From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEU Steel Market Boosted by Budget Plans: Plant Activity Shows Mixed Signals

The European steel market is showing signs of positive momentum amidst new budget proposals. Activity at several key plants reflects the ongoing market adjustments. The “The European Commission has proposed a new EU budget for 2028-2034” details plans to bolster competitiveness and secure supply chains, which could positively impact the European steel industry. No direct relationship can be established between observed changes in plant activity and the news articles titled “Neue Zahlen zum EU-Budget: Neuer deutscher Beitragsrekord?” and “Mega-EU-Haushalt: Bis zu 450 Milliarden Euro – Deutschland droht laut Bericht drastische Beitragserhöhung“.

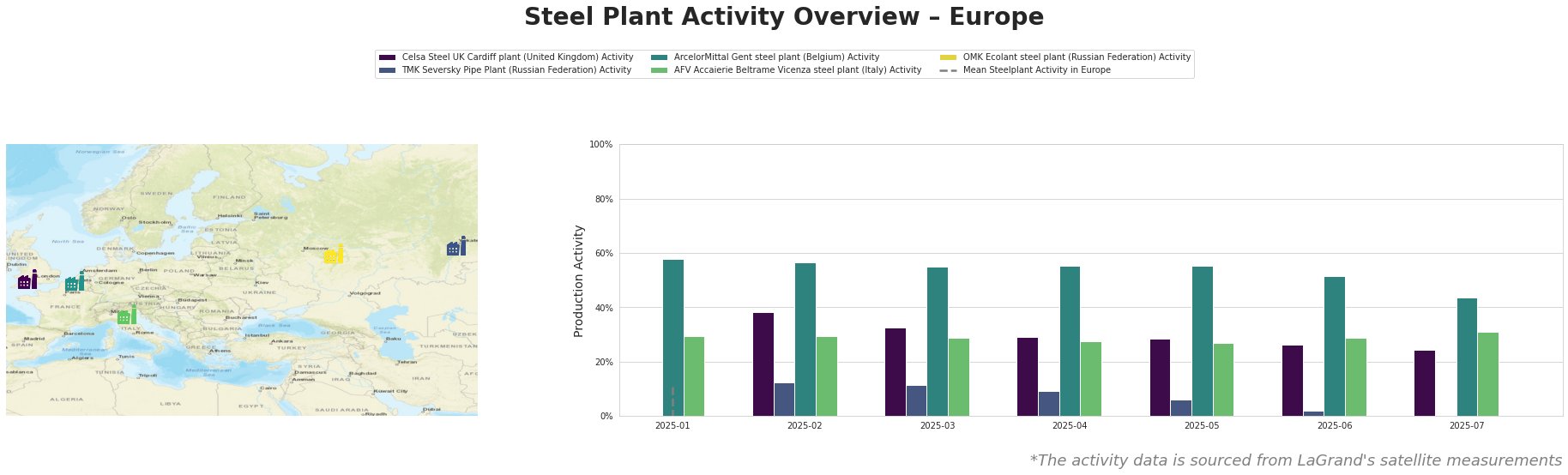

The data indicates considerable volatility and unreliable mean values. Analyzing individual plant activity levels is more insightful.

Celsa Steel UK Cardiff, an EAF-based plant with a 1.2 million tonne crude steel capacity focusing on rebar and wire rod, has experienced a consistent decline in activity from 38% in February to 24% in July. This steady decrease, while not directly linked to the budget news, may reflect broader market conditions or plant-specific issues.

TMK Seversky Pipe Plant, an EAF-based plant with a 1 million tonne crude steel capacity specializing in billets and pipes, shows a more pronounced activity decrease, dropping from 12% in February to 0% in July. Given its location, potential logistical or trade-related constraints may be factors, though no direct link to the provided news can be established.

ArcelorMittal Gent, an integrated BF-BOF plant with a substantial 5 million tonne crude steel capacity, showed the strongest activity, with activity decreasing from 58% in January to 44% in July. Its diverse product range, including rails, pipes and slabs, mitigates risk. Again, there’s no direct link to the budget news, but the overall positive sentiment might explain the high level of steel production.

AFV Accaierie Beltrame Vicenza, an EAF-based plant with a 1.2 million tonne capacity, has maintained a relatively stable activity level, fluctuating between 27% and 31%. The steadiness suggests a consistent operational strategy and demand for its output.

OMK Ecolant is excluded from this analysis due to corrupt activity data, as is the Mean Steelplant Activity in Europe.

Based on the presented data and news, procurement professionals should:

- Monitor ArcelorMittal Gent closely. Given the positive budget outlook (“The European Commission has proposed a new EU budget for 2028-2034”) and relatively high activity levels at the plant, ensure to secure supply contracts, particularly for products like rails and slabs, to capitalize on potential infrastructure projects.

- Diversify suppliers. Due to the decreasing activity at Celsa Steel UK Cardiff and TMK Seversky Pipe Plant, mitigate supply chain risk by establishing relationships with alternative suppliers for rebar, wire rod, billets, and pipes. Although, the reported activity changes at both plants can not directly related to the mentioned EU budget plans.

- Assess the Italian Market. Considering the consistent activity in Italy, further evaluate to increase business with AFV Accaierie Beltrame Vicenza.

These actions are recommended assuming the reliability of the activity level data and are intended to mitigate potential disruptions while leveraging opportunities arising from the anticipated EU budget investments.