From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineDeclining Steel Production and Strict Export Licensing Signal Turmoil in Asia’s Steel Market

Recent developments in Asia’s steel market indicate a negative sentiment driven by decreased production and new export regulations. The articles titled “China’s Crude Steel Output Drops Below 70 Million Tons in November,” and “China Moves to License Steel Exports, Reshaping Asian Trade Flows and Mill Strategies,” reveal significant declines in steel production due to environmental restrictions and the implementation of an export licensing system that could disrupt typical sourcing strategies in the region.

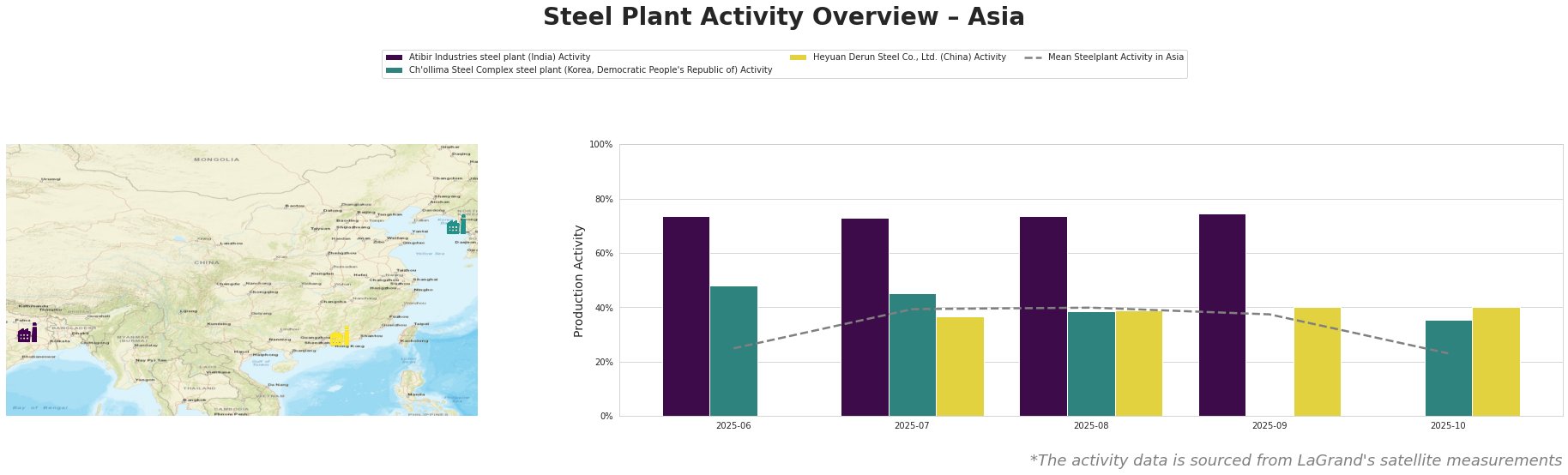

Measured Activity Overview

Recent satellite data show that average steel plant activity across Asia has significantly dropped, hitting a low point of 23% in October 2025. Notably, the activity of the Atibir Industries steel plant has shown relative stability at around 74% despite regional pressures, while the Heyuan Derun Steel Co., Ltd. experienced a decline in activity, remaining stable at 40% in October. The Ch’ollima Steel Complex did not report activity for October, limiting the ability to connect its performance to recent news.

The decline in overall steel production in China, specifically to a two-year low as highlighted in “China cut steel production to a two-year low in November,” may signify broader regional supply disruptions, especially given the export licensing changes that will come into effect from January 2026.

Evaluated Market Implications

With China’s crude steel production reported at 69.87 million tons in November, a 10.9% decline year-on-year, buyers should prepare for unexpected supply chain disruptions. The export licensing system may further restrict metal availability and increase costs, particularly affecting nations reliant on Chinese steel.

Steel procurement professionals should consider diversifying sources and evaluating domestic capabilities. Specifically, monitoring the Atibir Industries and Heyuan Derun for procurement could be beneficial due to their relatively higher activity levels. Conversely, the unpredictability surrounding the Ch’ollima Steel Complex indicates a significant risk—interruption in either capacity or supply should prompt buyers to secure additional contracts or anticipate price fluctuations.

With these dynamics reshaping trade flows, strategic adjustments in procurement strategies could minimize impacts stemming from concurrent drops in production and licensing challenges.