From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEurope Steel Market Braces for Uncertainty: Trump’s UN Stance and Steel Plant Activity Dip

Europe’s steel market faces increased uncertainty amidst political tensions and fluctuating plant activity. The analysis is driven by news surrounding Donald Trump’s UN General Assembly address and the associated commentary, alongside recent changes in steel plant activity across the region. The activity shifts at key plants can be directly related to developments discussed in various news articles like “UN-Generaldebatte im Liveticker: ++ Trump kritisiert europäische Migrationspolitik – und lobt plötzlich Deutschland ++“, “Trump attackiert UNO und warnt Europa vor Ruin“, and “UN-Generaldebatte: ++ Trump nennt Russland einen „Papiertiger“ – Selenskyj ist überrascht von „großer Kehrtwende“ ++ Liveticker“.

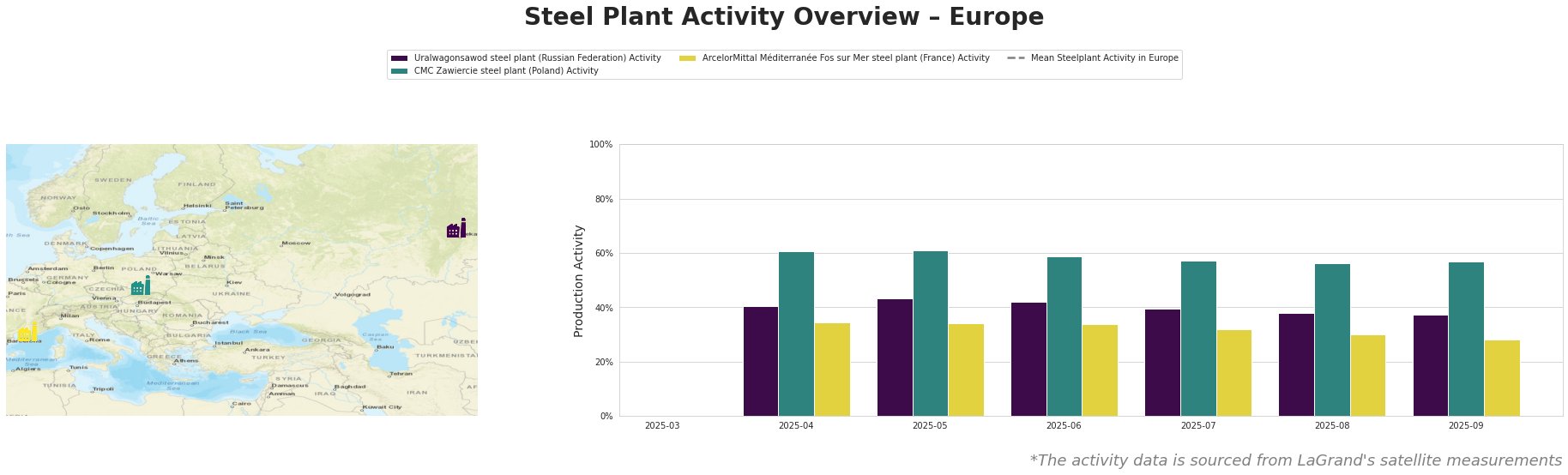

The mean steel plant activity in Europe demonstrates volatility over the observed period, peaking in May and July before a significant drop in September. The Uralwagonsawod steel plant in Russia shows a consistent decline from April (40%) to September (37%). CMC Zawiercie in Poland experienced a decrease in activity from April (61%) to August (56%) but rebounded slightly in September (57%). ArcelorMittal Méditerranée in France shows a steady decline in activity from April (35%) to September (28%).

Uralwagonsawod steel plant (Russian Federation): This plant, serving primarily the defense sector, showed a steady decline in activity levels from 40% in April to 37% in September. While the plant details do not provide specific capacity information, this downward trend could be indirectly related to the political and economic uncertainty reflected in articles such as “UN-Generaldebatte: ++ Russland ist weder „Papiertiger“ noch „Papierbär“, spottet der Kreml über Trump ++ Liveticker“, as changing international relations may affect the Russian defense sector. However, a direct causal link cannot be definitively established.

CMC Zawiercie steel plant (Poland): This EAF-based plant with a crude steel capacity of 1.7 million tonnes per annum, serving sectors like automotive and infrastructure, saw a decrease in activity from 61% in April to 56% in August, before a slight rebound to 57% in September. No direct connection to the named news articles can be established for these fluctuations.

ArcelorMittal Méditerranée Fos sur Mer steel plant (France): A major integrated steel plant with 4 million tonnes of crude steel capacity, serving automotive and construction industries, witnessed a steady decline from 35% in April to 28% in September. This decline occurs in the context of Trump’s criticism of European policies as reported in “Trump attackiert UNO und warnt Europa vor Ruin”. While this may signal a weakening economic outlook for the French steel industry in line with the news, a direct causal link to the news events cannot be established due to various economic factors that may play a role.

Given the overall negative sentiment driven by political uncertainties and the observed decline in steel plant activity, procurement actions should prioritize:

- Diversification of Supply Sources: Steel buyers should actively explore alternative supply options outside of the directly impacted regions to mitigate potential disruptions. Specifically, buyers who rely on ArcelorMittal Méditerranée (France) should immediately explore alternative suppliers given the steady decline in activity.

- Negotiating Contractual Protections: New or renegotiated contracts should include clauses that protect against supply disruptions and price volatility stemming from geopolitical events and potential trade conflicts.

- Increased Inventory: Maintain slightly higher-than-normal inventory levels of critical steel products to buffer against potential short-term supply shortages.

- Closely Monitor Geopolitical Developments: Continuously track developments related to trade policies and international relations, particularly any statements or actions by key political figures, as these could have a significant impact on the steel market. Pay close attention to further commentary regarding Trump’s UN address as reported in news such as “UN-Generaldebatte im Liveticker: ++ Trump befürwortet Abschuss russischer Jets bei Verletzung des Nato-Luftraums – Kehrtwende bei Ukraine-Kurs ++“.