From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEgypt Steel Market Reacts Positively to Safeguard Duties: Production Stable Amid Import Restrictions

Egypt’s steel market is showing resilience following the implementation of safeguard duties on imports. The core issue is the protection of the domestic steel industry, as evidenced by the article “Egypt protects domestic flat steel industry with 13.6% safeguard duty,” which details the implementation of a duty on hot-rolled coil (HRC) imports. The news articles “Egypt Considers Imposing Safeguard Duties on Rolled Steel Imports for 200 Days,” “Egypt has imposed a temporary duty on imports of hot-rolled steel at 13.6%,” and “Egypt Imposes Temporary Safeguard Duties of 13.6% on Hot-Rolled Steel Imports” further confirm this government action. While these news items signal potential shifts in import dynamics, there is no immediate, directly observable correlation with the satellite activity data during the period specified. However, the introduction of safeguard duties on billets is confirmed by the article “Egypt Imposes Safeguard Duties on Billet Imports at 16.2%“.

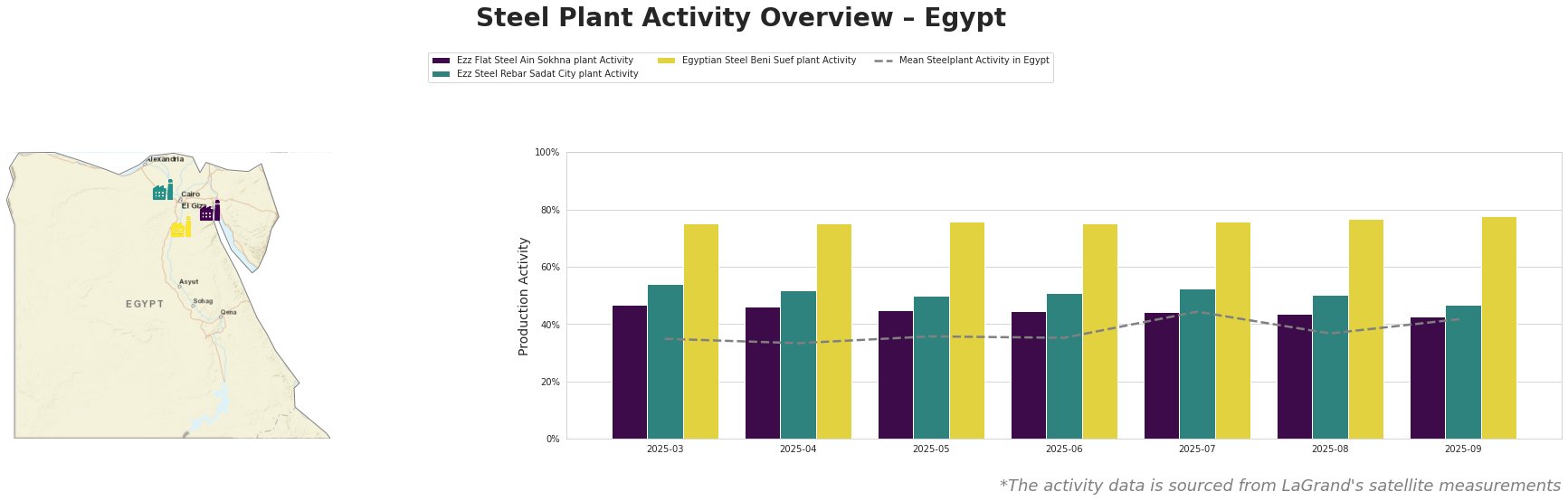

The mean steel plant activity in Egypt showed a slight increase throughout the observed period, from 35% in March to 42% in September. Ezz Flat Steel Ain Sokhna plant’s activity was relatively stable, fluctuating between 43% and 47%. Ezz Steel Rebar Sadat City plant saw a decrease from 54% in March to 47% in September. Egyptian Steel Beni Suef plant maintained a consistently high activity level, increasing slightly from 75% to 78% during the same period, and significantly above the national mean.

Ezz Flat Steel Ain Sokhna plant, located in Suez, operates with a 2300 ttpa crude steel capacity utilizing DRI and EAF technologies to produce semi-finished products like billets and finished rolled products, including rebar and HRC. Its activity has remained relatively stable, hovering around 45%, throughout the observed period, with a slight dip to 43% by September. There is no directly observable correlation between this stable activity and the news articles regarding safeguard duties, though the plant’s HRC production could be indirectly influenced by the reduced import competition.

Ezz Steel Rebar Sadat City plant, situated in Menofia, focuses on finished rolled products, specifically rebar, with a 1000 ttpa crude steel capacity using EAF technology. Its activity has experienced a gradual decrease from 54% in March to 47% in September. No direct connection can be established between this decrease and the news regarding import duties, although the safeguard duties on billets (“Egypt Imposes Safeguard Duties on Billet Imports at 16.2%“) might create higher input costs.

Egyptian Steel Beni Suef plant, in Beni Suef, produces semi-finished (billets) and finished rolled products (rebar) with a 600 ttpa capacity, also employing EAF technology. This plant has consistently shown high activity, increasing slightly from 75% to 78% over the observation period, substantially exceeding the national mean. No direct correlation can be established between this consistently high activity and the news articles regarding safeguard duties.

The implementation of safeguard duties, as highlighted in “Egypt protects domestic flat steel industry with 13.6% safeguard duty,” along with other related announcements, signals a government strategy to bolster domestic steel production by restricting imports. Given the high and stable activity at Egyptian Steel Beni Suef plant and the stable activity at Ezz Flat Steel Ain Sokhna plant, coupled with billet and HRC import restrictions, potential supply disruptions are more likely for products historically reliant on imports.

Procurement Actions: Steel buyers and analysts should prioritize securing contracts with domestic producers like Egyptian Steel and Ezz Steel to ensure a stable supply of rebar. Given the implemented duties on HRC imports, monitor domestic HRC pricing from Ezz Flat Steel Ain Sokhna, as import options become less competitive. The “Egypt Imposes Safeguard Duties on Billet Imports at 16.2%” news article suggests potential risks in billet supply, and it is advisable to confirm billet availability from domestic sources such as Egyptian Steel Beni Suef plant if applicable to your operations.