From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEurope Steel Market Buoyant Despite Regional Production Variances: Ukraine Exports Down, Spain Up

Europe’s steel market exhibits a very positive sentiment, marked by both growth and regional disparities. Recent shifts in steel plant activity levels have occurred against the backdrop of news events like “Steel production in Ukraine decreased by 6.1% YoY in August,” “Global steel production rose by 0.3% y/y in August,” and “France reduced steel production by 12% y/y in August.” These articles, alongside activity data, paint a picture of a complex market landscape, though a direct link between activity levels and the news articles could only partially be established.

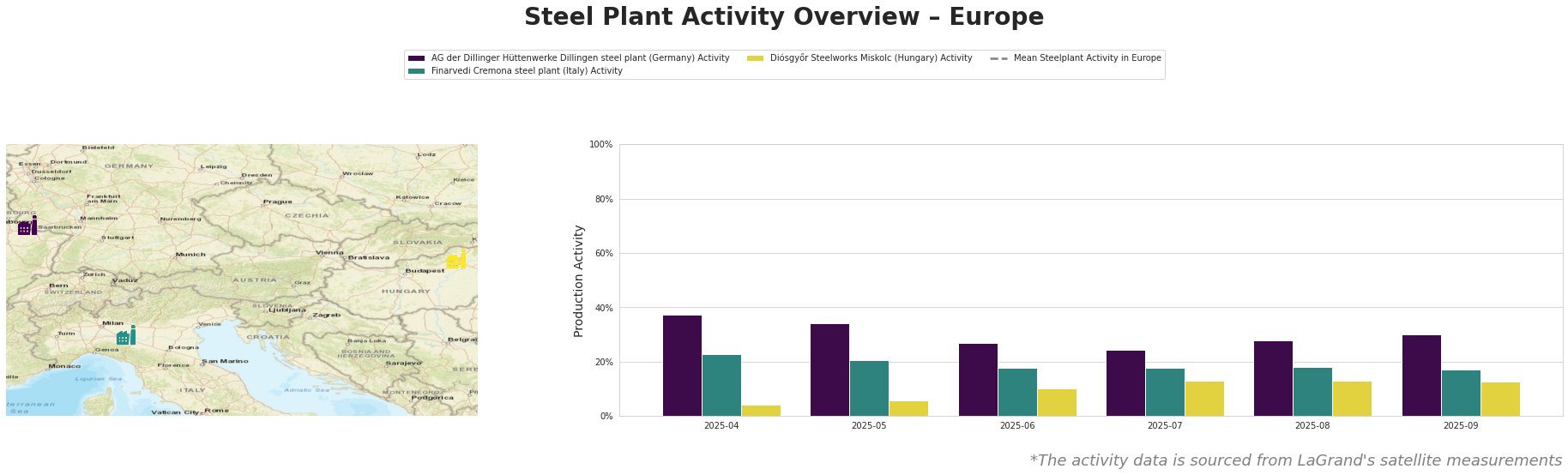

Overall, average European steel plant activity has fluctuated, reaching peaks in May and July/August 2025. The activity levels for August 2025 remain significantly elevated.

The AG der Dillinger Hüttenwerke Dillingen steel plant in Germany, a major integrated steel producer with a capacity of 2.76 million tons of crude steel (BOF) and 4.79 million tons of iron (BF), has exhibited a decline in activity from April (37%) to July (24%), followed by a slight recovery to 30% in September. Given the news of “France reduced steel production by 12% y/y in August” and France sharing a border with Germany, there may be a correlated impact on Dillingen, although no direct evidence can be established. The plant’s focus on heavy-plate products for sectors like energy and infrastructure implies that its production is sensitive to broader economic conditions and demand within these sectors.

The Finarvedi Cremona steel plant in Italy, an EAF-based producer with a crude steel capacity of 3.85 million tons, has displayed a relatively stable activity level, fluctuating between 17% and 23% over the observed period. This stability might be attributed to its focus on hot rolled coil and galvanized products for the automotive sector. The news articles do not provide a direct link to the plant’s activity.

Diósgyőr Steelworks in Miskolc, Hungary, a smaller EAF-based plant with a 550,000-ton crude steel capacity, has shown a consistent upward trend in activity, increasing from 4% in April to 13% in July and remaining stable through September. This growth trajectory, while notable, cannot be directly correlated with any specific news mentioned, although, given the “Industrial production in Ukraine fell by 3% y/y in January-July” it could be that demand has shifted west, though that connection can not be proven with the provided information. The plant’s focus on specialty steels for the building and infrastructure sector may explain its steady increase in activity as it is serving a specific, growing niche.

The “Ukraine’s steel exports down 13% as domestic consumption rises” article, when viewed alongside satellite observations that don’t capture Ukraine, indicates possible regional shifts. While Ukrainian production decreased, Spanish steel production increased, according to the article “Spain increased steel production by 4.4% y/y in January-August,” suggesting some production is moving from Ukraine to other regions.

Given these trends, steel buyers and market analysts should:

- Monitor Spanish steel prices closely: As suggested by “Spain increased steel production by 4.4% y/y in January-August,” Spanish steel mills may present favorable procurement opportunities due to increased production capacity utilization compared to other European countries like France.

- Assess the impact of Ukrainian export reductions: The “Ukraine’s steel exports down 13% as domestic consumption rises” article could lead to a steel shortage in specific steel product categories. Steel buyers dependent on Ukrainian exports should diversify their supply chain to prevent disruptions, although alternative suppliers are not directly named in the provided articles.