From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEU Ferroalloy Safeguards Spark Uncertainty Amidst Stable Steel Plant Activity

The European steel market faces potential ferroalloy supply disruptions due to newly implemented safeguard measures, as detailed in articles titled “EU proposes TRQ to reduce ferro-alloy imports by 25 percent“, “EC imposes safeguard measures on FeSi, SiMn, Mn alloys“, and “EU introduces quotas to restrict imports of ferroalloys“. These measures, aimed at protecting EU ferroalloy producers, introduce tariff-rate quotas (TRQs) and variable duties on imports of ferromanganese, ferrosilicon, and related alloys. While these measures are expected to influence input costs for steel production, no immediate, directly correlated impact on the activity levels of the selected steel plants was discernable from satellite observations.

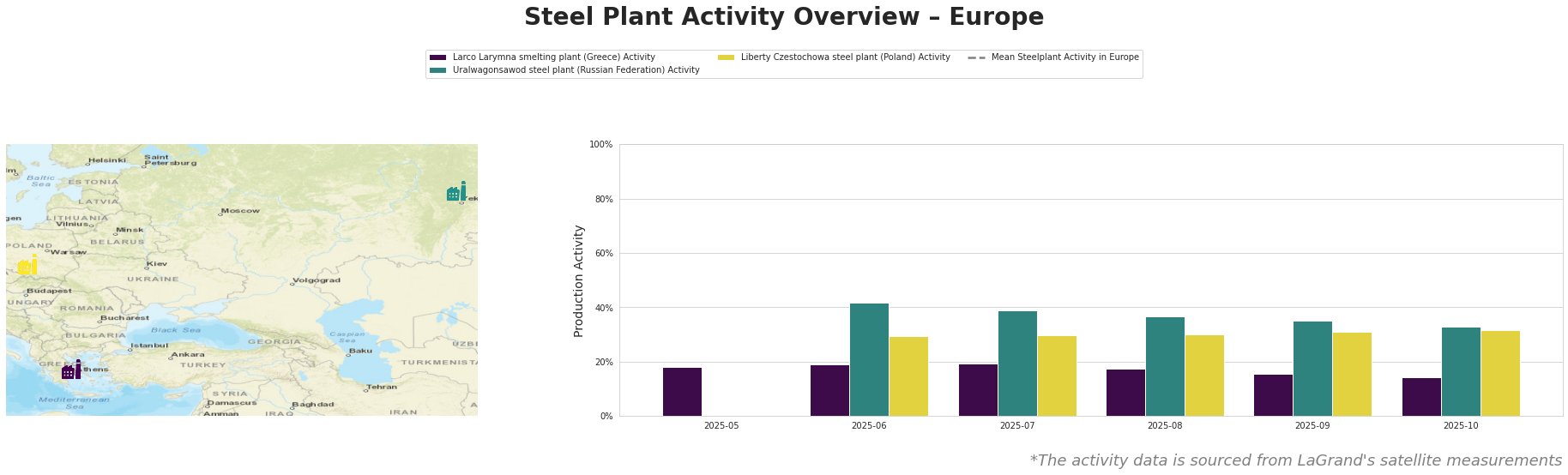

The mean steel plant activity in Europe shows some fluctuations, with peaks in July and August and drops in September and October.

Larco Larymna smelting plant (Greece), a ferronickel producer with an EAF capacity of 1150 ttpa, demonstrated relatively stable activity levels, fluctuating between 14% and 19% during the observed period. There’s a slight decrease from 19% in June-July to 14% in October. Given the plant’s focus on ferronickel, the ferroalloy safeguard measures discussed in “EU imposes safeguards on silicon and manganese-based ferroalloy imports“ may have indirect effects, but no immediate link to activity changes is apparent from the observed data.

Uralwagonsawod steel plant (Russian Federation), Primarily serving the defense sector, experienced a gradual decline in activity from 42% in June to 33% in October. This decline doesn’t appear to be directly linked to the EU’s ferroalloy safeguard measures described in “EU states to vote on TRQ, variable duty alloy safeguard“, as these measures primarily target EU imports. No direct connection between the EU measures and Uralwagonsawod’s activity levels could be established based on the available news articles.

Liberty Czestochowa steel plant (Poland), an EAF-based plate producer with a capacity of 840 ttpa, showed stable activity levels around 30-32% throughout the observed period. No correlation could be established between the EU safeguard measures and the plant’s output.

The introduction of TRQs and variable duties, as reported in “EU proposes TRQ to reduce ferroalloy imports by 25 percent“, could lead to increased price volatility and potential supply disruptions, particularly for smaller companies, as mentioned in “EC imposes safeguard measures on FeSi, SiMn, Mn alloys”. The article “Assofermet urges EU ferroalloys safeguard revision“ further underscores the concerns about potential supply disruptions and calls for adjustments to the proposed measures.

Given the implementation of safeguard measures on ferroalloy imports, steel buyers and market analysts should:

- Monitor ferroalloy prices closely: Track price fluctuations of ferromanganese, ferrosilicon, and related alloys to assess the immediate impact of the new duties.

- Diversify ferroalloy suppliers: Explore alternative supply sources outside the EU, particularly from countries not subject to the most restrictive quotas, to mitigate potential disruptions.

- Assess contract terms: Review existing supply contracts for ferroalloys to understand potential price adjustments and delivery schedules under the new regulations.

These recommendations are based on the expected impact of the EU’s safeguard measures on ferroalloy imports, as indicated in the provided news articles, and aim to proactively address potential supply chain challenges. No direct links between the observed plant activity and news articles could be established.