From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineChina’s Steel Exports Surge Amidst Iron Ore Import Dip: Plant Activity Analysis

China’s steel market presents a mixed picture. While “China increased steel exports by 9.9% y/y in May,” driven by concerns over potential tariff hikes, “China’s iron ore imports decrease by 5.2 percent in January-May,” potentially impacting production capacity. Observed steel plant activity shows variations, although no direct relationships to these specific news articles can be definitively established based solely on the provided information.

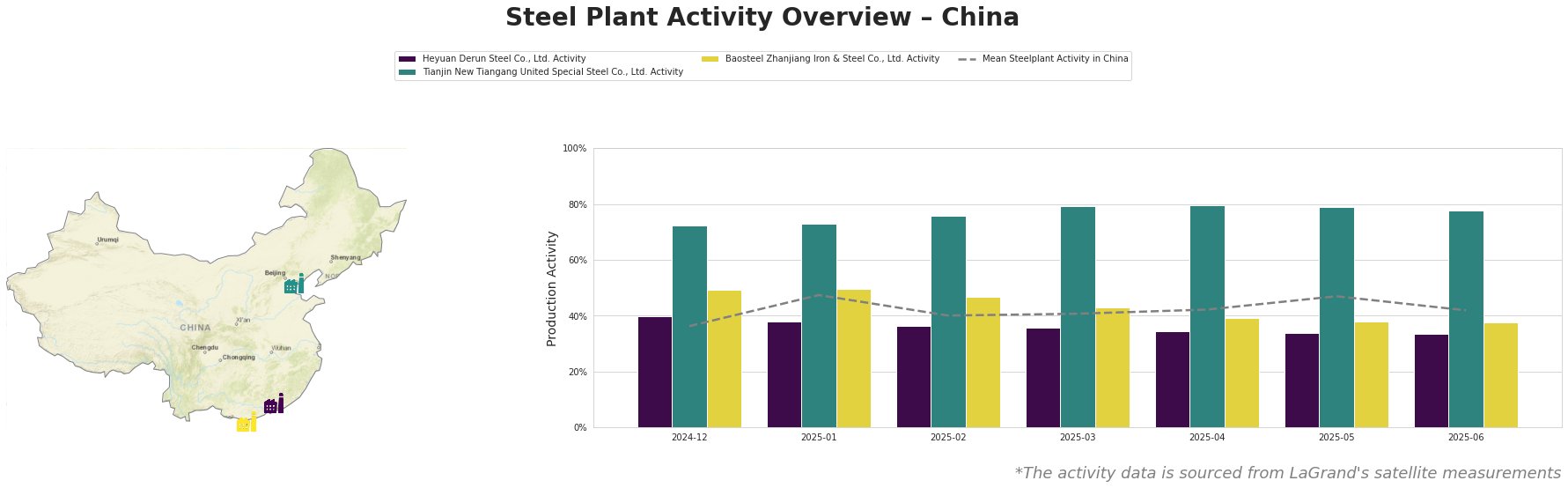

The mean steel plant activity in China fluctuated between 36% and 47% over the observed period, ending at 42% in June 2025. Tianjin New Tiangang consistently operated at significantly higher activity levels than the average. Heyuan Derun Steel Co., Ltd. consistently showed activity levels below the mean, while Baosteel Zhanjiang’s activity was initially close to the mean but dropped significantly in recent months. No direct connection can be established between these specific plant activity levels and the provided news articles.

Heyuan Derun Steel Co., Ltd., located in Guangdong and operating exclusively with EAF technology (capacity 1.2 million tons of crude steel), has shown consistently lower activity than the national average, remaining at 34% since April 2025. Given the reliance on electric arc furnaces, reduced iron ore imports, as stated in “China’s iron ore imports decrease by 5.2 percent in January-May,” would not directly impact this plant’s operations as heavily as plants relying on BF/BOF processes. No direct link between the “China increased steel exports by 9.9% y/y in May” article can be established.

Tianjin New Tiangang United Special Steel Co., Ltd., an integrated BF/BOF plant in Tianjin with a crude steel capacity of 4.5 million tons, demonstrated consistently high activity, fluctuating between 72% and 80%. This suggests strong domestic or export demand for its products (angle steel and continuous casting billet), despite the reported decrease in overall iron ore imports. No direct connection between plant activity changes and the news regarding “China increased steel exports by 9.9% y/y in May” or “China’s iron ore imports decrease by 5.2 percent in January-May” can be conclusively established based on the provided data.

Baosteel Zhanjiang Iron & Steel Co., Ltd., a major integrated steel producer in Guangdong with a capacity of 12.5 million tons, showed a decline in activity from 50% in January 2025 to 38% in June 2025. Its product portfolio includes hot-rolled plates, cold-rolled sheets, and galvanized products. A possible explanation for this observed drop might be found in the “China’s iron ore imports decrease by 5.2 percent in January-May”, this article could provide a correlation in production activity reduction in that region, but no direct evidence can be established based on the provided data.

Given the increased steel exports and decreased iron ore imports, procurement professionals should closely monitor steel prices, especially for products like hot-rolled sheets and coils, galvanized sheets, and heavy plates, as mentioned in “Global steel exports grew by 3.3% y/y in 2024.” Sourcing steel from Tianjin New Tiangang might offer more supply stability compared to Baosteel Zhanjiang due to its consistently higher activity levels. It is advised to diversify sources and explore import opportunities, keeping in mind that “Assofermet: Italian steel market remains uncertain in May amid growing concerns” highlights potential trade policy changes in the EU that could impact global steel flow.