From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineDeteriorating Sentiment in Asia’s Steel Market: Direct Impacts from Global Oil Price Hikes and Activity Drops

Recent activities in Asia’s steel market reflect a negative sentiment largely influenced by evolving dynamics in the oil sector. The Trump’s Sanctions Light a Fire Under Oil Prices have marked a significant uptick in oil prices, which, coupled with German diesel prices rise on sanctions, has created a ripple effect, dampening steel production activity across key facilities in the region. These events have not only impacted raw material procurement but have also curtailed operational efficiencies at various steel plants.

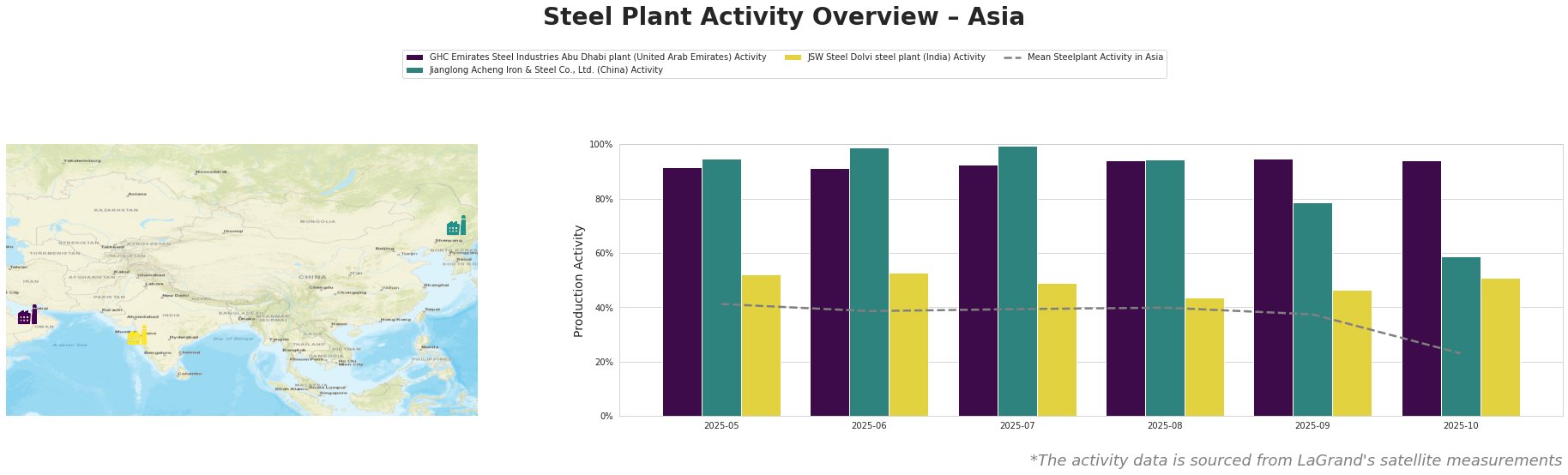

As evidenced by satellite-observed data, average steel plant activity in Asia plummeted to 23% by October 31, 2025, a sharp decline from 37% in September. Notably, the GHC Emirates Steel Industries Abu Dhabi plant and Jianglong Acheng Iron & Steel Co., Ltd. have observed activity drops to 94% and 59% respectively, the latter reflecting a 20% decrease since September, directly correlating with heightened operational costs due to rising oil prices without a corresponding increase in demand aligned with Trump’s Sanctions narrative. Meanwhile, JSW Steel Dolvi steel plant remained relatively stable at 51%, likely indicating resilience amidst increasing operational pressures.

Measured Activity Overview

Evaluated Market Implications

The anticipated supply disruptions are predominantly associated with Jianglong Acheng Iron & Steel Co., Ltd., whose activity has significantly dropped by 20%, likely reflecting a tighter operational framework amid rising energy costs spotlighted in the aforementioned articles. As buyers, it is advisable to consider diversifying sourcing as operational costs are likely to spike further due to the reliance on volatile oil prices, particularly evident from India Has Been ‘Very Very’ Good: Trump After Refiners Halt Russian Oil Imports, indicating a shift away from Russian oil which may strain supply chains indirectly affecting steel input costs.

Procurement strategies should pivot to lock in inventory from resilient plants such as JSW Steel Dolvi, which shows steady activity levels and could provide some buffer against rising costs. Taking immediate stock of operational output and forecasts from these key players will be crucial in navigating the downward trend that appears set to continue in the current market climate.