From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEU Steel Exports Up, Producer Prices Down: Activity Mixed Amid Scrap Uncertainty

Europe’s steel market presents a mixed picture, with increasing finished steel exports offset by declining industrial producer prices. This is reflected in varying steel plant activity levels across the region. According to “EUROFER: EU’s finished steel exports register two percent increase in January-February,” EU exports of finished steel products saw a modest increase, but whether this impacts individual plant activity remains unclear from the provided satellite data. The Italian scrap market’s uncertain rebound, as noted in “Assofermet on Italian scrap market: First signs of a rebound in May, but outlook remains uncertain,” may be impacting EAF-based steelmakers.

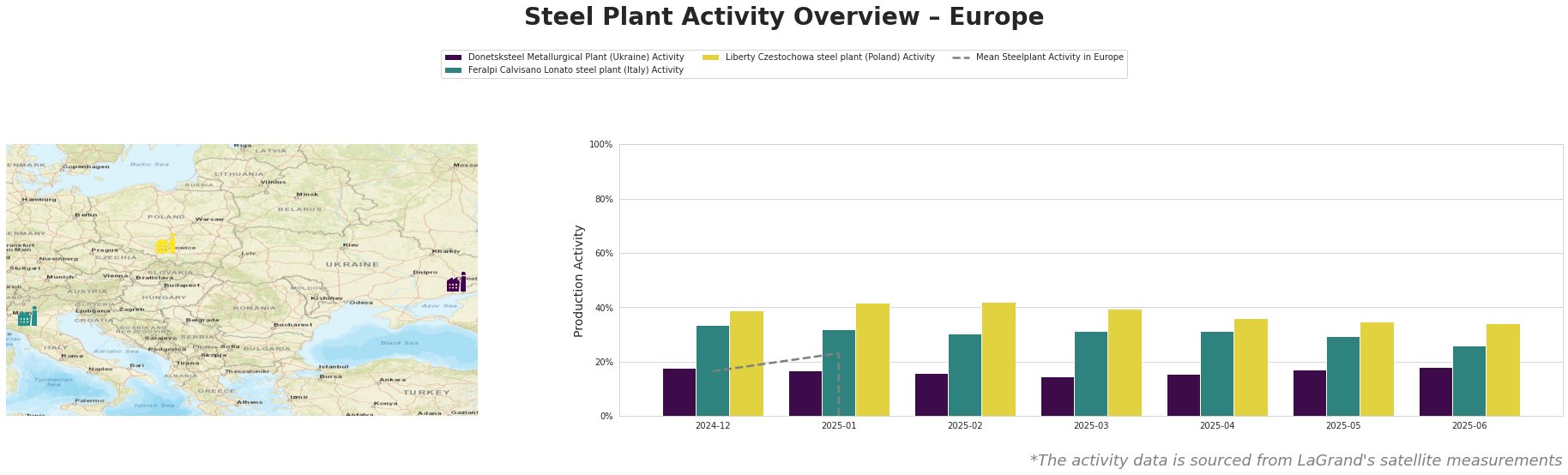

The Mean Steelplant Activity in Europe value shows a significant distortion, making any conclusion about the general market development impossible.

Donetsksteel Metallurgical Plant, an integrated BF-EAF producer in Ukraine focusing on pig iron, has shown a slight but consistent increase in activity, rising from 17% in January 2025 to 18% in June 2025. While this increase is modest, it could reflect increased pig iron demand. No direct link can be established with the news articles provided.

Feralpi Calvisano Lonato steel plant, an EAF-based billet producer in Italy, has seen a gradual decline in activity from 32% in January 2025 to 26% in June 2025. This decrease might be related to the uncertainty in the Italian scrap market as described in “Assofermet on Italian scrap market: First signs of a rebound in May, but outlook remains uncertain“. The news reports specifically mentions a shortage of scrap and logistical issues, potentially impacting EAF-based producers like Feralpi.

Liberty Czestochowa steel plant, an EAF-based plate producer in Poland, also shows a declining activity trend, decreasing from 42% in January 2025 to 34% in June 2025. As for Feralpi Calvisano Lonato steel plant, given that no steel scrap prices are available for Poland, the decrease might be related to the uncertainty in the Italian scrap market as described in “Assofermet on Italian scrap market: First signs of a rebound in May, but outlook remains uncertain“. No other direct connection to the provided news articles can be established.

Evaluated Market Implications:

The decline in activity at Feralpi Calvisano Lonato and Liberty Czestochowa, potentially linked to scrap market uncertainties highlighted in “Assofermet on Italian scrap market: First signs of a rebound in May, but outlook remains uncertain,” could lead to localized supply disruptions for billets and plates, respectively.

Recommended Procurement Actions:

Given the uncertainty in scrap availability and the observed decline in activity at EAF-based plants like Feralpi, steel buyers sourcing billets in Italy should:

- Diversify Suppliers: Explore alternative billet suppliers outside of Italy to mitigate potential supply risks.

- Monitor Scrap Prices: Closely track Italian and Turkish scrap prices (as Turkish prices are mentioned in the Assofermet report) for early signs of further disruptions.

- Consider Forward Purchasing: If prices are favorable and demand is predictable, consider forward purchasing to secure supply and hedge against potential price increases due to scrap shortages.

- Negotiate Flexible Contracts: Ensure contracts with existing suppliers include clauses that allow for adjustments based on scrap price fluctuations and potential supply disruptions.