From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEgypt’s Steel Safeguards: African Plant Activity Mixed Amid Import Duty Changes

Egypt’s imposition of safeguard duties is reshaping the African steel market. The observed steel plant activity shows mixed signals across the region. The news articles “Egypt Considers Imposing Safeguard Duties on Rolled Steel Imports for 200 Days“, “Egypt protects domestic flat steel industry with 13.6% safeguard duty“, “Egypt has imposed a temporary duty on imports of hot-rolled steel at 13.6%“, and “Egypt Imposes Temporary Safeguard Duties of 13.6% on Hot-Rolled Steel Imports” directly explain the implemented duties. The article “Egypt Imposes Safeguard Duties on Billet Imports at 16.2%” explains the duties for billet imports. As a consequence, these measures are expected to influence domestic steel production levels. However, no direct link can be established, based on the provided articles and satellite-observed activity, between these new import duties and activity changes at the Sider El Hadjar Annaba steel plant, the Libyan Iron and Steel Misrata plant or the Mahgreb Steel Casablanca plant, as described in the following sections.

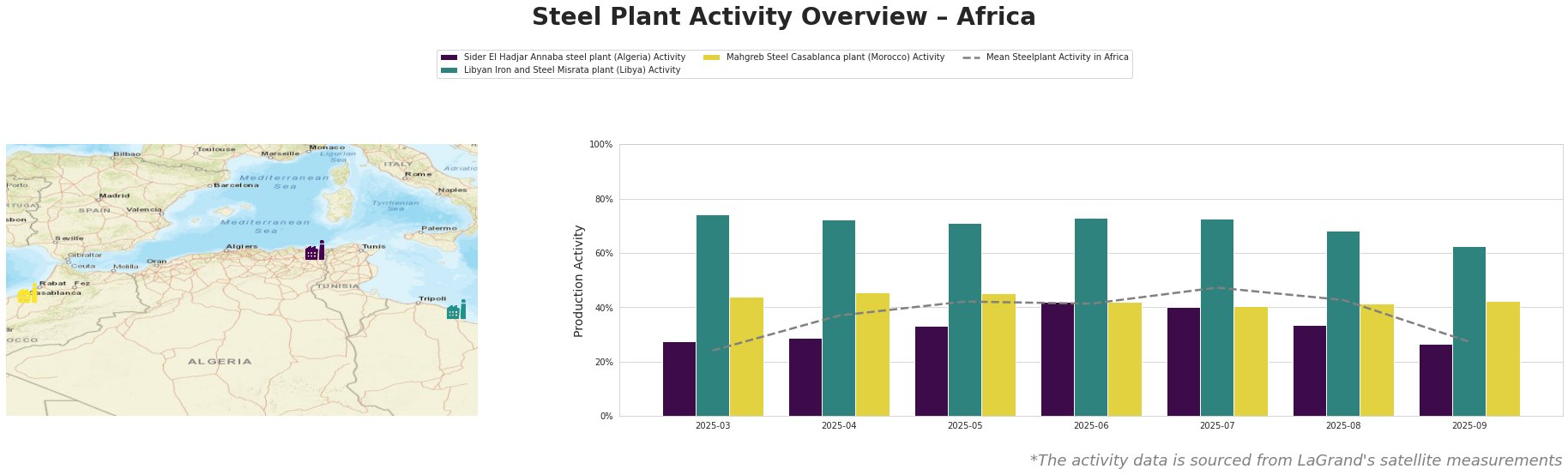

The average steel plant activity in Africa peaked in July 2025 at 47.0% and dropped to 27.0% in September 2025. The Libyan Iron and Steel Misrata plant shows significantly higher activity levels than the average, ranging from 63.0% to 74.0%. The Sider El Hadjar Annaba steel plant shows activity levels below the average African activity, ranging from 27.0% to 42.0%. The Mahgreb Steel Casablanca plant shows activity levels close to the African average.

The Sider El Hadjar Annaba steel plant in Algeria, an integrated BF-EAF producer with a crude steel capacity of 1.8 million tonnes per annum, showed fluctuating activity. From March to June 2025, activity increased from 28% to 42%, followed by a decrease to 27% in September 2025. No direct connection can be established between this activity pattern and the news articles concerning Egyptian import duties.

The Libyan Iron and Steel Misrata plant, a DRI-EAF based plant with a crude steel capacity of 1.75 million tonnes, has consistently exhibited high activity levels relative to the African average. The activity decreased from 74.0% in March to 63.0% in September, which is the biggest activity drop of this plant in the observed period. No direct connection can be established between this activity pattern and the news articles concerning Egyptian import duties.

The Mahgreb Steel Casablanca plant in Morocco, an EAF-based plant with a 1 million tonne capacity, showed relatively stable activity levels, ranging from 40% to 46% during the observed period. No direct connection can be established between this relatively stable activity pattern and the news articles concerning Egyptian import duties.

Egypt’s safeguard duties on hot-rolled steel and billet imports, as highlighted in the articles “Egypt protects domestic flat steel industry with 13.6% safeguard duty” and “Egypt Imposes Safeguard Duties on Billet Imports at 16.2%,” are likely to reduce imports from countries like China, Russia, Japan, and Turkey into Egypt. Given the limited direct correlation between the news articles and observed plant activity, steel buyers and analysts should:

- Monitor Egyptian domestic prices closely: The news indicates potential price increases in the Egyptian domestic market due to reduced import competition. Track local HRC prices (currently around $600/mt) and billet prices to identify potential arbitrage opportunities or increased costs.

- Diversify sourcing: With Egypt potentially becoming a less accessible market for some international suppliers, proactively explore alternative markets in North Africa to secure competitive pricing, if Egypt was the main target market.