From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEU Steel Market Faces Closures & Import Quota Challenges: Liberty Steel’s Exit & Activity Declines

Europe’s steel market is under pressure due to plant closures and restrictive import quotas. Liberty Steel’s potential exit from Belgium and Luxembourg, as detailed in “Liberty Steel prepares for final exit from Belgium and Luxembourg“, “Dudelange, Liège face closure; EU quotas deter buyers“, “Euroquotes have buried the hopes of saving Liberty Steel plants” and “Dudelange and Liege face closure; EU quotas scare off buyers“, highlights the negative impact of EU import quotas on attracting investors and maintaining production. While ArcelorMittal’s acquisition of a portion of the Liège assets offers a potential future boost, the immediate outlook remains bleak. No direct relationship could be established between the provided satellite data and these closures due to a lack of coverage for those specific plants.

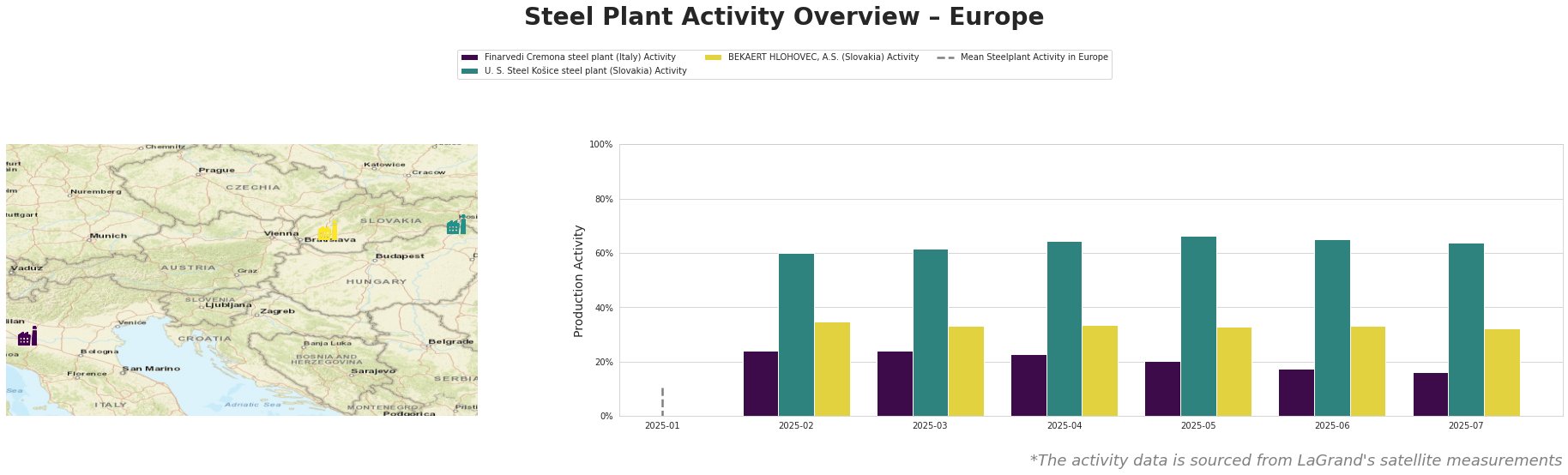

The mean steel plant activity in Europe shows fluctuating negative values, which does not provide meaningful trend insights without context or a valid baseline. Finarvedi Cremona’s activity shows a consistent decline from 24% in February and March to 16% in July. U. S. Steel Košice maintained a relatively stable activity level, fluctuating between 60% and 66%. BEKAERT HLOHOVEC, A.S. also demonstrates a stable trend, with activity hovering around 33%-35%. No direct connection could be established between the satellite data activity and the named news articles.

Finarvedi Cremona, located in the Province of Cremona, Italy, operates two EAFs with a total crude steel capacity of 3.85 million tonnes per annum. The plant focuses on producing semi-finished and finished rolled products such as hot rolled coil and galvanized products, primarily serving the automotive sector. The observed decline in activity from 24% in February/March 2025 to 16% in July 2025 represents a notable slowdown.

U. S. Steel Košice, situated in the Košice Region of Slovakia, is an integrated steel plant with a crude steel capacity of 4.5 million tonnes per annum. Utilizing BF and BOF processes, its product range includes hot-rolled, cold-rolled, and coated steel products for various sectors, including automotive and construction. Despite the closures elsewhere, the plant shows stable activity, fluctuating between 60% and 66% during the observed period.

BEKAERT HLOHOVEC, A.S., located in the Tyrnauer Landschaftsverband, Slovakia, specializes in wire rod production and primarily serves the automotive and construction sectors. Its activity remained relatively stable, fluctuating between 33% and 35% during the observed period. Detailed equipment and processes are unknown.

The potential closure of Liberty Steel plants in Belgium and Luxembourg, as reported in “Liberty Steel prepares for final exit from Belgium and Luxembourg“, “Dudelange, Liège face closure; EU quotas deter buyers“, “Euroquotes have buried the hopes of saving Liberty Steel plants” and “Dudelange and Liege face closure; EU quotas scare off buyers“, coupled with the import quota issues, indicates potential supply disruptions in the hot-rolled and coated steel market, especially for EU buyers reliant on these plants. The observed decline in activity at Finarvedi Cremona further contributes to this concern.

Recommended Procurement Actions:

* Steel buyers should actively diversify their supply base, particularly those who previously relied on Liberty Steel’s Dudelange and Liège facilities for galvanized steel.

* Due to the U. S. Steel Košice plant’s stable activity, despite the negative market sentiment, buyers should attempt to negotiate forward contracts to secure supply, but the overall picture remains negative due to the unfulfilled potential of Arcelor Mittal in Liege.

* Monitor EU trade policy developments closely, as potential changes to import quotas could significantly impact steel availability and pricing.