From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEU Steel Market Faces Summer Slowdown Amid CBAM Concerns, Select Plant Activity Holds Steady

The European steel market is experiencing a seasonal slowdown, compounded by concerns surrounding the Carbon Border Adjustment Mechanism (CBAM). The news articles “EU plate, slab spot liquidity drops amid summer lull” and “Prices are rising in the European HRC market amid a lull” describe weak demand and price uncertainty. While these articles suggest a general slowdown, no direct relationship can be explicitly established with specific satellite-observed plant activity changes, although it is logical to assume a loose connection. Furthermore, activity in the UK aligns with the article “UK HRC prices steady on seasonal summer slowdown“, confirming overall a slowdown in the market.

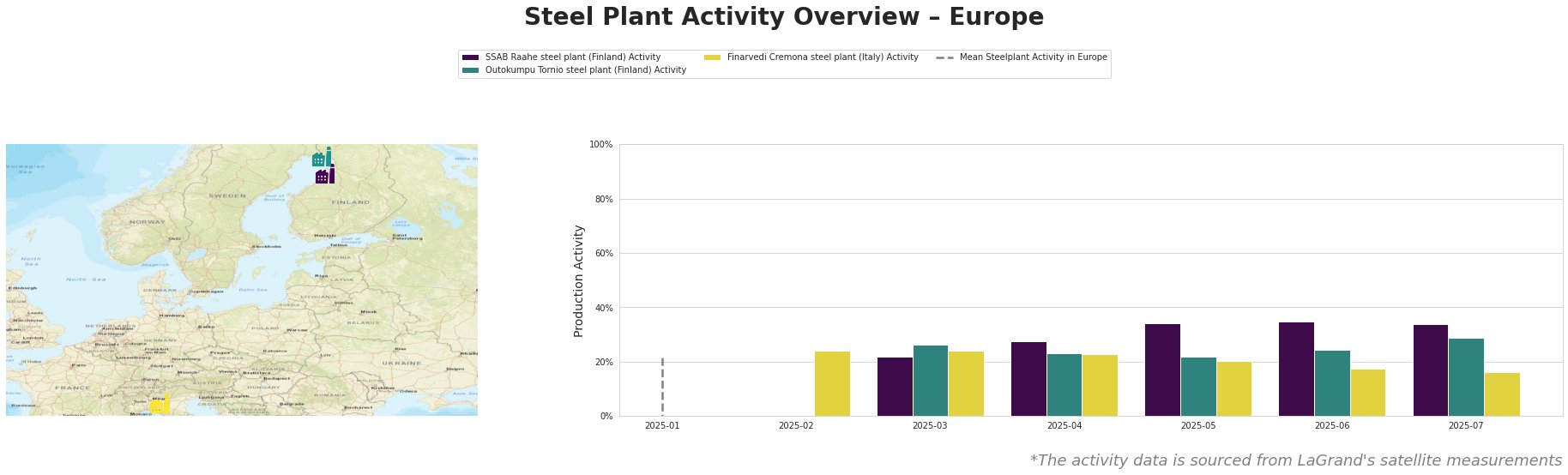

The provided “Mean Steelplant Activity in Europe” is exhibiting irregular negative values, rendering it unusable for meaningful analysis. Therefore, individual plant activity is assessed in isolation.

SSAB Raahe, an integrated BF/BOF plant in Finland with a crude steel capacity of 2.6 million tonnes, shows a stable activity level. From March to July 2025, activity increased from 22% to 34% and then slightly decreased to 34%. This relative stability, despite the summer slowdown reported in “EU plate, slab spot liquidity drops amid summer lull,” may reflect existing order backlogs or a focus on fulfilling long-term contracts. No direct connection can be explicitly established, yet.

Outokumpu Tornio, a Finnish EAF-based stainless steel producer with a 1.2 million tonne crude steel capacity, shows fluctuating activity. Activity decreased from 26% in March to 22% in May, then rose to 29% in July. Given Outokumpu’s focus on automotive, building, and energy sectors, this volatility might reflect demand shifts in these end-user segments but no direct connection to the provided articles can be explicitly established.

Finarvedi Cremona, an Italian EAF-based plant with a 3.85 million tonne capacity, experienced a gradual activity decrease from 24% in February/March to 16% in July. This downtrend could be linked to the weaker spot market activity reported in “EU plate, slab spot liquidity drops amid summer lull,” particularly given Finarvedi’s production of hot-rolled coil and galvanized products used in automotive, but no direct connection can be explicitly established.

Evaluated Market Implications:

Based on the news articles indicating a summer slowdown and CBAM-related uncertainty, steel buyers should anticipate continued price volatility in the short term, as indicated in “Prices are rising in the European HRC market amid a lull“.

Given the stable observed activity at SSAB Raahe, buyers seeking heavy plate and slab may find relatively consistent supply from this source. However, they should factor in potential CBAM-related costs, as highlighted in “EU plate, slab spot liquidity drops amid summer lull“.

The UK steel market faces uncertainty regarding import quotas, particularly for hot-dip galvanizing, which will probably raise costs and increase lead times, as indicated in “UK HRC prices steady on seasonal summer slowdown“. Buyers relying on galvanized steel should diversify their sourcing, considering suppliers from Brazil and Turkey, as these countries are less affected by the quota changes, but factor in increased shipping times. Buyers must carefully monitor official government notifications regarding quota adjustments to optimize their procurement strategies.

Despite overall European concerns, individual plant data (SSAB Raahe) indicate potential for strategic steel procurement, specifically for European heavy plate and slab consumers who rely on integrated BF/BOF production.