From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineChina’s Steel Exports Surge Amidst Stable Iron Ore Imports: Asia Market Signals

Asia’s steel market displays a mixed landscape with rising exports from China contrasting with fluctuating activity levels in Indian steel plants. “China increased steel exports by 9.2% y/y in January-September” and “China’s Steel Exports Rise by 9.2% in the First Nine Months of 2025” directly relate to the overall positive export trend. Although “China’s iron ore imports hit record high in Sept, almost stable in Jan-Sept” does describe increasing ore imports, no direct link to specific plant activity levels can be established based on the provided data. Separately, “Taiwan’s iron and steel export value down 7.7 percent in Jan-Sep 2025” suggests a localized market contraction, but its impact is overshadowed by China’s dominant export performance.

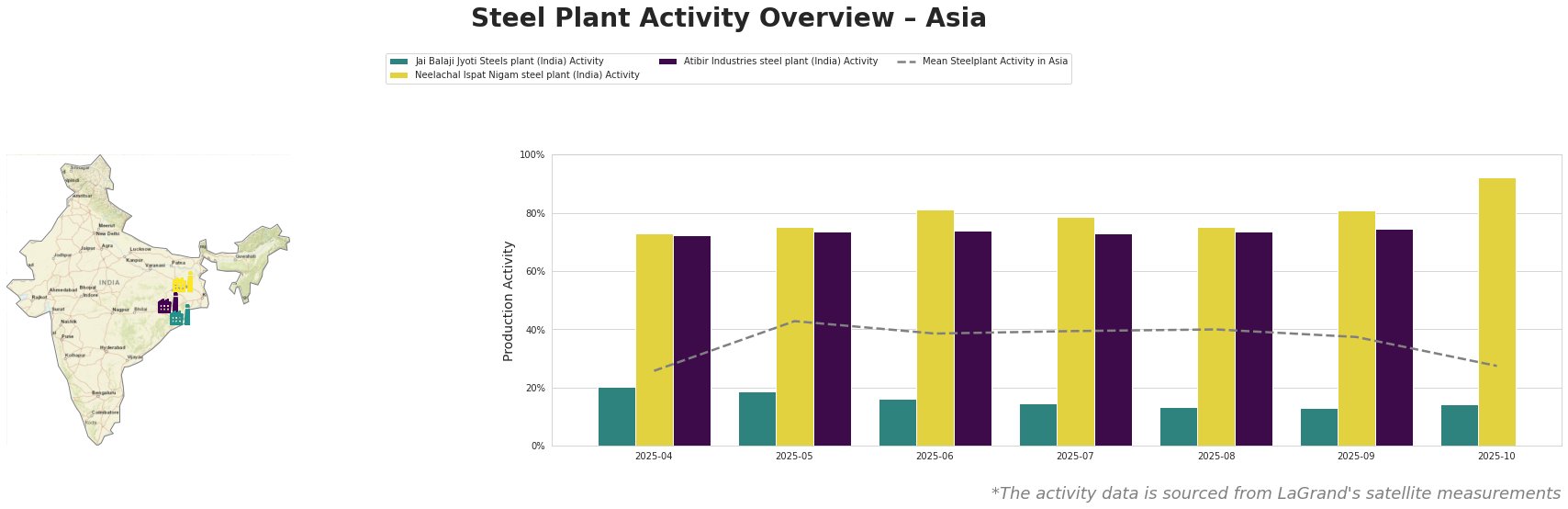

Across Asia, average steel plant activity experienced a significant drop in October to 27% after hovering between 37% and 43% from May to September. In contrast, Neelachal Ispat Nigam saw a activity surge to 92% in October.

Jai Balaji Jyoti Steels, an Odisha-based plant utilizing DRI and EAF technologies with a crude steel capacity of 92 ttpa, has exhibited a consistent decline in activity from April (20%) to September (13%), experiencing its lowest activity level in August. There was a very slight increase in October to 14%. Given China’s rising exports reported in “China increased steel exports by 9.2% y/y in January-September” and “China’s Steel Exports Rise by 9.2% in the First Nine Months of 2025”, potential competitive pressure on regional Indian producers is a possible explanation, although a direct link cannot be definitively established.

Neelachal Ispat Nigam, an integrated BF-BOF plant in Odisha with a larger 1100 ttpa crude steel capacity, demonstrates a starkly different trend. After a slight dip to 75% in August, activity rebounded strongly to 81% in September and peaked at 92% in October, the highest value in the observation window. This surge, occurring while overall regional activity declines, indicates potentially targeted efforts to ramp up production, but its relation to either China’s export increases or “Taiwan’s iron and steel export value down 7.7 percent in Jan-Sep 2025” cannot be explicitly established based on the provided information.

Atibir Industries, a Jharkhand-based integrated BF-BOF plant with a 600 ttpa crude steel capacity, maintained relatively stable activity levels between 72% and 75% from April to September. No data is available for October. No direct links can be established between the observed stable production and recent news articles.

Based on “China increased steel exports by 9.2% y/y in January-September” and “China’s Steel Exports Rise by 9.2% in the First Nine Months of 2025”, and given the consistent drop in activity at Jai Balaji Jyoti Steels, steel buyers should carefully evaluate their reliance on regional Indian suppliers like Jai Balaji Jyoti Steels, especially for products like billets, bars, and wire rods. Actively explore diversifying supply chains to mitigate potential supply disruptions and price volatility stemming from increased Chinese exports. Simultaneously, the sharp increase in activity at Neelachal Ispat Nigam may indicate a potential opportunity for securing supply from this source, especially for pig iron and semi-finished products, but procurement professionals must closely monitor pricing trends and quality assurances.