From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEU Steel Market Braces for Safeguard Changes Amidst Steady Plant Activity

European steel market participants are anticipating shifts driven by evolving safeguard measures, as highlighted in “Leaked European Parliament draft on safeguards backs 50% steel over-quota duty, adds Russia/Belarus ban, quota carryover” and “Safeguard amendment proposes permitting carry-over, easing melt-and-pour proof“. While these legislative developments signal potential supply chain realignments, satellite-observed activity at key European steel plants shows relatively stable output levels, offering no direct connection to the cited news at present.

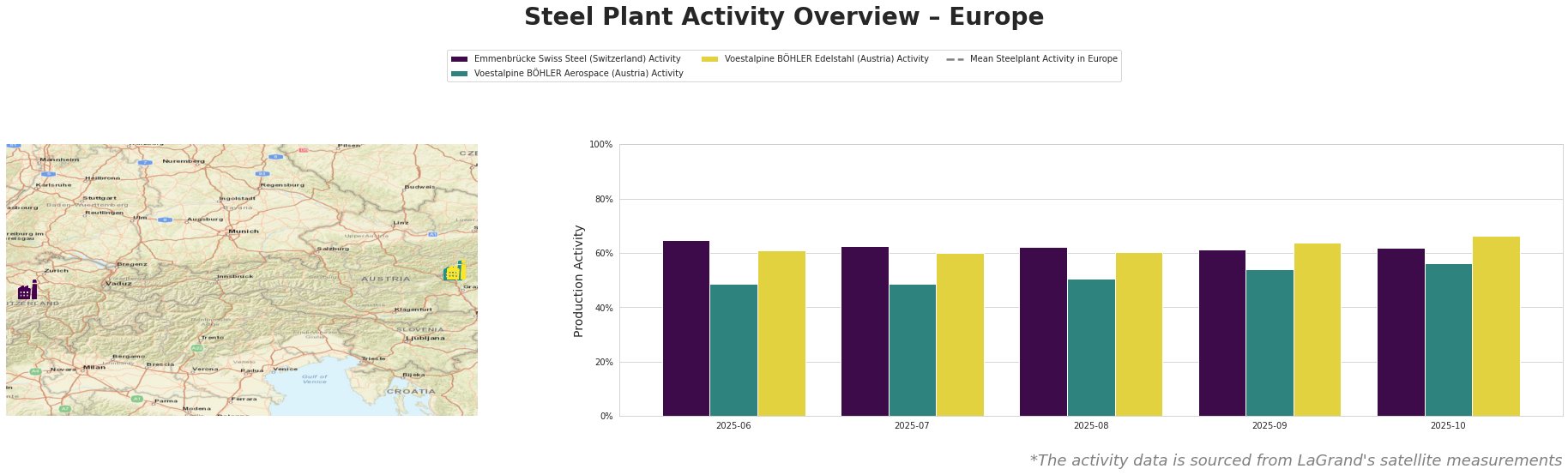

Measured Activity Overview

Over the observed period, mean steel plant activity in Europe has fluctuated. Emmenbrücke Swiss Steel experienced a slight decrease from 65% to 61% between June and September, followed by a minor rise to 62% in October. Voestalpine BÖHLER Aerospace showed a gradual increase from 49% to 56% over the same period. Voestalpine BÖHLER Edelstahl also demonstrated a gradual increase in activity from 61% in June to 66% in October. No direct connection between these activity levels and the news articles “Leaked European Parliament draft on safeguards backs 50% steel over-quota duty, adds Russia/Belarus ban, quota carryover” and “Safeguard amendment proposes permitting carry-over, easing melt-and-pour proof” can be established.

Steel Plant Details

Emmenbrücke Swiss Steel, located in Luzern, Switzerland, operates an electric arc furnace (EAF) for steel production, but further details on capacity and specific product categories are unknown. The plant holds a ResponsibleSteel Certification. The plant’s activity levels show a slight decline followed by a small recovery, but there’s no apparent correlation with the impending EU safeguard changes.

Voestalpine BÖHLER Aerospace, situated in Kapfenberg, Austria, also uses EAF technology. Holding ResponsibleSteel Certification but lacking detailed production or capacity information, it supplies specialty steel products to the aerospace industry. The observed increase in activity may reflect aerospace sector demand, but this cannot be directly linked to changes in EU trade policy.

Voestalpine BÖHLER Edelstahl, also in Kapfenberg, Austria, is a larger operation with a reported EAF capacity of 145,000 tonnes and a workforce of 2,500. Like the other two plants, Voestalpine BÖHLER Edelstahl uses EAF technology. This plant also holds a ResponsibleSteel Certification. The gradual rise in activity levels may indicate increased demand for its specialty steel products, however, this activity shows no direct correlation to changes in EU trade policy, but, like Voestalpine BÖHLER Aerospace, could benefit from the easing of melt-and-pour origin proof proposed in “Safeguard amendment proposes permitting carry-over, easing melt-and-pour proof“.

Evaluated Market Implications

Based on “Leaked European Parliament draft on safeguards backs 50% steel over-quota duty, adds Russia/Belarus ban, quota carryover” and “Safeguard amendment proposes permitting carry-over, easing melt-and-pour proof“, European steel buyers should proactively:

- Diversify sourcing: Given the impending ban on steel from Russia and Belarus, buyers heavily reliant on these sources should immediately identify and qualify alternative suppliers to mitigate potential disruptions.

- Negotiate contract clauses: Implement clauses that address potential price increases or delivery delays due to the 50% over-quota duty. These clauses should allow for renegotiation or termination if the safeguard measures significantly impact procurement costs.

- Prioritize EU or compliant suppliers: Favoring suppliers within the EU or those fully compliant with the “melt and pour” origin requirements, particularly EAF producers such as Voestalpine BÖHLER Edelstahl, can help avoid over-quota duties and ensure supply chain stability.

- Monitor Scrap Supply Dynamics: Given the call in “British steelmakers call for strengthening of scrap supply chain in the country,” increased domestic scrap retention in the UK could eventually tighten scrap availability and increase prices for EAF producers across Europe, including Emmenbrücke Swiss Steel, Voestalpine BÖHLER Aerospace and Voestalpine BÖHLER Edelstahl. Therefore, monitor scrap price trends closely.