From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEU-UK Steel Deal Boosts Confidence: Activity Ramps Up at Key European Plants

The European steel market is showing positive signs following the recent EU-UK trade agreement. “UK Steel welcomes linking with EU carbon markets” and “UK and EU reach new deal to set out post-Brexit relations” highlight improved market access and reduced trade friction for UK steel exports to the EU. Satellite data reveals concurrent activity increases at key steel plants, although a definitive causal link cannot be established for all.

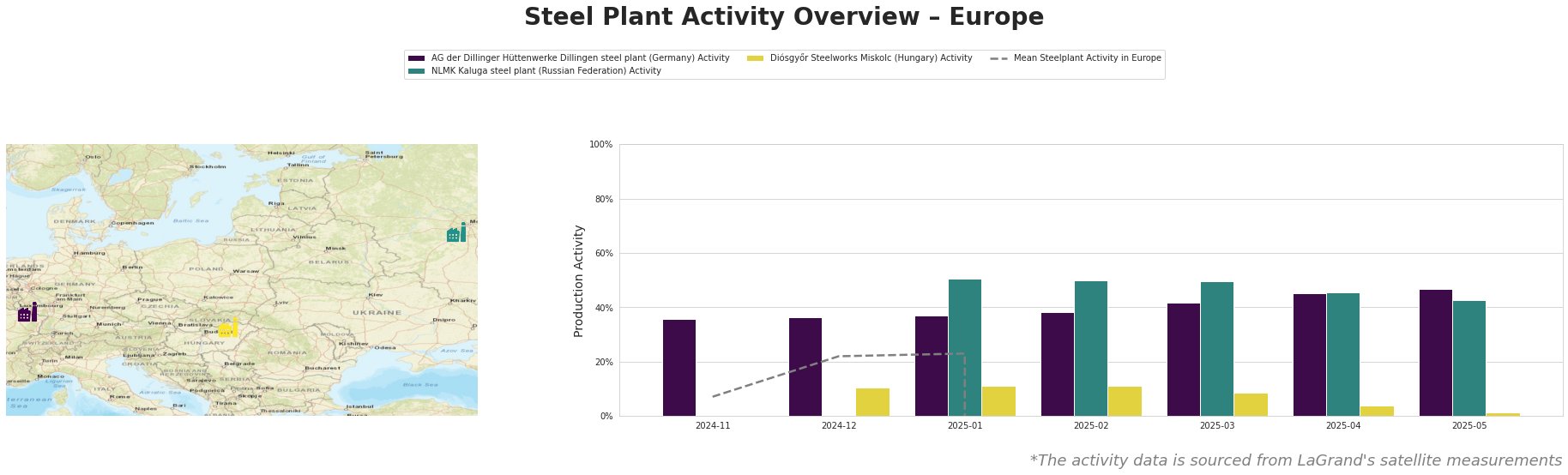

The monthly “Mean Steelplant Activity in Europe” data contains negative, nonsensical values starting on “2025-02-28”. Thus, this dataset is invalid and must not be used for quantitative analysis.

AG der Dillinger Hüttenwerke Dillingen steel plant, an integrated BF-BOF producer in Germany with a crude steel capacity of 2.76 million tonnes per annum, specializing in heavy-plate products, has shown a consistent increase in activity, rising from 36% in November 2024 to 47% in May 2025. While the observed activity increase coincides with news of the EU-UK trade deal, no direct connection can be explicitly established.

NLMK Kaluga steel plant, a Russian EAF-based producer with a crude steel capacity of 1.5 million tonnes per annum focusing on long products like rebar and angles, exhibited relatively high activity levels between January and March 2025 (51% and 50% respectively). However, activity decreased to 43% by May 2025. The plant’s location in Russia means that the EU-UK agreement has no direct bearing on its operations, and no explicit link between news events and observed activity can be established.

Diósgyőr Steelworks Miskolc, a smaller Hungarian EAF-based producer with a 0.55 million tonnes per annum crude steel capacity specializing in special bar quality (SBQ) steels, started from a low level in December 2024 at 10%. The activity levels remained quite low with a steep decline in April and May 2025, reaching 1% in May. Given the focus on SBQ steels for construction and engineering, no direct link between the EU-UK agreement and plant activity can be established.

Given the increased activity at AG der Dillinger Hüttenwerke Dillingen, procurement professionals should consider securing contracts for heavy plate products sooner rather than later. Monitor price trends closely as increased demand may lead to upward pressure. For buyers focused on long products, no immediate supply concerns are apparent, though monitoring the activity levels at NLMK Kaluga is advisable. Finally, buyers should watch the development of EU carbon taxation based on articles as “EU, UK to ‘work towards’ linking carbon markets“, and its impact on pricing in the coming months, especially if UK ETS prices surpass EU prices, as the article “UK Steel welcomes linking with EU carbon markets” warns.