From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEU Steel Market Optimism Amidst Safeguard Measures: Production Trends and Procurement Strategies

The European steel market exhibits very positive sentiment driven by anticipated benefits from new safeguard measures, yet faces potential disruptions due to varying plant activity. Multiple news articles, including “Unesid lauds European Commission steel trade measure proposal” and “EU’s new safeguard framework wins producers’ support but faces backlash from users“, highlight the support for the European Commission’s proposals aimed at protecting domestic steel production. These safeguards appear to be already influencing market behavior as noted in “EU license plate offers are growing in line with upcoming trade regulations“, where prices saw slight increases, particularly for thick-sheet metal. While activity data shows fluctuation, no direct causal link between the cited articles and specific activity changes is explicitly evident for observed facilities.

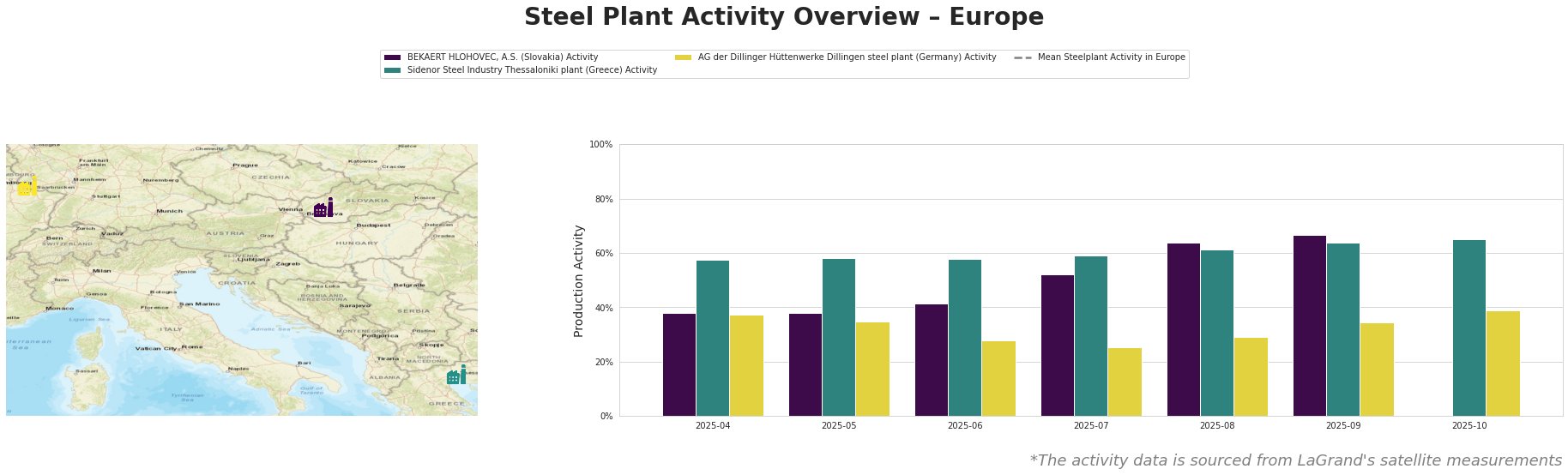

The satellite data reveals varying activity levels across selected European steel plants. BEKAERT HLOHOVEC, A.S. in Slovakia, producing wire rod using EAF technology for automotive and construction sectors, experienced a steady increase in activity from April to September 2025, peaking at 67% in September. No data is available for October. Sidenor Steel Industry’s Thessaloniki plant in Greece, an EAF-based producer of semi-finished and finished rolled products, showed a stable trend with activity hovering between 58% and 65% throughout the observed period, ultimately reaching 65% in October. In contrast, the AG der Dillinger Hüttenwerke Dillingen steel plant in Germany, an integrated BF-BOF producer of heavy-plate products for various sectors, exhibited a fluctuating activity pattern with a notable drop to 25% in July, followed by a gradual increase to 39% in October. These fluctuations in the AG der Dillinger Hüttenwerke Dillingen steel plant activity may reflect efficiency-focused strategies as mentioned in “RESOUREX: Cautious optimism mark Europe’s steel market in October“, however no explicit causal link can be established.

The activity trends at BEKAERT HLOHOVEC, A.S., and Sidenor Steel Industry’s Thessaloniki plant suggest stable to increasing production, potentially mitigating immediate supply concerns for their specific product categories. However, the reduced activity at AG der Dillinger Hüttenwerke Dillingen, despite the overall positive market sentiment, warrants closer monitoring.

Given the upcoming EU safeguard measures, as discussed in “New EU safeguard measures on steel imports should not harm Ukraine’s exports” and the mixed reactions outlined in “EU’s new safeguard framework wins producers’ support but faces backlash from users“, steel buyers should:

- Prioritize Securing Supply Agreements: Especially for heavy plate products sourced from facilities like AG der Dillinger Hüttenwerke, proactively engage with suppliers to confirm production schedules and inventory levels, mitigating risks associated with potential further activity reductions.

- Diversify Sourcing: Given the potential for increased prices due to import restrictions, explore alternative sources for long products, keeping in mind the analysis in “New safeguard may have limited EU longs impact” which suggests the impact on long products may be uncertain.

- Monitor Import Data: Track import volumes from countries potentially affected by the new safeguards. Pay close attention to the impact on different EU regions as “New safeguard may have limited EU longs impact” notes national import data can differ.