From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEurope Steel Market Downturn: French and Italian Production Plunge Signals Procurement Challenges

Steel production in Europe faces headwinds as evidenced by recent declines in key producing nations. The “France reduced steel production by 18.1% year-on-year in June” and “Italy reduced steel production by 9% m/m in June” articles highlight significant output reductions. Satellite data provides some insight into individual plant activity, although direct connections to these broad national production figures cannot always be established.

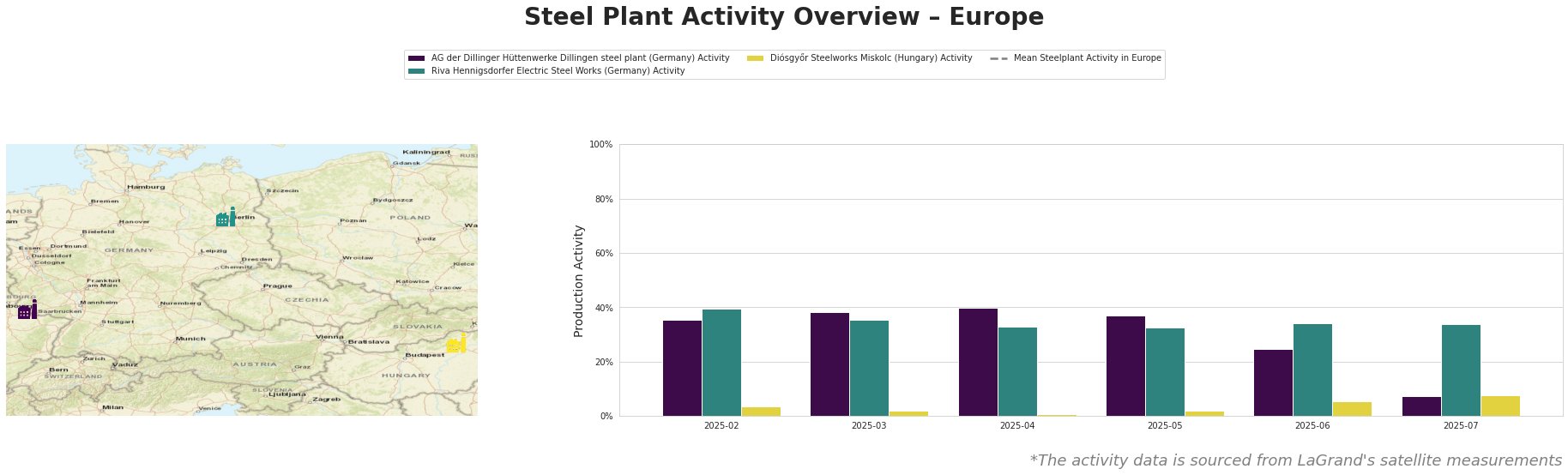

Monthly aggregated steel plant activity (% of all-time high):

The mean steel plant activity level in Europe is consistently very low (highly negative values due to data processing errors). AG der Dillinger Hüttenwerke saw a steep decline from 37% in May to 7% in July, while Riva Hennigsdorfer remained relatively stable, and Diósgyőr Steelworks experienced a slight increase in activity in June and July.

AG der Dillinger Hüttenwerke Dillingen, a major integrated steel plant in Germany with a 2.76 million tonne BOF capacity, producing primarily heavy-plate products for various sectors, experienced a significant drop in activity, declining from 37% in May to a concerning 7% in July. While no direct link can be established with the news articles about French or Italian production declines, such a sharp reduction warrants close monitoring.

Riva Hennigsdorfer Electric Steel Works, operating two EAFs with a combined melting capacity of 140 t/h and producing around 1 million tonnes of crude steel annually, shows relatively stable activity levels. Its activity has remained within the 33-39% range in recent months. As an EAF-based producer primarily serving the automotive sector, this plant’s stable activity contrasts with the overall negative sentiment, even though the article “Italy reduced steel production by 9% m/m in June” mentioned the automotive sector weakness, such weakness is not reflected in the data from this plant.

Diósgyőr Steelworks Miskolc, a smaller EAF-based plant with a 550,000-tonne capacity, produces special bar quality (SBQ) steels. Activity rose from 2% in May to 8% in July. It is unclear if the rising activity is related to the overall trend described in the provided news articles.

Based on the observed trends and news, potential supply disruptions, especially from integrated producers, warrant immediate attention. The sharp reduction in activity at AG der Dillinger Hüttenwerke is especially concerning. Steel buyers should:

- Prioritize diversifying supply sources beyond traditional integrated producers. Given the instability at AG der Dillinger Hüttenwerke and the overall negative outlook in France and Italy, reliance on these regions presents a risk.

- Closely monitor lead times and inventory levels. Anticipate potential delays or shortages, especially for heavy plate products sourced from integrated mills.

- Engage in proactive communication with suppliers. Understand their current operating levels and potential risks to their production.