From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEurope Steel Market: Decarbonization Efforts and ArcelorMittal’s Plans Drive Optimistic Outlook Despite Challenges

Europe’s steel market shows signs of renewed optimism as ArcelorMittal commits to resuming decarbonization projects, influenced by the European Commission’s Steel Action Plan. The observed activity changes in several steel plants may reflect these broader trends. The positive outlook is fueled by news articles such as “ArcelorMittal has committed to resume the implementation of the French decarbonization plan in line with EU measures,” “The European steel giant is preparing to restart green projects after the summer holidays,” and “ArcelorMittal committed to restarting French decarbonization plan following EU measures.” While these articles do not directly correspond to the activity data for the other plants provided, they frame the overall market sentiment. These articles mention the intention to resume decarbonization efforts. However, the news article “Macron unwilling to nationalize ArcelorMittal France” highlights ongoing challenges regarding job security and potential operational shifts within ArcelorMittal France.

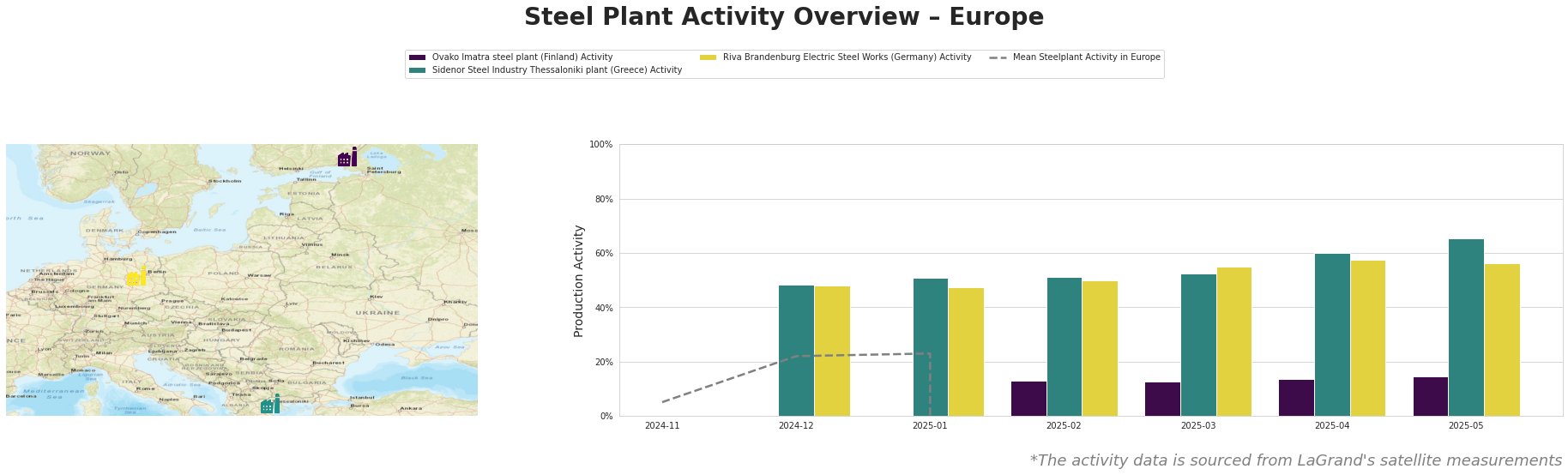

The provided data shows activity at Sidenor Steel Industry Thessaloniki plant (Greece) increased steadily from 48% in December 2024 to 65% in May 2025. The Riva Brandenburg Electric Steel Works (Germany) plant showed a slight increase from 48% in December 2024 to 56% in May 2025. Ovako Imatra steel plant (Finland) shows a modest increase from 13% in February 2025 to 15% in May 2025. The mean steel plant activity is negative due to what is likely erroneous data. No direct connection between the news articles and observed activity at these plants can be established from the provided information.

Ovako Imatra steel plant, located in Imatra, Finland, primarily uses electric arc furnace (EAF) technology to produce approximately 862 ttpa of crude steel, focusing on specialty steels like resistance and spring steel for automotive and energy sectors. Satellite data indicates a slight increase in activity from 13% in February 2025 to 15% in May 2025. No immediate link to the provided news about ArcelorMittal can be established from this data alone.

Sidenor Steel Industry Thessaloniki plant, located in Macedonia, Greece, operates an EAF with a capacity of 800 ttpa, producing rebar, bars & coil, and wire rod mainly for the building and infrastructure sectors. The satellite-observed activity at this plant has shown a consistent increase from 48% in December 2024 to 65% in May 2025. However, there is no direct evidence in the provided articles to link this growth to specific market events or news related to ArcelorMittal’s plans.

Riva Brandenburg Electric Steel Works, situated in Brandenburg, Germany, utilizes EAF technology with a capacity of 1800 ttpa to produce wire rod, rebar, and steel billets. Activity rose from 48% in December 2024 to 56% in May 2025. Similar to the other plants, the data doesn’t provide a direct connection with the ArcelorMittal news, but suggests steady output.

ArcelorMittal’s reaffirmed commitment to decarbonization, driven by the EU’s Steel Action Plan, is expected to positively influence the market. However, potential supply disruptions may arise from ArcelorMittal France due to workforce reductions and operational adjustments, as reported in “Macron unwilling to nationalize ArcelorMittal France.” Considering ArcelorMittal’s focus on decarbonization projects in France and potential workforce adjustments, steel buyers should:

- Diversify Sourcing: Proactively expand the supplier base to mitigate potential disruptions from ArcelorMittal France. Evaluate alternative suppliers within Europe, such as Riva Brandenburg, who are showing stable activity levels, to ensure a consistent supply of steel products like wire rod and rebar.

- Monitor Regional Impacts:Closely monitor regional news and production data for Northern France as ArcelorMittal reconfigures its operations. Stay informed about the progress of the Dunkirk EAF project, announced in the news articles, and assess its impact on the availability of green steel.

- Engage with Suppliers: Engage in direct communication with key suppliers, including ArcelorMittal, to clarify their production plans and timelines related to decarbonization efforts. Discuss potential impacts on product availability, pricing, and delivery schedules.

These actions are intended to provide targeted strategies for steel procurement professionals, informed by current news and observed production trends.