From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineChina’s Steel Exports Surge Amidst Output Fluctuations: A Mixed Outlook for Buyers

China’s steel market presents a complex picture. While “China reduces steel output for the third month in a row” indicates a production decrease, “China’s Rebar Exports Rise 52.4% in January–July 2025” and “Sharp Increase in China’s Semi-Finished Steel Exports in Jan.–July 2025” reveal a surge in exports, partly explained by “China’s steel sheet/plate exports up 2.3 percent in January-July“, driven by global uncertainties. The provided data allows for establishing connections between overall production trends and specific plant activity levels.

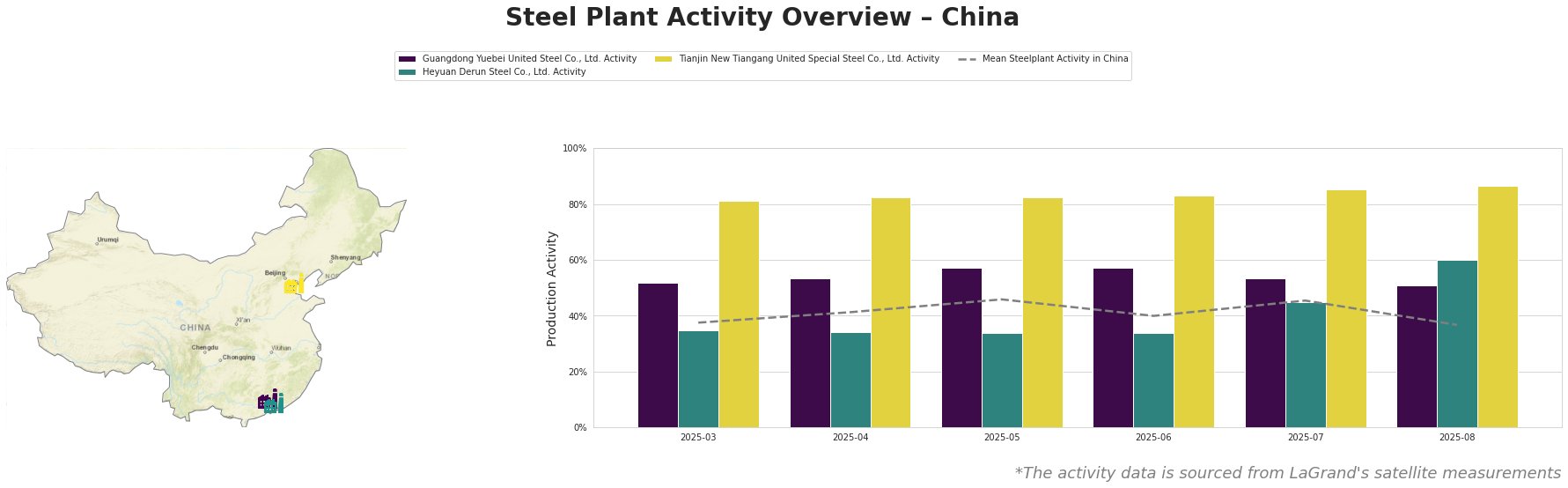

The average steel plant activity in China fluctuated, peaking at 46% in May and dropping to 37% in August. Guangdong Yuebei United Steel Co., Ltd. showed a similar trend, peaking at 57% in May and June before decreasing to 51% in August. Heyuan Derun Steel Co., Ltd. saw a significant increase in activity, jumping from 34% between April and June to 60% in August. Tianjin New Tiangang United Special Steel Co., Ltd. exhibited a consistently high activity level, rising steadily from 81% in March to 86% in August, significantly above the national average. No direct connection between these individual plant activities and the cited news articles can be established.

Guangdong Yuebei United Steel Co., Ltd., an integrated BF-based steel plant with a crude steel capacity of 2000 ttpa, primarily produces rebar for building and infrastructure. The observed activity peaked in May/June 2025 and subsequently declined by 6% to 51% in August, a level slightly above the national average. No direct connection between this fluctuation and the news articles can be established.

Heyuan Derun Steel Co., Ltd., a smaller EAF-based plant with a crude steel capacity of 1200 ttpa producing hot-rolled rebar and billet, showed a substantial activity increase to 60% in August. This is the highest activity measured for the observed period. No direct connection between this increased activity level and the news articles about increased export volumes, especially of semi-finished products, can be clearly established.

Tianjin New Tiangang United Special Steel Co., Ltd., an integrated BF-based plant with a crude steel capacity of 4500 ttpa, focuses on angle steel and continuous casting billet. Its activity has consistently increased from 81% in March to 86% in August, indicating stable or increasing production. Given the rising exports of semi-finished steel (“Sharp Increase in China’s Semi-Finished Steel Exports in Jan.–July 2025”), it’s possible, but not explicitly proven, that this plant contributes to this export volume.

The increase in exports, as highlighted by “China’s Rebar Exports Rise 52.4% in January–July 2025” and “Sharp Increase in China’s Semi-Finished Steel Exports in Jan.–July 2025”, coupled with fluctuating overall production, suggests a shift in market dynamics. The rise in steel sheet/plate exports (“China’s steel sheet/plate exports up 2.3 percent in January-July”) indicates an increased international demand. This creates an opportunity for Chinese steel mills that focus on production for exports like Tianjin New Tiangang United Special Steel Co., Ltd.

Procurement Recommendations:

- Rebar Buyers: Monitor activity levels at plants like Guangdong Yuebei United Steel Co., Ltd. A sustained decrease in activity may indicate potential supply constraints, warranting diversification of suppliers. Also, the increase in Chinese Rebar Exports might put pressure on the domestic supply and therefore drive prices upwards. Consider increasing your stock levels or agreeing on longer-term contracts to mitigate your risk.

- Semi-Finished Steel Buyers: Due to the “Sharp Increase in China’s Semi-Finished Steel Exports in Jan.–July 2025,” be aware of increased competition for Chinese semi-finished products, potentially leading to higher prices.

- Global Steel Buyers: Actively explore opportunities to capitalize on competitive pricing and increased availability of Chinese steel sheet/plate, as highlighted in “China’s steel sheet/plate exports up 2.3 percent in January-July,” particularly in light of global uncertainties and potential US tariffs that encourage these exports.