From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineChinese Steel Activity Remains Strong Despite Global Concerns: Ansteel Group Leads

China’s steel sector demonstrates resilience amidst global concerns over low-cost imports, particularly into the EU. While the EU debates measures to address import challenges as highlighted in “Alexander Julius: Industry must utilise political problem-solving momentum,” and “Eurometal has started collecting information from EU associations, national federations and steel consumers regarding imports of low-cost steel derivatives into the EU. The Association analyzes the increase in imports compared to the continued decline in” there is no direct linkage in the available news to specific activity fluctuations within Chinese steel plants.

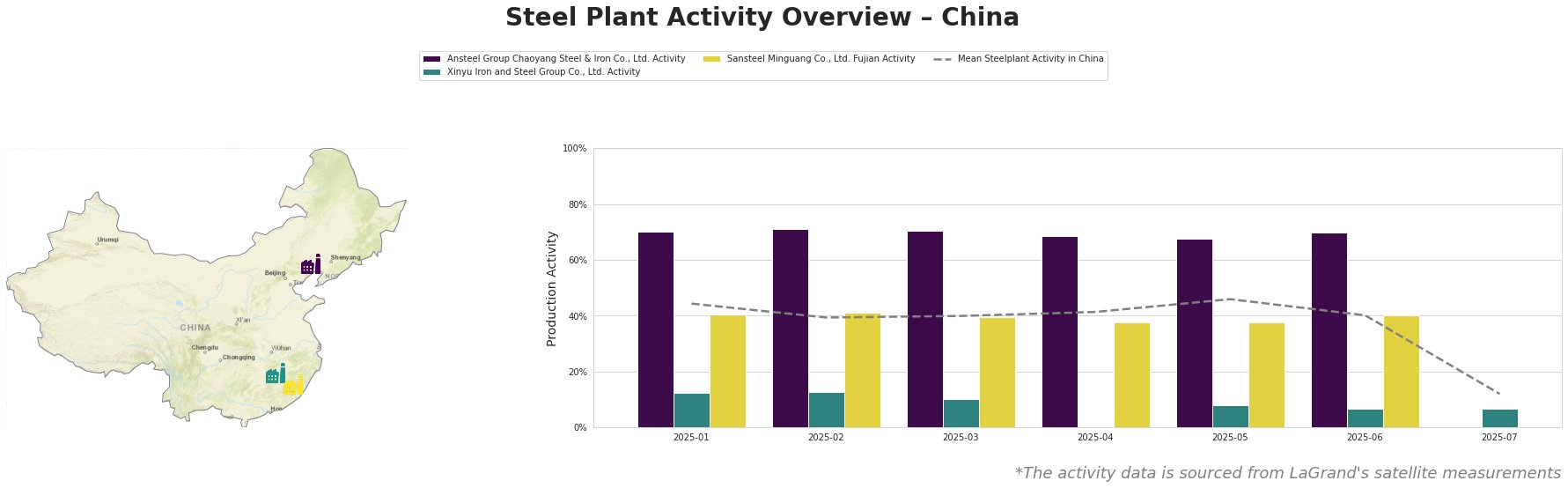

The mean steel plant activity in China has fluctuated between 39% and 46% from January to May 2025, with a notable drop to 12% in July. Ansteel Group Chaoyang consistently operates well above the mean, remaining near 70% activity. Xinyu Iron and Steel Group has consistently shown significantly lower activity, falling to 7% in June and July. Sansteel Minguang’s activity remained relatively stable between 38% and 41%. The sharp drop in the mean activity level in July and absence of some activity data makes inferences difficult. No direct connection to the provided news articles can be established for these specific activity fluctuations.

Ansteel Group Chaoyang Steel & Iron Co., Ltd., located in Liaoning, is an integrated BF/BOF steel plant with a crude steel capacity of 2.1 million tonnes. Its activity has been consistently high, averaging around 70% during the observed period. This suggests strong local demand or efficient operations, despite the concerns raised in “Alexander Julius: Industry must use political momentum to solve problems” regarding potential import restrictions in other regions. However, no explicit connection can be made between this article and Ansteel’s high activity level. The plant focuses on finished rolled products, including steel plate and steel pipe.

Xinyu Iron and Steel Group Co., Ltd., situated in Jiangxi, possesses a significantly larger crude steel capacity of 10 million tonnes, utilizing both BF/BOF and EAF processes. Its activity levels are notably lower than both the national average and Ansteel, consistently below 13% during the observed period. This lower activity could be due to a variety of factors, including maintenance, market conditions for its specific product mix (medium, cold/hot rolled thin, thick, and extra thick plates for energy, building/infrastructure, and transport sectors), or strategic decisions unrelated to the EU import concerns discussed in “Eurometal has started collecting information from EU associations, national federations and steel consumers regarding imports of low-cost steel derivatives into the EU. The Association analyzes the increase in imports compared to the continued decline in“. The sharp drop in July could indicate potential further operational issues, but this remains speculative without further data.

Sansteel Minguang Co., Ltd. Fujian, an integrated BF/BOF steel plant with 6.8 million tons of crude steel capacity, demonstrates steady activity between 38% and 41%. Its focus is on steel plates, round bars, and construction steel for building/infrastructure, transport, and tools/machinery. There’s no evident impact from the EU market concerns on its activity levels, and no explicit connection to the news articles can be established.

Evaluated Market Implications:

Given the consistently high activity levels at Ansteel Group Chaoyang and the overall positive sentiment, the Chinese domestic steel market appears robust. However, the significantly lower activity observed at Xinyu Iron and Steel Group, coupled with the sharp drop in mean activity in July, may indicate potential localized supply constraints for specific products.

Recommended Procurement Actions:

- Steel Buyers: Given the observations above, steel buyers sourcing medium, cold/hot rolled thin, thick, and extra thick plates should monitor Xinyu Iron and Steel Group’s production status and consider diversifying suppliers to mitigate potential delays or price increases. Closely monitor the average Chinese steel plant activity levels and consider advanced purchasing if those indicate a reduction in supply.

- Market Analysts: Further investigation is warranted to understand the reasons behind Xinyu Iron and Steel Group’s lower activity. Analyzing their specific product market and regional demand could provide valuable insights. Furthermore, monitoring the causes of the drastic reduction in mean steel plant activity in July 2025 is required to judge the overall stability of the Chinese steel production sector.