From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEU Steel Market Poised for Disruption: Safeguard Draft & Ukraine Scrap Ban Impact

Europe’s steel market faces potential disruptions due to evolving safeguard measures and shifts in Ukrainian scrap export policies. The leaked European Parliament draft on safeguards, as reported in “Leaked European Parliament draft on safeguards backs 50% steel over-quota duty, adds Russia/Belarus ban, quota carryover,” is anticipated to cause market confusion. Concurrently, Ukraine’s scrap export policies, outlined in “Export duties and zero quotas on scrap will preserve strategic raw materials – Kalenkov” and “Scrap exports from Ukraine increased by 52% y/y in January-October,” are set to tighten supply. While no direct correlation between the news articles and satellite activity can be established based solely on the provided information, the tightening supply could support the observed activity at EAF plants due to elevated scrap prices.

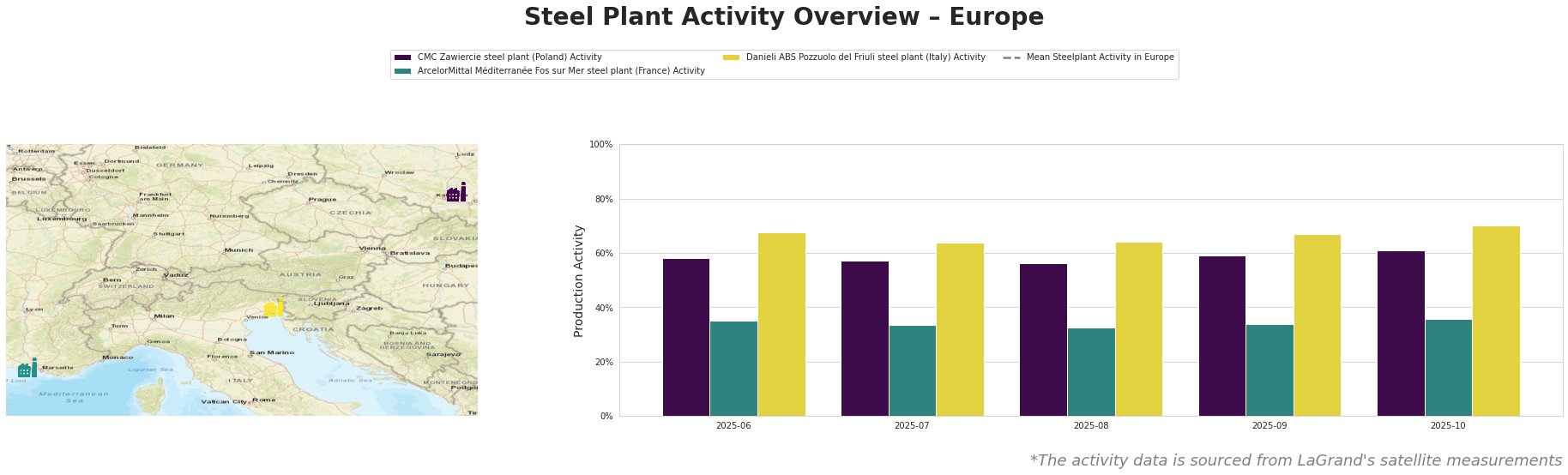

The mean steel plant activity in Europe has fluctuated significantly, indicating market volatility. CMC Zawiercie steel plant in Poland shows a relatively stable activity level with a slight upward trend, from 58.0% in June to 61.0% in October. ArcelorMittal Méditerranée Fos sur Mer steel plant in France displays the lowest activity levels of the observed plants, with a slight increase from 35.0% in June to 36.0% in October. Danieli ABS Pozzuolo del Friuli steel plant in Italy demonstrates the highest activity levels, increasing from 68.0% in June to 70.0% in October.

CMC Zawiercie, a Polish EAF steel plant with a 1.7 million tonne crude steel capacity, primarily serves the automotive, building, and energy sectors. Satellite data shows relatively stable plant activity. No direct link to provided news articles can be established.

ArcelorMittal Méditerranée Fos sur Mer, an integrated BF-BOF steel plant in France with a 4 million tonne crude steel and iron capacity, provides semi-finished and finished rolled products. It is equipped with a coking plant, sinter plant, and two BOFs slated for shutdown by 2030. Observed activity is the lowest across the observed plants. No direct link to provided news articles can be established.

Danieli ABS Pozzuolo del Friuli, an Italian EAF steel plant with a 1.1 million tonne crude steel capacity, produces crude, semi-finished, and finished rolled products. It utilizes two EAFs. Observed activity is the highest across the observed plants. No direct link to provided news articles can be established.

The impending EU safeguard draft, as outlined in “Leaked European Parliament draft on safeguards backs 50% steel over-quota duty, adds Russia/Belarus ban, quota carryover,” introducing a 50% over-quota duty and banning steel from Russia and Belarus, poses significant implications. The Ukrainian scrap export restrictions, detailed in “Export duties and zero quotas on scrap will preserve strategic raw materials – Kalenkov” and “Scrap exports from Ukraine increased by 52% y/y in January-October,” will further tighten scrap supply in Europe.

Recommended Procurement Actions:

- For EAF Steel Buyers: Given Ukraine’s scrap export restrictions and the focus on preserving domestic supply, secure alternative scrap sources. Monitor activity at plants using EAF, such as CMC Zawiercie and Danieli ABS Pozzuolo del Friuli, for signs of supply pressure as scrap availability tightens within the EU.

- For BF/BOF Steel Buyers: Analyze potential cost implications from the EU safeguard draft. The 50% over-quota duty could significantly raise import costs. Explore alternative supply chains and carefully consider order timing to mitigate price volatility.

- Overall Procurement Strategy: Diversify supplier base to mitigate risks associated with potential disruptions from the EU safeguard measures. Buyers are encouraged to carefully consider their reliance on specific regions and explore alternative procurement strategies.