebar prices. Although production stoppages are expected, there is no explicit link in the news to the observed activity levels of specific steel plants.

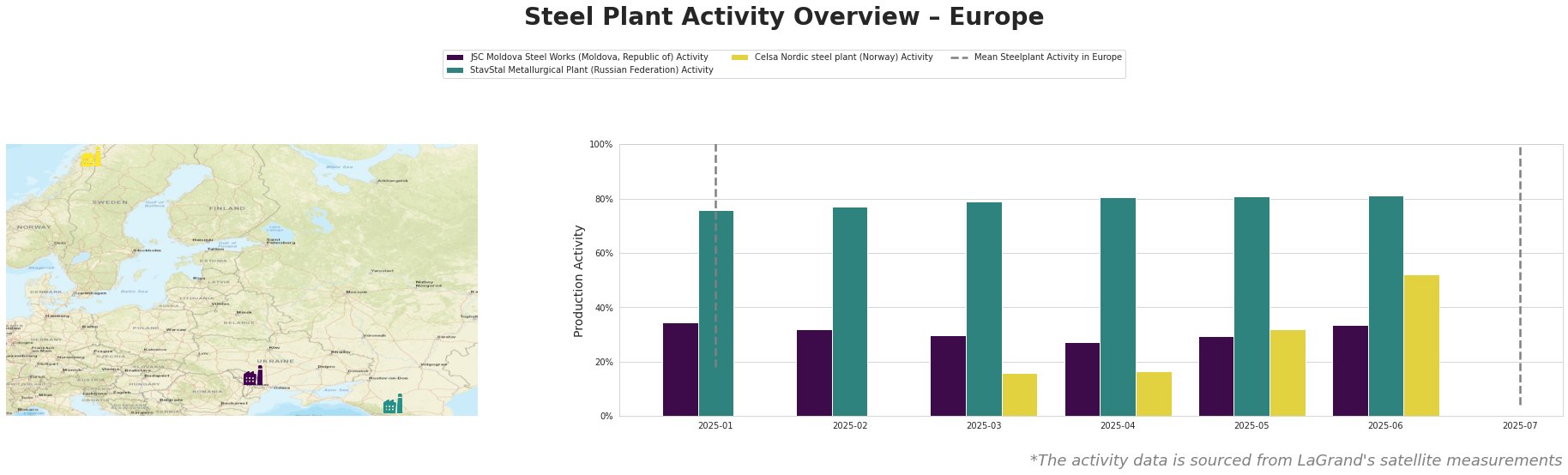

The mean steel plant activity in Europe fluctuated significantly from January to June before experiencing a sharp drop in July.

JSC Moldova Steel Works, an EAF-based plant with a 1 million tonne crude steel capacity producing wire rod, rebar, and billet, showed relatively stable activity levels, ranging from 27% to 34% between April and June, after initially starting from 34% in January and dropping to 27% in April. This plant consistently operated above the European mean for the period of reporting. There’s no explicit connection in the provided news articles to explain these activity patterns.

StavStal Metallurgical Plant, a 500,000 tonne EAF-based producer of square billet, rebar, and wire rod, consistently exhibited high activity, remaining between 76% and 81% from January to June. This is significantly higher than the European mean. No direct relationship between this plants activity and market news could be established based on the current report.

Celsa Nordic steel plant, which produces billet, rebar, and wire rod using EAF technology with a capacity of 700,000 tonnes, exhibited a gradual increase in activity. Starting at 16% in March, it rose to 52% by June, which is still slightly below the European mean for June. The rise in activity is not explicitly linked to any specific events mentioned in the provided news articles.

The combination of sluggish demand and increasing energy costs, as highlighted in “European longs market remains sluggish, higher energy costs may boost Italian rebar prices” and “The European market for long pipes remains sluggish, and higher energy prices may lead to higher prices for Italian fittings,” raises concerns about potential price volatility and localized supply disruptions, particularly in Italy.

Evaluated Market Implications:

Given the pressure on Italian producers due to rising electricity costs, as reported in “European longs market remains sluggish, higher energy costs may boost Italian rebar prices,” buyers sourcing rebar from Italy should anticipate potential price increases and possible production cuts. Specifically, those dependent on Italian rebar should:

- Secure Supply: Buyers should explore diversifying their rebar sources outside Italy.

- Monitor Italian rebar pricing trends: Closely observe Italian rebar price movements as producers attempt to pass on rising energy costs, creating opportunities to buy from alternative suppliers.

- Factor in Logistics: Expect potential shipment delays due to truck shortages mentioned in the article, plan accordingly by holding more safety stock or adjust project timelines if possible.