From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEurope Steel Market: Australian Iron Ore Surge Offsets Ukrainian Production Concerns Amidst Stable German Output

European steel markets face a mixed outlook. While increasing Australian iron ore output, reported in “Australia’s Mineral Resources posts higher iron ore output for FY 2024-25” and “Australia’s Fenix Resources posts sharp rise in output and sales for FY 2024-25,” may mitigate raw material price pressures, activity at the Donetsksteel Metallurgical Plant in Ukraine remains depressed, potentially impacting pig iron supply. The satellite-observed data shows no direct relationship to the Australian news articles.

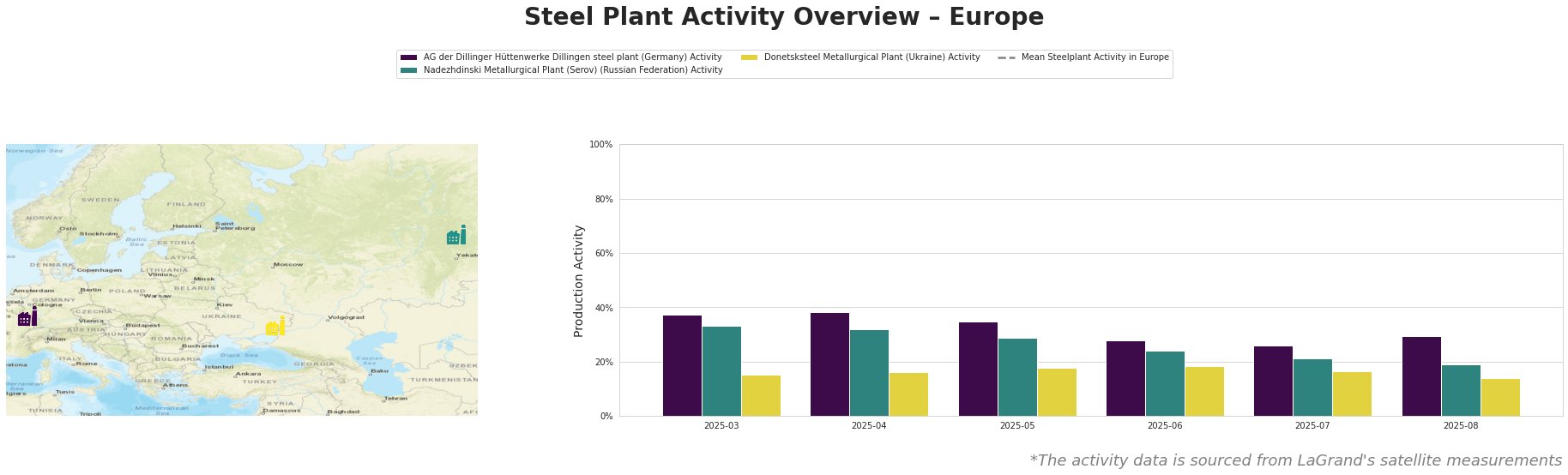

The data reveals relatively stable activity at AG der Dillinger Hüttenwerke in Germany, fluctuating between 26% and 38%. Nadezhdinski Metallurgical Plant in Russia experienced a gradual decline from 33% in March to 19% in August. Donetsksteel Metallurgical Plant in Ukraine consistently shows low activity, ranging from 14% to 18%, significantly below the levels of the other two plants. The “Mean Steelplant Activity in Europe” has no meaningful relationship to the individual activity levels.

AG der Dillinger Hüttenwerke Dillingen steel plant, an integrated BF-BOF producer with a crude steel capacity of 2.76 million tonnes, shows relatively stable activity. The observed fluctuations do not directly correlate with the provided news articles. The plant produces a wide range of heavy-plate products catering to various sectors.

Nadezhdinski Metallurgical Plant (Serov), an EAF-based producer with a crude steel capacity of 756,000 tonnes, has seen a gradual decline in activity over the period. There’s no explicit connection to the provided news articles. The plant primarily produces rolled steel bars and billets.

Donetsksteel Metallurgical Plant, with a pig iron capacity of 1.5 million tonnes, exhibits consistently low activity. This aligns with its operational details, indicating that BOF and EAF operations are either dismantled or mothballed. The reduced activity at this plant likely affects the regional supply of pig iron but shows no direct connection to the Australian iron ore news.

The increased iron ore supply from Australia, highlighted in “Australia’s Fenix Resources posts sharp rise in output and sales for FY 2024-25” and “Australia’s Mineral Resources posts higher iron ore output for FY 2024-25,” should ease price pressures on iron ore. However, steel buyers should monitor pig iron prices and availability due to the persistently low activity at Donetsksteel. Procurement professionals are advised to diversify their pig iron supply sources and consider forward purchasing to mitigate potential disruptions. Given the stable output at Dillinger, buyers focused on heavy plate can likely maintain existing procurement strategies. Buyers sourcing from Nadezhdinski Metallurgical Plant should closely monitor its output and be prepared to secure alternative suppliers if the downward trend continues.