From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEgyptian Steel Faces EU Duty Cut, Impacting African Output: A Market Downturn

The African steel market faces a negative outlook, influenced by recent EU policy changes and fluctuating plant activity. The “EU Decides to Reduce Anti-Dumping Duty on Egyptian Steel Imports to 11.7%” and “EC proposes lower HRC definitive AD on Ezz, Nippon” directly impact Egyptian steel producers, potentially shifting supply dynamics within Africa. While these articles highlight duty reductions, observed activity levels at key plants like Ezz Flat Steel Ain Sokhna do not show immediate positive correlation, suggesting other factors are at play.

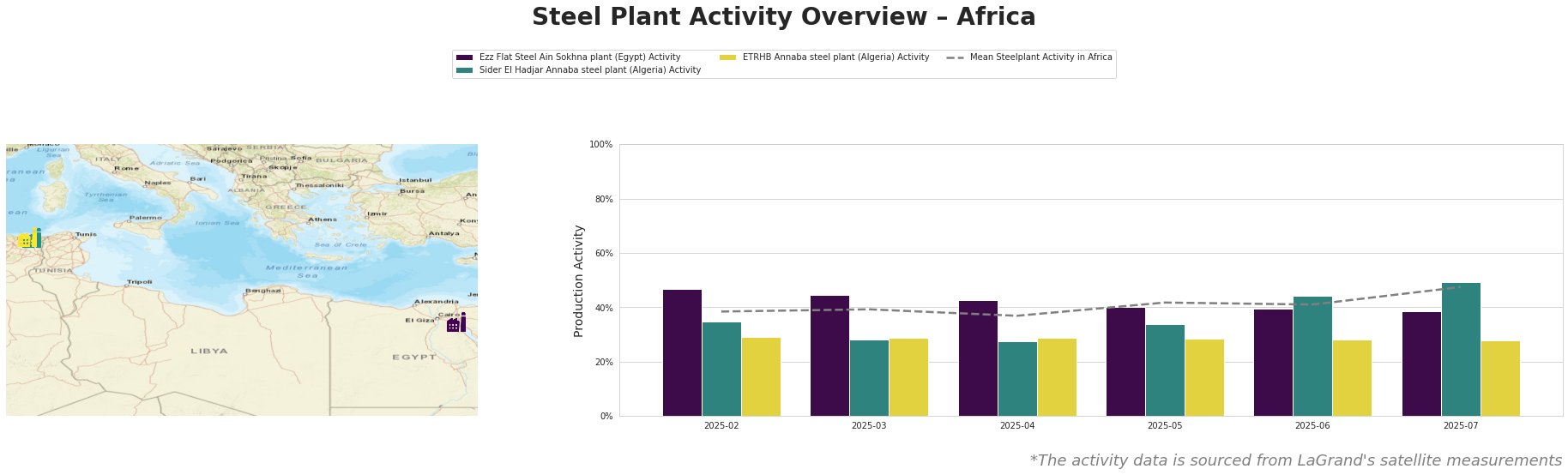

Overall, the mean steel plant activity in Africa increased from 38.0% in February to 47.0% in July. Ezz Flat Steel Ain Sokhna plant, a DRI- and EAF-based facility with a 2.3 million tonne crude steel capacity producing billets, rebar, and HRC, saw its activity decrease from 47.0% in February to 39.0% in July, despite the reduction in EU anti-dumping duties, as reported in “EU lowers AD duties on HRC from Egypt’s Ezz Steel and Japan’s Nippon Steel“. It is notable that while EU duties are reduced, Ezz plant activity is decreasing. This could suggest a shift in export strategy focusing on regions beyond the EU or internal production challenges. Sider El Hadjar Annaba, an integrated BF- and EAF-based plant in Algeria with a crude steel capacity of 1.8 million tonnes focusing on hot-rolled coils, sheets, and rebar, experienced a notable activity increase, from 35.0% in February to 49.0% in July, exceeding the African mean. No direct connection can be established between this increase and the provided news articles regarding Egyptian steel duties. ETRHB Annaba, another Algerian EAF-based plant, remained consistently low at approximately 28.0% throughout the period, indicating stable, potentially constrained production. No connection could be established between the activity of this plant and the provided news articles.

The reduction in EU anti-dumping duties on Egyptian HRC, specifically from Ezz Steel, might lead to increased HRC availability within Africa. However, the concurrent decrease in Ezz Flat Steel Ain Sokhna’s activity requires steel buyers to closely monitor inventory levels and lead times. Procurement Recommendation: Steel buyers should diversify their HRC sourcing, exploring opportunities with Algerian producers like Sider El Hadjar Annaba, given their increasing activity. Simultaneously, engage in active communication with Ezz Steel to understand their production and export plans, mitigating potential supply chain disruptions linked to the observed activity decrease.