From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEU Ferroalloy Safeguards Trigger Steel Supply Concerns Amidst Stable Plant Activity

The European steel market faces potential supply chain disruptions due to newly implemented ferroalloy import restrictions. The core issue is the European Commission’s decision to introduce safeguard measures, as detailed in articles titled “EU imposes definitive safeguard measures on certain ferroalloys“, “EU introduces quotas to restrict imports of ferroalloys“, and “EU imposes safeguards on silicon and manganese-based ferroalloy imports“. These measures, designed to protect EU ferroalloy producers, involve tariff-rate quotas (TRQs) and aim to reduce ferroalloy imports by 25% from 2022-2024 averages, as highlighted in “EU proposes TRQ to reduce ferro-alloy imports by 25 percent“. While we can see the EU taking steps to protect its internal markets via the news articles, the provided activity data does not provide an immediate correlation between this and recent changes in plant activity levels.

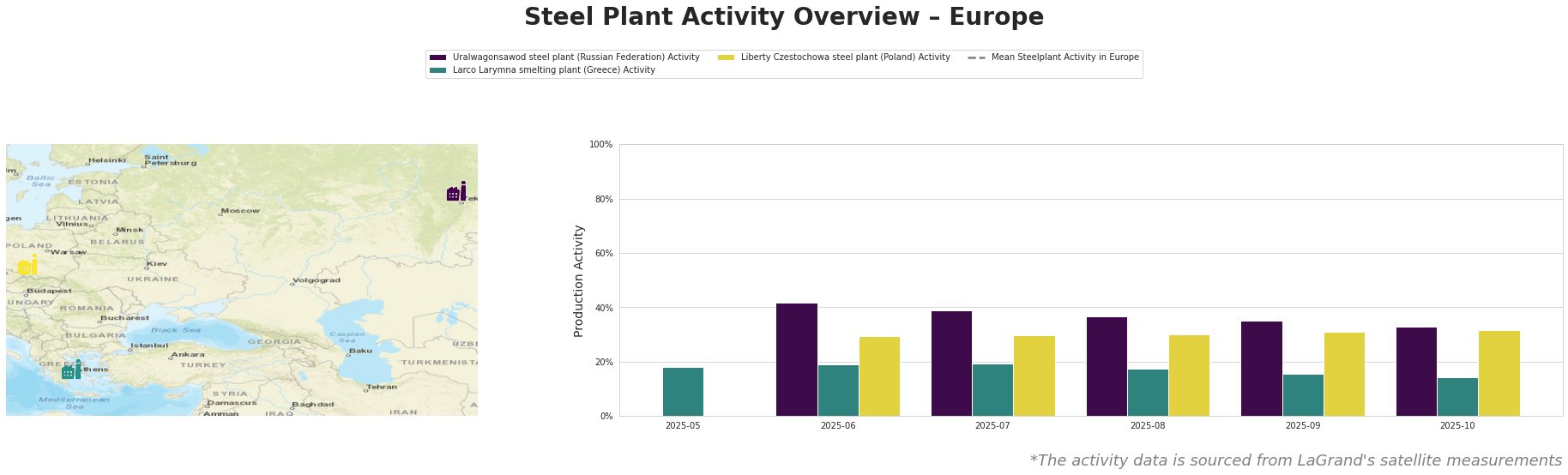

From May to October 2025, the average steel plant activity in Europe shows volatility, ranging from approximately 272 million to 408 million. The Uralwagonsawod steel plant in the Russian Federation saw a gradual decline in activity from 42% in June to 33% in October. The Larco Larymna smelting plant in Greece experienced relatively stable activity, fluctuating between 14% and 19%. The Liberty Czestochowa steel plant in Poland saw minor fluctuations, increasing slightly from 30% in June to 32% in October.

Uralwagonsawod steel plant, located in Rostov (Russian Federation), primarily serves the defense sector. The plant’s activity decreased from 42% in June 2025 to 33% in October 2025. Given the plant’s location in Russia and its focus on the defense sector, the decline may be influenced by factors unrelated to the EU’s ferroalloy safeguard measures; no direct connection can be established based on the provided news articles.

The Larco Larymna smelting plant in Thessaly (Greece) has a crude steel capacity of 1150 ktpa and a ferronickel capacity of 2500 ktpa, utilizing EAF technology. Activity at the plant remained relatively stable, fluctuating between 14% and 19% from May to October 2025. As the news articles “EU imposes definitive safeguard measures on certain ferroalloys“, “EU introduces quotas to restrict imports of ferroalloys“, and “EU imposes safeguards on silicon and manganese-based ferroalloy imports” mention that Greece (as an EU member) will be affected by TRQs, it is possible that this plant’s activity is correlated. The Larco Larymna smelting plant produces ferronickel, which does not directly fall under the ferroalloy categories facing import restrictions, and as such no direct correlation can be established.

Liberty Czestochowa steel plant, located in Silesia (Poland), has a crude steel capacity of 840 ktpa, using EAF technology to produce semi-finished products and plates. The plant’s activity experienced a slight increase from 30% in June to 32% in October 2025. As Poland is an EU member, it is possible that the increased activity at this steel plant is correlated with the EU measures to increase internal production. However, as the Liberty Czestochowa steel plant relies on semi-finished steel products, the increased tariffs may equally lead to increased costs to the firm.

The EU’s new ferroalloy import restrictions, detailed in “EU imposes definitive safeguard measures on certain ferroalloys“, “EU introduces quotas to restrict imports of ferroalloys“, and “EU imposes safeguards on silicon and manganese-based ferroalloy imports” are likely to cause supply disruptions within the European steel industry.

Recommended Actions for Steel Buyers and Market Analysts:

1. Carefully monitor ferroalloy prices: Given the new TRQs, prices for ferromanganese, ferrosilicon, and related alloys are likely to increase.

2. Diversify ferroalloy supply sources: Explore alternative sources outside the EU to mitigate potential supply shortages within quota limits. Prioritize suppliers from countries with favorable TRQ allocations.

3. Assess the impact on specific steel grades: Understand which steel grades rely heavily on the affected ferroalloys and anticipate potential cost increases or production adjustments.

4. Negotiate long-term contracts with EU ferroalloy producers: Secure supply from domestic producers to hedge against import uncertainties and benefit from the intended market share increase for EU producers.

5. Closely track policy developments and adjustments: Monitor any adjustments to the TRQs or related policies, as indicated in “EU proposes TRQ to reduce ferro-alloy imports by 25 percent” and “EU proposes TRQ to reduce ferroalloy imports by 25 percent“, and adapt procurement strategies accordingly. This is crucial to understand potential shifts in market dynamics.

6. Monitor activity data of internal producers: Closely observe activity levels of European producers like Liberty Czestochowa steel plant, located in Silesia (Poland), as changes may indicate production capacity and market share shifts.