From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEurope Steel: CBAM Uncertainty Stalls HRC Trading Amid Stable Plate Prices, Plant Activity Mixed

The European steel market faces a complex landscape, marked by CBAM-related uncertainties impacting HRC trading, as highlighted in “European HRC trading at near standstill amid ample stocks, CBAM uncertainty” and “European HRC price remains stable as mills eye higher levels“. While HRC demand stagnates, heavy plate prices show resilience, supported by CBAM cost expectations, as reported in “Steel heavy plate prices edge higher supported by persistent expectations of CBAM costs“. Plant activity levels reflect this mixed sentiment.

The news article “Europe steel market in the final week of november: Weak demand, tighter quotas and stabilizing prices” reports stable HRC prices despite declining EU steel production. A connection between this article and observed plant activity cannot be explicitly established from the data provided.

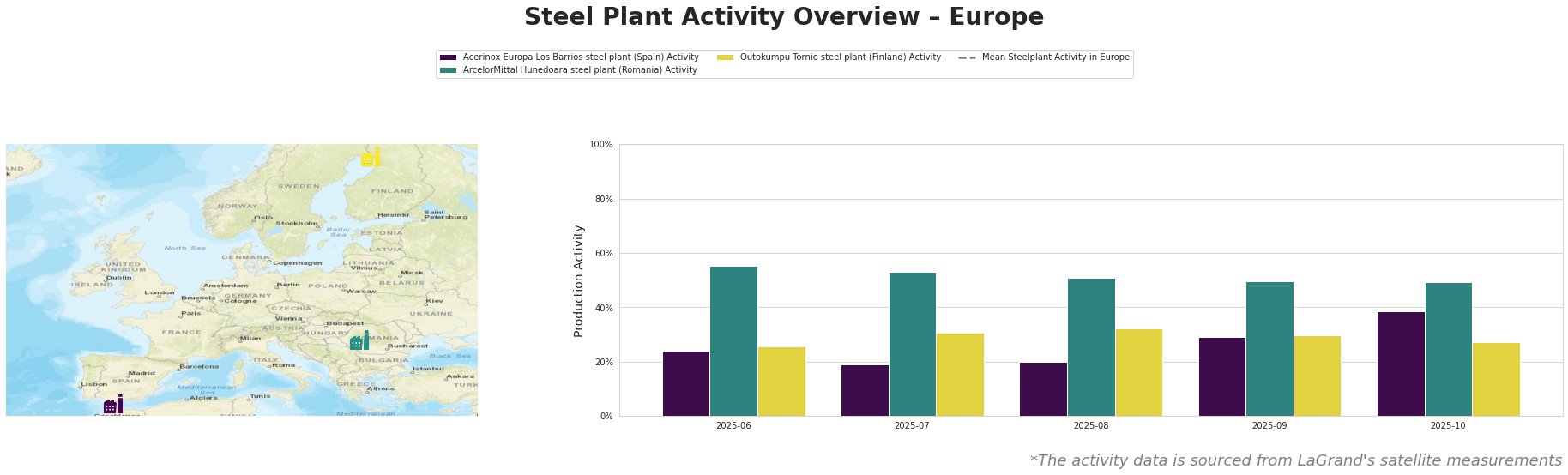

The mean steel plant activity in Europe shows fluctuating levels across the observed period, with the lowest activity in October 2025.

Acerinox Europa Los Barrios, a Spanish stainless steel producer relying on EAF technology, experienced a steady increase in activity from June (24%) to October (39%). This increase in activity does not appear to correlate directly with any of the provided news articles, as these focus more on HRC and heavy plate market dynamics.

ArcelorMittal Hunedoara, a Romanian long profile producer using EAF technology, demonstrates a gradual activity decrease from June (55%) to October (49%). Like Acerinox, there is no explicit connection to the specific news articles provided.

Outokumpu Tornio, a Finnish stainless steel producer, maintained a relatively stable activity level. Starting at 26% in June, activity peaked at 32% in August before declining to 27% in October. These fluctuations do not have a clear link to the provided news articles.

Given the ample HRC stocks reported in “European HRC trading at near standstill amid ample stocks, CBAM uncertainty” and stable prices noted in “Europe steel market in the final week of november: Weak demand, tighter quotas and stabilizing prices“, steel buyers should:

- Delay HRC restocking: With distributors well-supplied and uncertainty surrounding CBAM implementation, postpone large-scale HRC purchases until clearer pricing trends emerge, potentially early 2026, as indicated in “European HRC trading at near standstill amid ample stocks, CBAM uncertainty“.

- Focus on heavy plate procurement: Given the expectation of rising CBAM costs driving heavy plate prices as highlighted in “Steel heavy plate prices edge higher supported by persistent expectations of CBAM costs“, secure necessary volumes now to mitigate future cost increases.

- Monitor import dynamics closely: The “European HRC trading at near standstill amid ample stocks, CBAM uncertainty” article indicates a wide range of import offers including DDP contracts that factor in CBAM costs. Closely monitoring these offers will be key to optimizing costs.