From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEurope Steel Market: Coking Coal Expansion Fuels Positive Outlook Despite Localized Declines

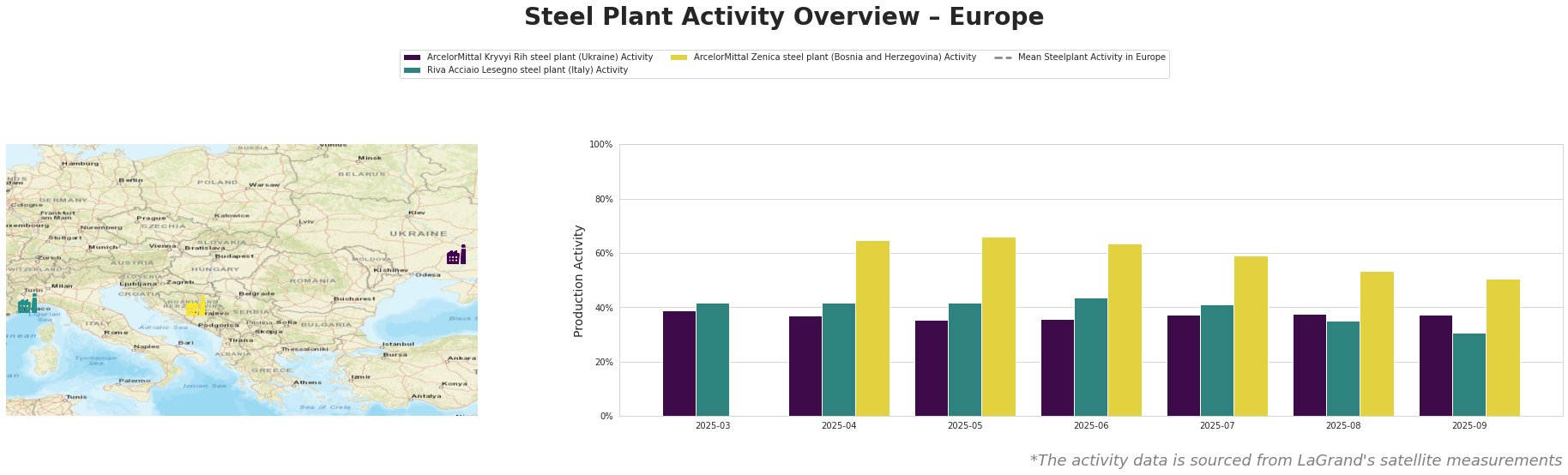

Europe’s steel market demonstrates a positive outlook, primarily driven by increased coking coal production in Poland. The upward trend is supported by news articles such as “Poland’s JSW mined 1.01 million tons of coal in August,” “Poland’s JSW launches a new longwall at Pniówek mine with 490 thousand tons of coal reserves,” and “Poland’s JSW continues to expand coking coal resources with another longwall at Pniówek mine“. While increased coking coal availability suggests a strengthened supply chain for steel production, satellite data reveals varied activity levels across European steel plants.

ArcelorMittal Kryvyi Rih, an integrated BF-BOF steel plant in Ukraine with a crude steel capacity of 8000 ttpa, has shown relatively stable activity, fluctuating between 35% and 39% from March to September 2025. There is no immediately evident connection between the reported increase in Polish coking coal production and activity at this plant based on the provided news.

Riva Acciaio Lesegno, an EAF-based steel plant in Italy with a crude steel capacity of 600 ttpa, has experienced a notable activity decline, decreasing from 43% in June to 31% in September 2025. The decline at Riva Acciaio Lesegno cannot be directly linked to any of the provided news articles concerning Polish coking coal production.

ArcelorMittal Zenica, an integrated BF-BOF-EAF steel plant in Bosnia and Herzegovina with a crude steel capacity of 1940 ttpa, demonstrated a downward trend in activity, decreasing from 66% in May to 50% in September 2025. This decrease cannot be directly linked to the provided news articles regarding Polish coking coal production.

The increased coking coal production by JSW, detailed in “Poland’s JSW mined 1.01 million tons of coal in August,” “Poland’s JSW launches a new longwall at Pniówek mine with 490 thousand tons of coal reserves,” and “Poland’s JSW continues to expand coking coal resources with another longwall at Pniówek mine,” supports a positive outlook for steel production inputs. However, the satellite data shows decreasing activity at the Riva Acciaio Lesegno and ArcelorMittal Zenica steel plants.

Based on the expansion of coking coal resources reported in “Poland’s JSW launches a new longwall at Pniówek mine with 490 thousand tons of coal reserves” and “Poland’s JSW continues to expand coking coal resources with another longwall at Pniówek mine,” steel buyers and market analysts should consider the following:

- Procurement Action: Given the increased coking coal production by JSW, buyers should explore opportunities to secure more favorable pricing or long-term supply contracts with JSW or other suppliers who benefit from this increased availability.

- Market Analysis: The activity decline observed at Riva Acciaio Lesegno and ArcelorMittal Zenica, alongside the increased coking coal availability, warrants a closer look at regional demand and other factors affecting production beyond raw material supply. A recommendation would be to examine local economic indicators, import/export data, and energy costs within Italy and Bosnia to determine the underlying causes of the production slowdown.