From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEgyptian Steel Market Faces Headwinds: EU Duty Cut Amidst Factory Slowdown

The Egyptian steel market faces a challenging outlook following the EU’s decision to reduce anti-dumping duties, coupled with recent declines in steel plant activity levels. While the news articles “EU Decides to Reduce Anti-Dumping Duty on Egyptian Steel Imports to 11.7%“, “EC proposes lower HRC definitive AD on Ezz, Nippon“, and “EU lowers AD duties on HRC from Egypt’s Ezz Steel and Japan’s Nippon Steel” suggest improved export conditions, satellite data indicates potential production adjustments. No direct relationship can be explicitly established between the duty changes and observed plant activity.

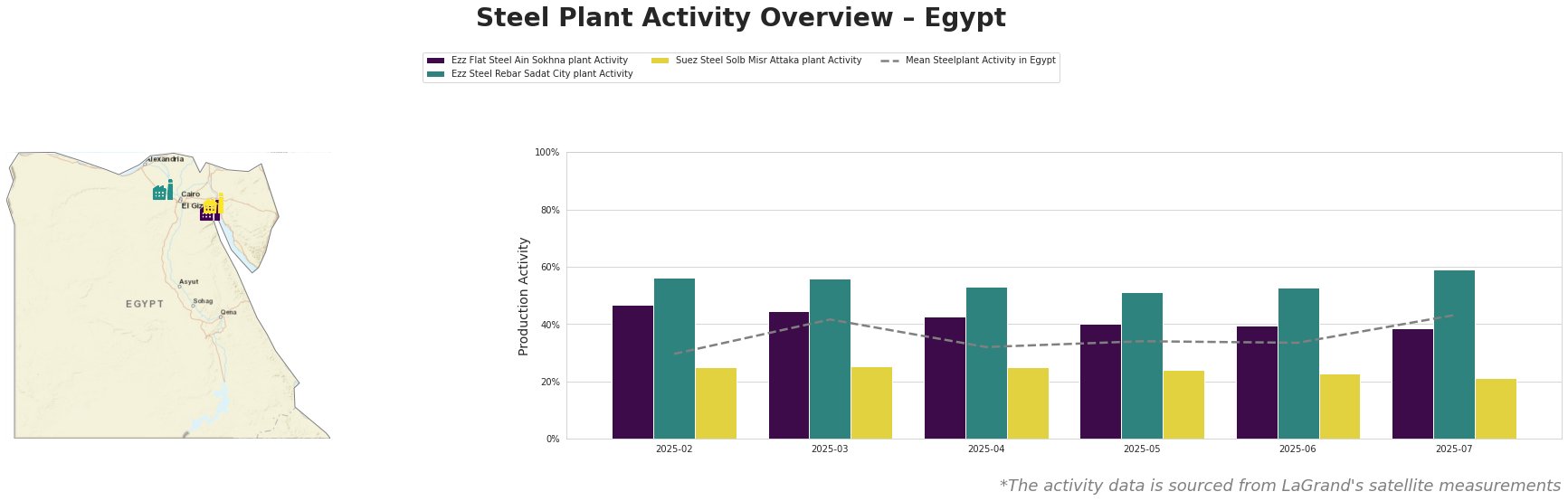

The average steel plant activity in Egypt fluctuated, peaking in March at 42% and reaching a high of 43% in July. Ezz Steel Rebar Sadat City plant consistently exhibited the highest activity relative to the other plants. In contrast, Suez Steel Solb Misr Attaka plant consistently showed the lowest activity levels. Ezz Flat Steel Ain Sokhna plant’s activity experienced a decline from 47% in February to 39% in July.

Ezz Flat Steel Ain Sokhna plant, located in Suez, possesses a crude steel capacity of 2.3 million tonnes per annum (ttpa), utilizing DRI and EAF technologies for producing semi-finished and finished rolled products including HRC, billet and rebar. The plant’s activity decreased from 47% in February to 39% in July. No direct connection can be established between this decline and the news articles regarding EU anti-dumping duties.

Ezz Steel Rebar Sadat City plant, situated in Menofia, has a crude steel capacity of 1.0 million ttpa, relying on EAF technology to produce rebar. This plant demonstrated the highest activity among those observed. Its activity remained relatively stable, fluctuating between 51% and 59% throughout the observed period. No direct link can be established between this stable trend and the news concerning EU duties.

Suez Steel Solb Misr Attaka plant, located in Suez, features a crude steel capacity of 2.1 million ttpa, integrating DRI and EAF processes to manufacture billet, rebar, and slabs. This plant showed the lowest activity levels of the three, dropping to 21% in July. No direct correlation can be explicitly established between this activity level and the news regarding EU duties.

Despite reduced EU anti-dumping duties potentially increasing export competitiveness, the observed decline in activity, particularly at Ezz Flat Steel Ain Sokhna and Suez Steel Solb Misr Attaka, raises concerns about potential supply disruptions. Steel buyers should monitor the activity levels, especially for HRC from Ezz Flat Steel Ain Sokhna, and consider diversifying their sourcing to mitigate risks associated with potential production cuts. Market analysts should closely observe the impact of the reduced duties on export volumes in the coming months to assess whether increased demand can offset the observed activity decreases.