From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineChinese Steel Production Stable Despite EU Tariff Threats: Xinjiang Yili Surges

China’s steel sector remains resilient despite potential EU tariffs. According to news articles titled “The EU may impose tariffs of 25-50% on Chinese steel – Handelsblatt,” “EU plans tariffs of 25%-50% on Chinese steel and related products, Handelsblatt reports” and “The EU plans to impose duties of 25-50% on Chinese steel and related products, according to Handelsblatt.“, the EU is considering tariffs on Chinese steel. However, satellite observations show stable to increasing activity at key Chinese steel plants, although no direct relationship between the EU announcement and production activities could be established.

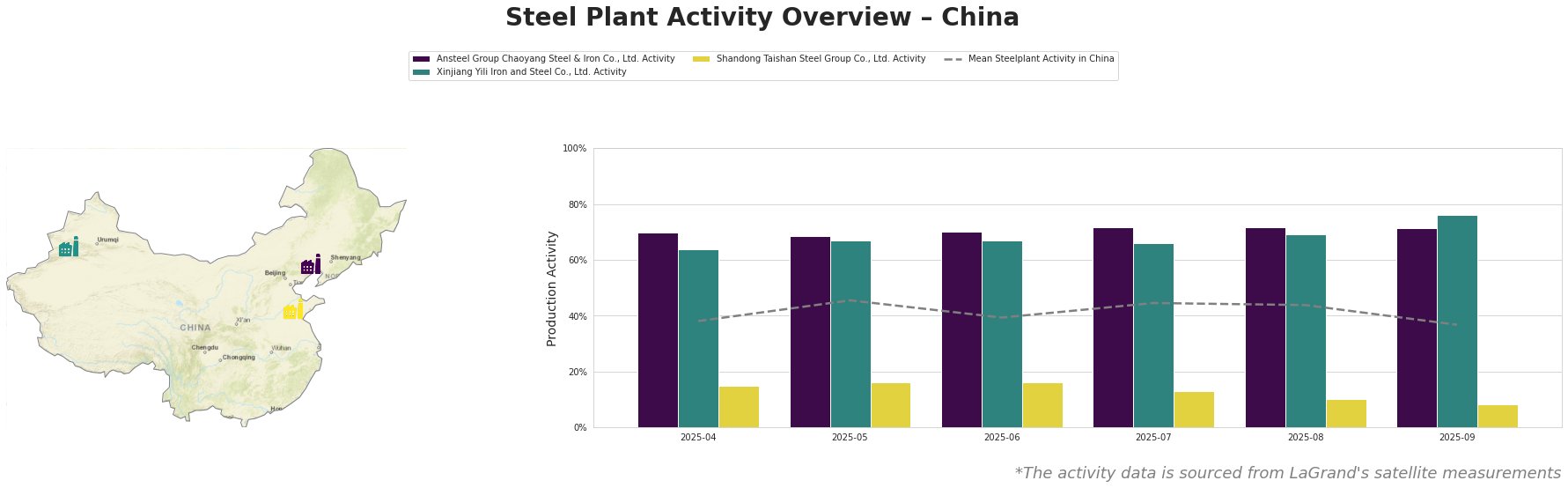

The mean steel plant activity in China fluctuated between 37% and 46% during the observed period. Ansteel Group Chaoyang Steel & Iron Co., Ltd. consistently operated above the national average, holding steady at 72% for the last three months of observation. Xinjiang Yili Iron and Steel Co., Ltd. also operated well above the average, rising to 76% in September. Shandong Taishan Steel Group Co., Ltd. operated significantly below the average, declining to just 8% activity in September.

Ansteel Group Chaoyang Steel & Iron Co., Ltd., located in Liaoning, uses integrated BF/BOF processes with a crude steel capacity of 2.1 million tonnes. Activity remained consistently high at approximately 70% and then settling at 72% for the last 3 months of observation, significantly above the national average. Considering its Responsible Steel Certification and consistent output, this plant appears to be a reliable supplier, despite potential external trade pressures referenced in “The EU may impose tariffs of 25-50% on Chinese steel – Handelsblatt“. No direct link could be established between the observed activity level and the news reports.

Xinjiang Yili Iron and Steel Co., Ltd., based in Xinjiang, also utilizes integrated BF/BOF processes with a capacity of 1 million tonnes of crude steel. The plant showed strong activity in the observed period, increasing to 76% in September. As with Ansteel, there is no direct evidence to link these high activity rates to the EU tariff news.

Shandong Taishan Steel Group Co., Ltd., situated in Shandong, has a crude steel capacity of 5 million tonnes, with both BF/BOF and EAF processes. It is the only plant of the three with an EAF. The plant’s activity was significantly below the national average and declined steadily, reaching only 8% in September. No direct connection can be established between this decline and the news articles concerning EU tariffs. This may indicate internal adjustments within the company, or regionally impacting circumstances that aren’t revealed in the news articles, or simply due to end of quarter “slow downs.”

Evaluated Market Implications:

Given the stable output at Ansteel Group Chaoyang Steel & Iron Co., Ltd. and Xinjiang Yili Iron and Steel Co., Ltd., and the potential for EU tariffs as outlined in “The EU may impose tariffs of 25-50% on Chinese steel – Handelsblatt,” “EU plans tariffs of 25%-50% on Chinese steel and related products, Handelsblatt reports” and “The EU plans to impose duties of 25-50% on Chinese steel and related products, according to Handelsblatt.“, steel buyers should:

- Diversify Sourcing: For EU-based buyers, consider diversifying steel sourcing outside of China to mitigate tariff impacts if tariffs do materialize.

- Monitor Shandong Taishan Steel Group: Closely monitor the production outlook for Shandong Taishan Steel Group Co., Ltd. due to its sharply reduced activity levels; potential supply disruptions may arise, and alternative sources for its products may be required. Explore domestic alternatives within China.

- Engage with Suppliers: Communicate with existing Chinese suppliers, particularly Ansteel and Xinjiang Yili, to understand their strategies for navigating potential trade barriers and securing long-term supply agreements.