From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineChina’s Steel Exports Surge Amidst Stable Iron Ore Imports, Signaling Continued Production

China’s steel market exhibits positive momentum driven by robust export growth and consistent iron ore imports. According to “China increased steel exports by 9.2% y/y in January-September” and “China’s Steel Exports Rise by 9.2% in the First Nine Months of 2025“, steel exports have seen a substantial increase. This trend aligns with “China’s iron ore imports hit record high in Sept, almost stable in Jan-Sept“, suggesting sustained steel production capacity, further sustained by high Iron Ore Imports, despite consistent year-to-date numbers.

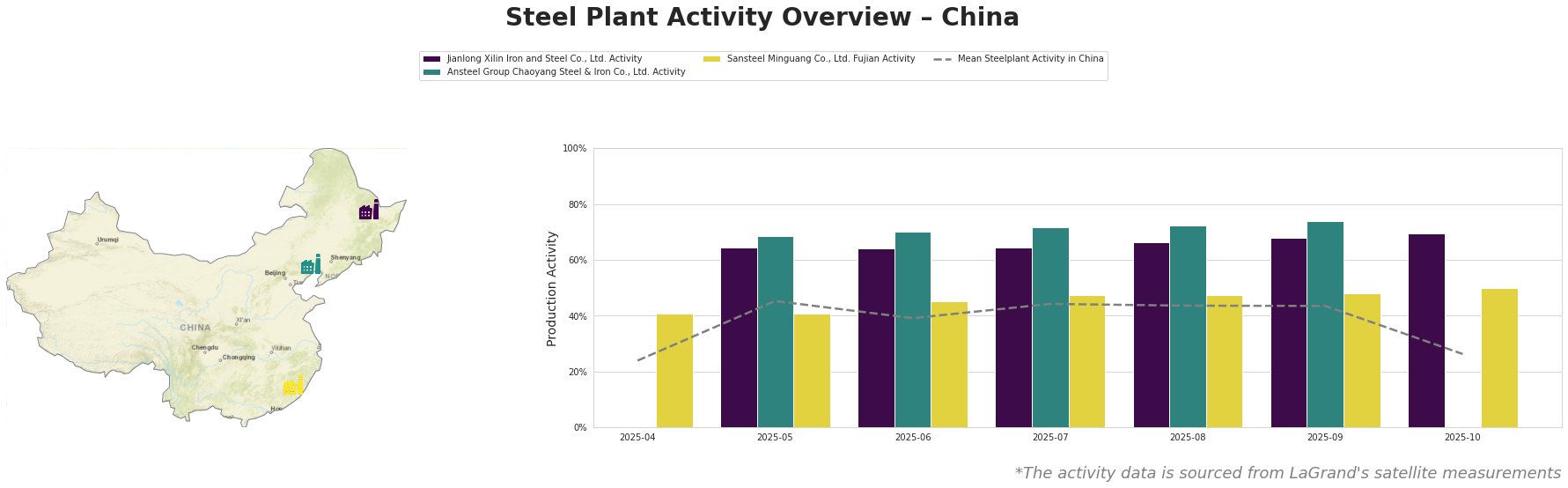

The mean steel plant activity in China peaked in May 2025 at 45% and remained relatively stable around 44% between July and September, before dropping to 26% in October. This drop in mean activity is not clearly reflected in the activity of the three individual steel plants, implying that the drop is potentially caused by a change in the total set of monitored steel plants.

Jianlong Xilin Iron and Steel Co., Ltd. shows consistently high activity, increasing steadily from 64% in May to 70% in October. Ansteel Group Chaoyang Steel & Iron Co., Ltd. also demonstrated increasing activity between May and September, peaking at 74% in September. Sansteel Minguang Co., Ltd. Fujian shows stable activity, fluctuating between 41% and 50% throughout the observed period.

Jianlong Xilin Iron and Steel Co., Ltd., located in Heilongjiang, has a crude steel capacity of 4.2 million tonnes, primarily utilizing BF and BOF technologies to produce construction-grade steel and railway equipment. The plant’s activity has steadily increased, reaching 70% in October. While the news articles highlight a general increase in steel exports and iron ore imports, no direct connection can be established between these broad trends and the specific activity increase observed at Jianlong Xilin.

Ansteel Group Chaoyang Steel & Iron Co., Ltd., based in Liaoning, possesses a crude steel capacity of 2.1 million tonnes, relying on BF and BOF processes for manufacturing steel plate and pipe. Activity levels at this plant peaked at 74% in September. Similar to Jianlong Xilin, no direct correlation can be explicitly linked between the plant’s activity and the cited news articles regarding national export and import trends.

Sansteel Minguang Co., Ltd. Fujian, located in Fujian, boasts a larger crude steel capacity of 6.8 million tonnes, using BF and BOF methods to produce steel plates, round bars, and construction steel. The plant’s activity remained relatively stable. No direct correlation can be explicitly linked between the plant’s stable activity and the cited news articles regarding national export and import trends.

Based on “China increased steel exports by 9.2% y/y in January-September” and the consistently high activity levels observed at Jianlong Xilin Iron and Steel Co., Ltd., despite a drop in the mean activity in October, steel buyers should anticipate stable supply from this region for construction grade steel, and railway products. Procurement specialists may consider prioritizing Jianlong Xilin for supply contracts, as its sustained high activity suggests reliable output. However, the overall drop in the mean production should be considered, keeping the option open to also procure from other regions/plants.