From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEurope Steel Market Booms: New Mill and Green Upgrades Drive Optimism

The European steel market shows strong positive sentiment driven by capacity expansions and green initiatives. The “Metinvest, Danieli complete €3bn flats mill JV closing“ and “Metinvest and Danieli are completing the closure of a joint venture for the production of rolled products worth €3 billion.“ articles detail significant investments in new, low-carbon flat steel production. These articles suggest an increase in future flat steel supply. There is currently no direct correlation between these investments and observed recent satellite activity data across all observed steel plants, based on the provided data, since they concern future production capabilities.

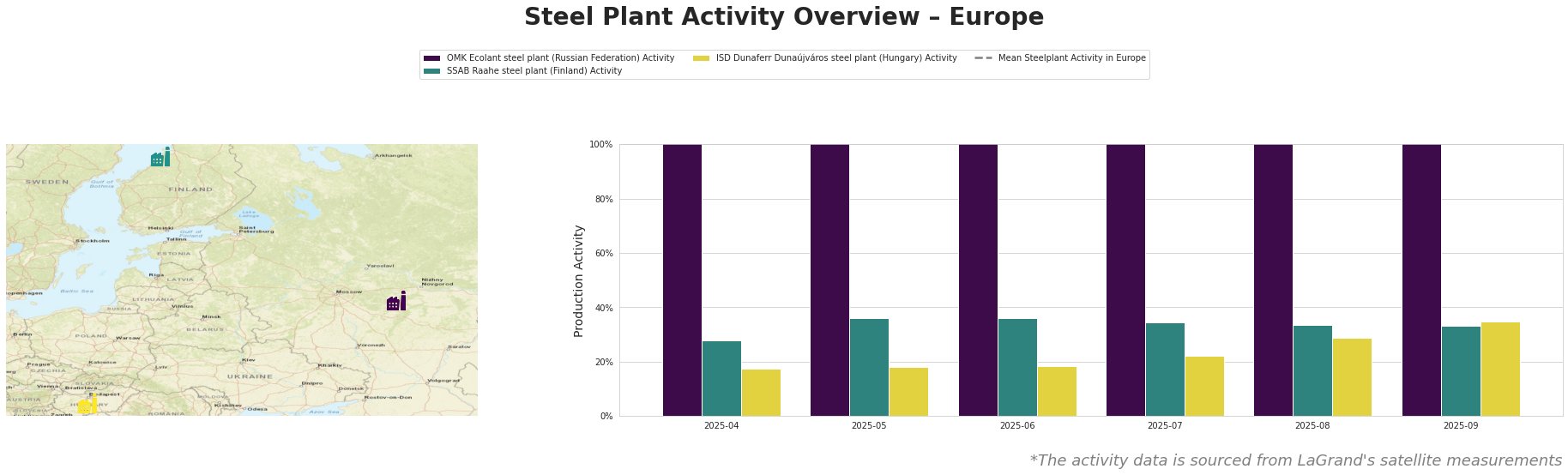

The mean steel plant activity in Europe fluctuated significantly, ranging from approximately 5.2E9 to 7.0E9. OMK Ecolant consistently registered very high activity levels. SSAB Raahe experienced a rise from 28% in April to 36% in May and June, before slightly decreasing to 33% in September. ISD Dunaferr showed a steady increase in activity from 17% in April to 35% in September. There is no directly attributable link between these observed activities and the news articles, as no plant is explicitly mentioned in them other than through future developments.

OMK Ecolant, a Russian DRI-EAF based plant with a 1.8 million tonne EAF capacity and ResponsibleSteel certification, consistently showed very high activity levels compared to the European mean. The plant produces semi-finished products like slabs and round billets.

SSAB Raahe, an integrated BF-BOF plant in Finland with a 2.6 million tonne crude steel capacity and ResponsibleSteel certification, experienced a peak in activity in May and June. SSAB plans to transition to EAF production by 2030. Recent changes in plant activity are not directly linked to specific news articles.

ISD Dunaferr, a BF-BOF based plant in Hungary with a 1.6 million tonne crude steel capacity, showed steady increases in activity over the observed period. The plant produces hot-rolled, cold-rolled, and coated products. There is no clear connection between activity levels and the provided news articles.

The “ArcelorMittal Sestao picks Danieli for new green steel upgrades in Spain“ highlights investments in emissions reduction and capacity expansion at the ArcelorMittal Sestao plant. This project, unrelated to the other plants listed, signals a move towards greener steel production and increased capacity for advanced flat products, but there is no observed activity data for it.

Evaluated Market Implications

The “Metinvest, Danieli complete €3bn flats mill JV closing” suggests an increase in flat steel production capacity in Europe in the future.

Procurement Actions: Steel buyers should closely monitor progress of the Metinvest Adria project and, if possible, establish early contact with Metinvest to explore potential supply agreements for future hot-rolled steel needs. Due to ArcelorMittal Sestao’s upgrade, procurement professionals can start preparing for potential shifts in the availability and pricing of ultra-clean and advanced flat steel products suitable for the automotive and clean technology sectors around August 2026.