From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEurope Steel: HRC Prices Rise Amid Summer Lull; Activity Mixed Amid CBAM Concerns

European steel market activity is experiencing a summer slowdown, with mixed signals across different product categories. The “EU plate, slab spot liquidity drops amid summer lull” article indicates weakening import demand due to the upcoming Carbon Border Adjustment Mechanism (CBAM) and seasonal factors, which may influence the production strategies of domestic mills. Activity in steel plants also appears to be fluctuating. “Stainless steel prices in Europe continue to fall amid summer lull” highlights continuous price declines due to low demand and increased import competition. In contrast, the “Prices are rising in the European HRC market amid a lull” article notes a slight increase in HRC prices despite weak seasonal demand, while the “UK HRC prices steady on seasonal summer slowdown” article observes stable prices in the UK but raises concerns about tightening UK quotas on certain steel types.

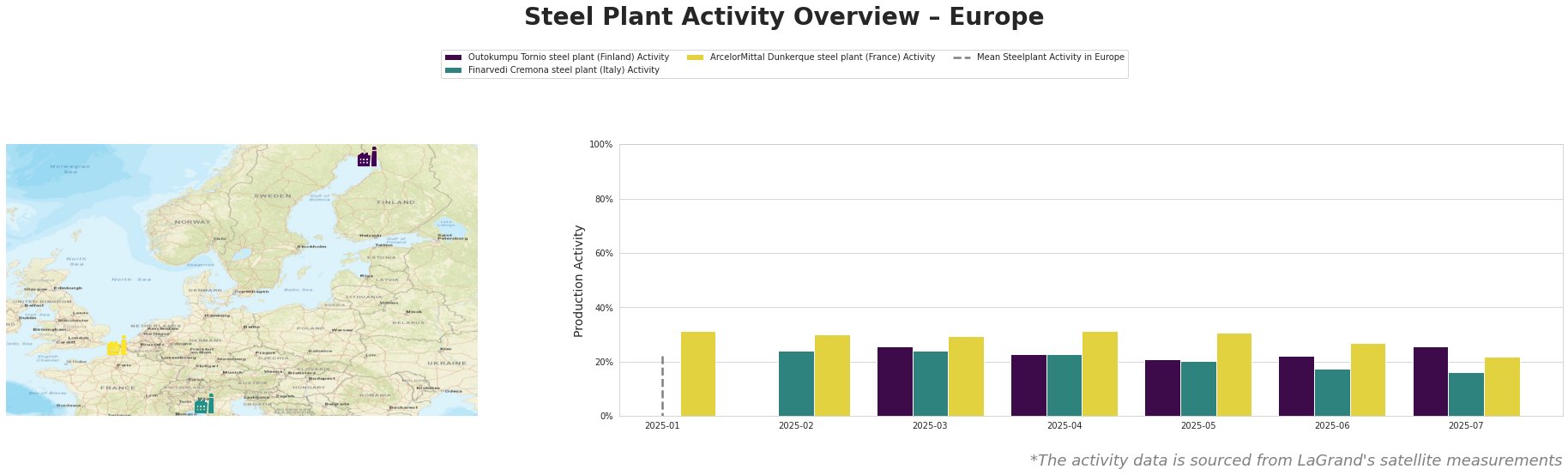

The provided data shows fluctuating activity levels across the measured plants. The “Mean Steelplant Activity in Europe” fluctuates significantly and is not a reliable representation of activity levels. Activity at ArcelorMittal Dunkerque steel plant (France) showed relative stability at around 30%, dropping in June and further dropping significantly to 22% in July. Activity at Finarvedi Cremona steel plant (Italy) declined steadily from 24% in February and March to 16% in July. Activity at Outokumpu Tornio steel plant (Finland) peaked at 26% in March and July, with lows of 21% in May.

Outokumpu Tornio, located in Lapland, Finland, operates two EAFs with a crude steel capacity of 1.2 million tonnes per year, focusing on stainless steel products like cold-rolled coil, strip, and sheet. The plant serves various sectors including automotive and construction. Observed activity at the plant fluctuated, reaching 26% in March and July. While “Stainless steel prices in Europe continue to fall amid summer lull” mentions decreased demand, no direct connection can be established between this news and the observed activity levels.

Finarvedi Cremona, situated in the Province of Cremona, Italy, produces around 3.85 million tonnes of crude steel annually using two EAFs, specializing in hot-rolled coil and galvanized products for the automotive industry. Plant activity has steadily decreased, reaching a low of 16% in July. This decline may relate to the overall summer slowdown mentioned in “EU plate, slab spot liquidity drops amid summer lull,” although no explicit relationship can be established.

ArcelorMittal Dunkerque, based in Haus-de-France, operates using the integrated BF-BOF process with a crude steel capacity of 6.75 million tonnes per year, producing slabs and hot-rolled products. Activity levels at Dunkerque decreased to 22% in July. The “EU plate, slab spot liquidity drops amid summer lull” suggests potential CBAM-related impacts on plate and slab demand, and given that ArcelorMittal Dunkerque produces slabs, this could potentially explain the activity decline.

Given the summer slowdown, the observed decline in activity at Finarvedi Cremona, and the potential CBAM-related impacts on plate and slab demand, steel buyers should closely monitor domestic plate and slab prices after summer, as suggested by the “EU plate, slab spot liquidity drops amid summer lull” article. Furthermore, monitor import dynamics in the UK, specifically the UK HRC quotas and port congestion mentioned in the “UK HRC prices steady on seasonal summer slowdown” article, when procuring HRC.