From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEU Steel Market: Increased Russian Imports Offset by Ukrainian Production Fluctuations Amidst Global Uncertainty

In Europe, the steel market shows a mixed landscape, with increasing imports from Russia contrasting with fluctuating Ukrainian output. “The EU imported 2.95 million tons of iron and steel products from Russia in January-June” highlights a continuing reliance on Russian steel despite sanctions, while “Ukraine produced 4.25 million tons of rolled steel in January-August” indicates a slight production decrease, offset by an increase in pig iron output reported in “Ukraine reports eight percent rise in pig iron output for January-August 2025“. These Ukrainian increases may be related to recent rises in plant activity.

Measured Activity Overview:

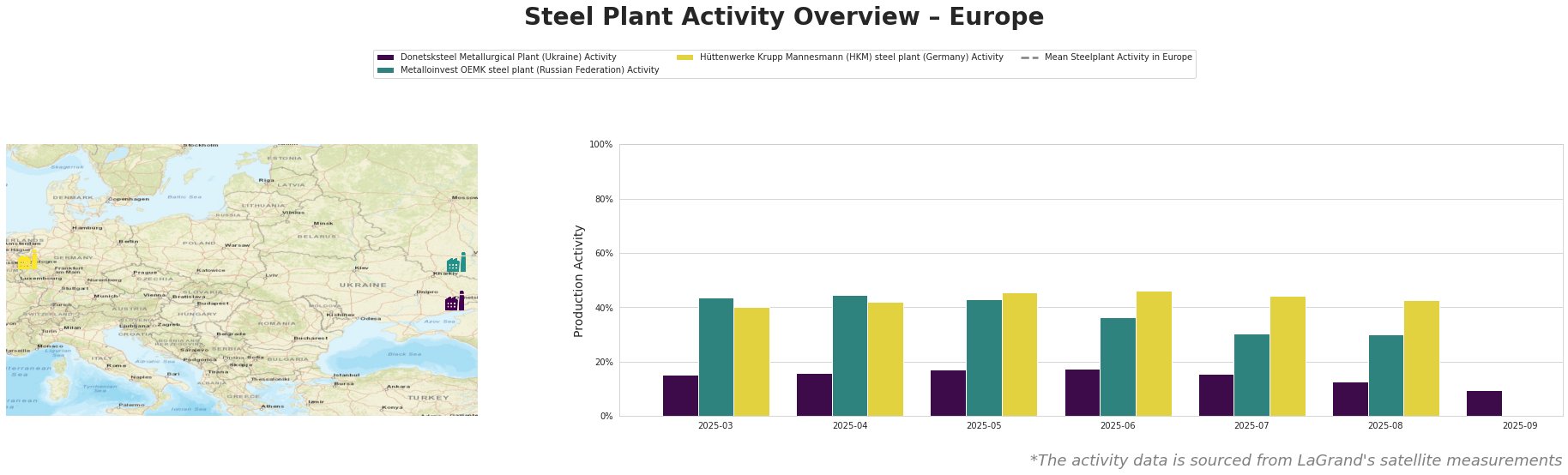

The mean steel plant activity in Europe demonstrates a high variance across the observed period.

Donetsksteel Metallurgical Plant in Ukraine experienced a consistent decline in activity from June (18%) to September (9%). This downturn could correlate with the overall decrease in Ukrainian rolled steel production reported in “Ukraine produced 4.25 million tons of rolled steel in January-August,” although no direct causality can be established. The plant, primarily focused on pig iron production using integrated BF process, shows activity levels significantly below the average.

Metalloinvest OEMK steel plant in Russia exhibited fluctuating activity, dropping from 45% in April to 30% by August. The plant activity in September could not be measured. This decrease in activity is happening during a time where “The EU imported 2.95 million tons of iron and steel products from Russia in January-June” has increased. No direct connection can be clearly established. This plant relies on DRI and EAF for crude, semi-finished, and finished rolled products and showed above-average activity in the earlier periods.

Hüttenwerke Krupp Mannesmann (HKM) in Germany showed relatively stable activity, fluctuating between 40% and 46%. No activity could be measured in September. This indicates consistent production at this integrated BF/BOF plant despite broader market shifts. While “Australia increased iron ore exports to 75 million tons in July” highlights increased global iron ore supply, no direct impact on HKM’s activity can be explicitly linked from the provided information. The plant activity remained above the average.

Evaluated Market Implications:

The increase in EU imports from Russia, as detailed in “The EU imported 2.95 million tons of iron and steel products from Russia in January-June”, coupled with the observed activity decline at Metalloinvest OEMK steel plant in Russia until August, suggests a shift in Russian export strategy. The Ukrainian production figures, as stated in “Ukraine produced 4.25 million tons of rolled steel in January-August” and its corresponding plant activity decline in the Donetsksteel Metallurgical Plant indicate that buyers should expect potential supply chain disruptions when sourcing steel from Ukraine. Based on these observed trends, steel buyers should:

- Diversify Sourcing: Reduce reliance on Ukrainian sources and explore alternative suppliers, particularly given the observed production fluctuations.

- Monitor Russian Export Policies: Closely track any changes in EU trade policies that could further impact the availability and price of Russian steel.

- Assess Inventory Levels: Maintain sufficient inventory to buffer against potential supply disruptions originating from the Donetsksteel Metallurgical Plant.

- Contractual Flexibility: Negotiate flexible contract terms that allow for adjustments based on market conditions and potential supply disruptions.