From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEU Steel Market Optimism Fueled by Climate Initiatives Despite Production Fluctuations

Europe’s steel market sentiment remains very positive, driven by ambitious climate targets and citizen engagement, as highlighted in “Denmark still eye deal on EU’s 2040 target” and “Mehr städtischer Klimaschutz mit Bürgerbeteiligung“. These policy initiatives potentially support long-term demand for green steel. However, satellite data reveals fluctuating activity levels in specific steel plants. A direct relationship between these climate policy discussions and observed plant activity could not be established.

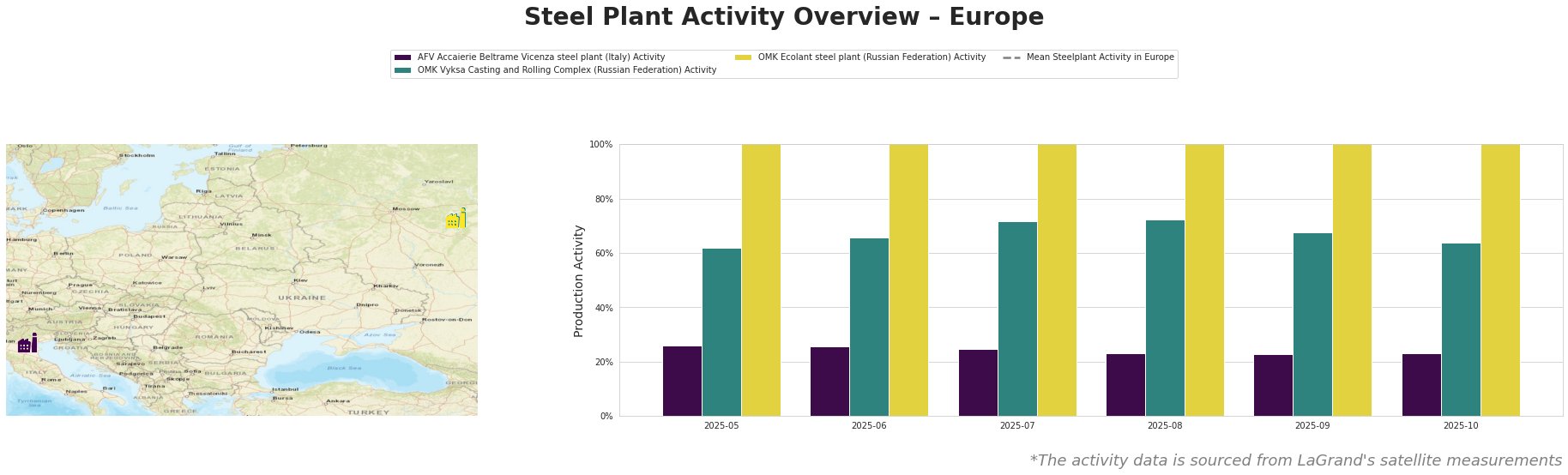

The mean steel plant activity in Europe shows variability, peaking in July/August 2025 and dropping to its lowest level in October. AFV Accaierie Beltrame Vicenza steel plant has the lowest overall activity and shows a slight decline in the period from May to October. OMK Vyksa Casting and Rolling Complex exhibits the highest activity levels and a general increase until July/August. OMK Ecolant steel plant activity is constant across all months.

AFV Accaierie Beltrame Vicenza, an EAF-based plant in Italy with a 1.2 million tonne crude steel capacity, primarily serves the building, infrastructure, tools, machinery, and transport sectors. Its activity level saw a minor decrease from 26% in May to 23% in August and remained stable since then. There’s no readily apparent link between this relatively stable production activity and initiatives like the Greensand project discussed in “Klimaschutz: Ein Kreislauf für das Treibhausgas“.

The OMK Vyksa Casting and Rolling Complex in Russia, also an EAF-based plant with a capacity of 1.25 million tonnes, is focused on finished rolled products for building, infrastructure, energy, and transport. It showed an increase in activity from 62% in May to 72% in July/August. While “Mehr städtischer Klimaschutz mit Bürgerbeteiligung” highlights citizen engagement in climate action, its direct impact on the Russian plant’s output is not demonstrable based on the provided information.

OMK Ecolant, another Russian steel plant, uses DRI technology and EAFs to produce 1.8 million tonnes of crude steel and 2.5 million tonnes of iron, with semi-finished products (slabs and billets) sold to the building, energy, and transport sectors. Its activity remained constant. No direct connection can be established between this stability and “Denmark still eye deal on EU’s 2040 target“.

Given the stable activity at OMK Ecolant, steel buyers should consider this plant a reliable source of slabs and billets, especially as the EU pursues ambitious climate targets which could increase demand for DRI-produced steel. However, monitor geopolitical developments affecting Russian steel exports. The minor drop in activity at AFV Accaierie Beltrame should be monitored for potential supply constraints; buyers reliant on this plant may want to diversify their sourcing to mitigate risk, particularly in the building and infrastructure sectors where the plant’s products are primarily used.