From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineChina’s Steel Market: Positive Activity Trends Amid Reduced Iron Ore Production

China’s steel market sentiment remains positive, supported by a recent uptick in plant activities despite a decline in iron ore production. As reported in “China has reduced iron ore production“ and “Global pig iron production in 2025 fell to 1.37 billion tons,” the observed reductions in iron ore production have not stifled steel plant activity, as evidenced by satellite data.

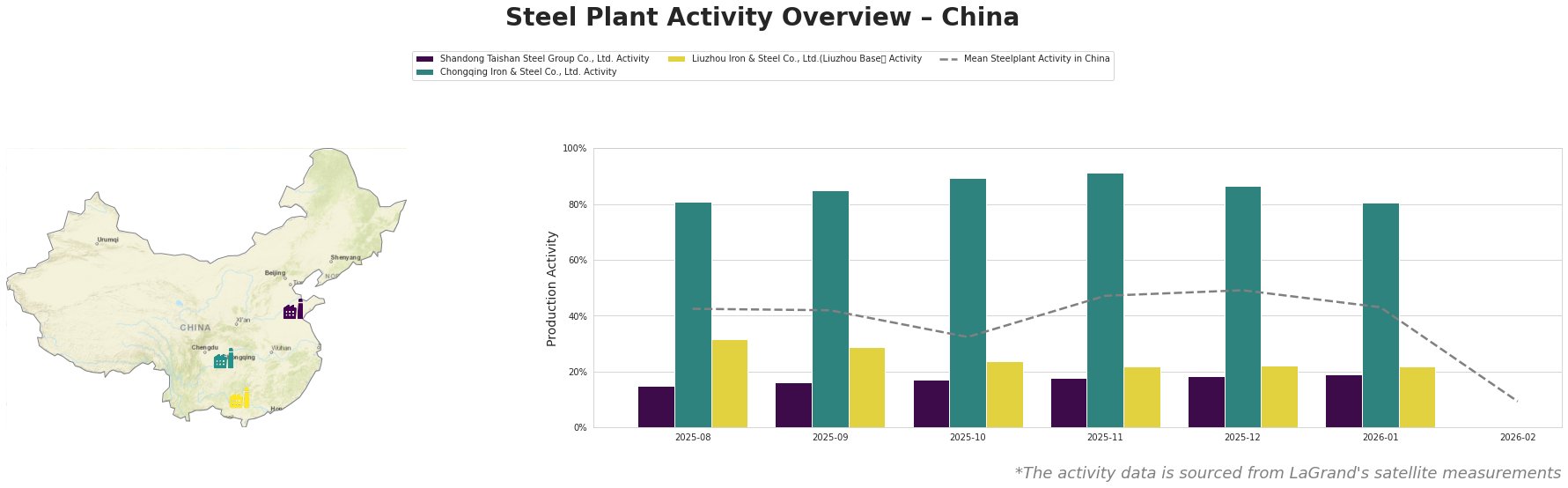

Satellite trends indicate that while the mean activity across steel plants increased to 43% in January 2026, marked by a rise in Shandong Taishan Steel Group’s output to 19% (up from 18%), Chongqing Iron & Steel remained robust at 81% activity. Liuzhou’s levels stabilized at 22%, consistent with previous trends. These activity levels align with reports, notably the rise in iron ore imports by 1.8% year-on-year, as highlighted in the aforementioned iron ore production article, which may have supported steel processing operations despite domestic output constraints.

Shandong Taishan Steel, with a crude steel capacity of 5 million tonnes, operates primarily with an integrated process, emphasizing finished rolled products. It recently reported a slight increase to 19%, potentially benefiting from the growing import of iron ore as noted in “China has reduced iron ore production”.

Chongqing Iron & Steel maintains an impressive operational level at 81%. This stability contrasts with the volatile global production of pig iron, where China’s production led the capacity at 836.04 million tons as stated in “Global pig iron production in 2025 fell to 1.37 billion tons.” This indicates efficient utilization amidst global disruptions.

Liuzhou Iron & Steel’s activity at 22% remains low, indicating minimal shifts likely influenced by the broader market dynamics captured in recent news reports.

In light of these patterns, procurement actions should focus on establishing contracts with engaged plants like Chongqing Iron & Steel, which demonstrate resilience and output capacity, while closely monitoring iron ore supply trends. The export figures from “China exported over 5 million tons of stainless steel in 2025“ provide additional leverage for potential suppliers, enhancing the scope for strategic sourcing as domestic offerings become more competitive.

Overall, maintaining flexibility and building robust relationships with high-activity plants will allow for mitigated supply risks and improved procurement strategies during these dynamic market conditions.