From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineChina’s Steel Production Declines to Lowest Levels, Signaling Supply Pressures

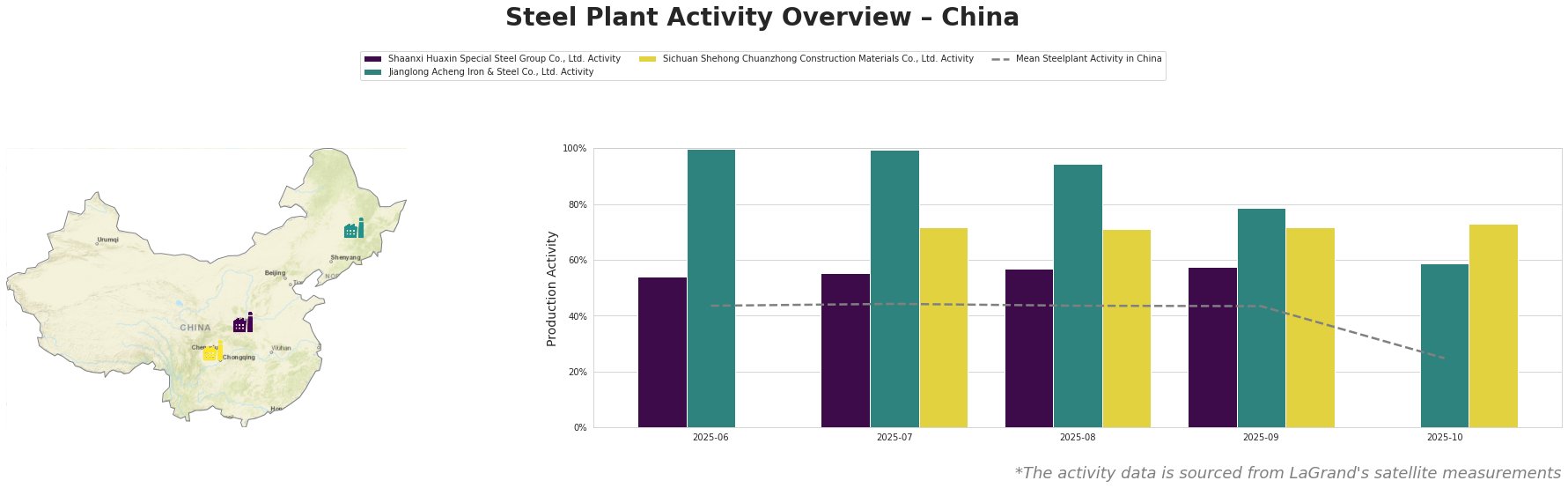

China’s steel market is experiencing significant turbulence, with production hitting a two-year low. According to China cut steel production to a two-year low in November, the country’s crude steel output fell to 69.87 million tons in November 2025, reflecting a 10.9% year-on-year decrease. Satellite data corroborates this, showing a dramatic reduction in plant activity levels, particularly notable in the latest observed month.

The data reveals a sharp drop in average activity levels across the steel plants, with a notable decrease from 43% down to 25% in October 2025. This coincides with the revelations in China’s Crude Steel Output Drops Below 70 Million Tons in November, linking the overall market downturn to the reductions enacted to meet air quality goals and production caps.

Shaanxi Huaxin Special Steel Group Co., Ltd. operates a 1,200 ktpa capacity, primarily producing finished rolled products via Electric Arc Furnaces (EAF). Activity peaked at 57% in August but observed an abrupt halt in late October when monitoring revealed no operational activity—aligned with announcements in China cut steel production to a two-year low in November.

Jianglong Acheng Iron & Steel Co., Ltd. maintains a similar capacity of 1,100 ktpa with integrated technologies. Its activity has been fluctuating but fell to 59% during the last monitored month, reflecting the broader industry declines as noted in China’s crude steel output falls below 70 million mt in Nov.

Sichuan Shehong Chuanzhong Construction Materials Co., Ltd., with a lesser capacity of 550 ktpa, showed slight resilience with 73% activity levels in October, though this is still a slump from prior months. This plant’s data lacks a direct link to wild fluctuations in overall output, suggesting it might still be operational amidst broader plant shutdowns.

Given the negative sentiment and ongoing production constraints, steel buyers should strategically prepare for:

– Potential supply disruptions particularly from Shaanxi Huaxin, where activity has ceased, indicating future shortages.

– Procurement actions should focus on securing supplies from Jianglong and Sichuan, which might provide more stable output compared to others.

Timely purchasing is advised to mitigate risks from continuing reductions, as further projections indicate that production might not rebound in 2024 as previously anticipated.