From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineChina’s Steel Exports Surge Amidst Global Uncertainty: Asian Market Report

Asia’s steel market faces increasing competition from Chinese exports amidst global economic uncertainty and protectionist measures. The forecast of “IREPAS Meeting: 2025 set to be record year for China’s steel exports“ highlights China’s growing influence. The challenges are further detailed in “Producers at IREPAS: Chinese exports and protectionism squeeze global steel industry”. However, whether these shifts directly impact individual plant activity as observed via satellite remains largely unconfirmed.

Measured Activity Overview

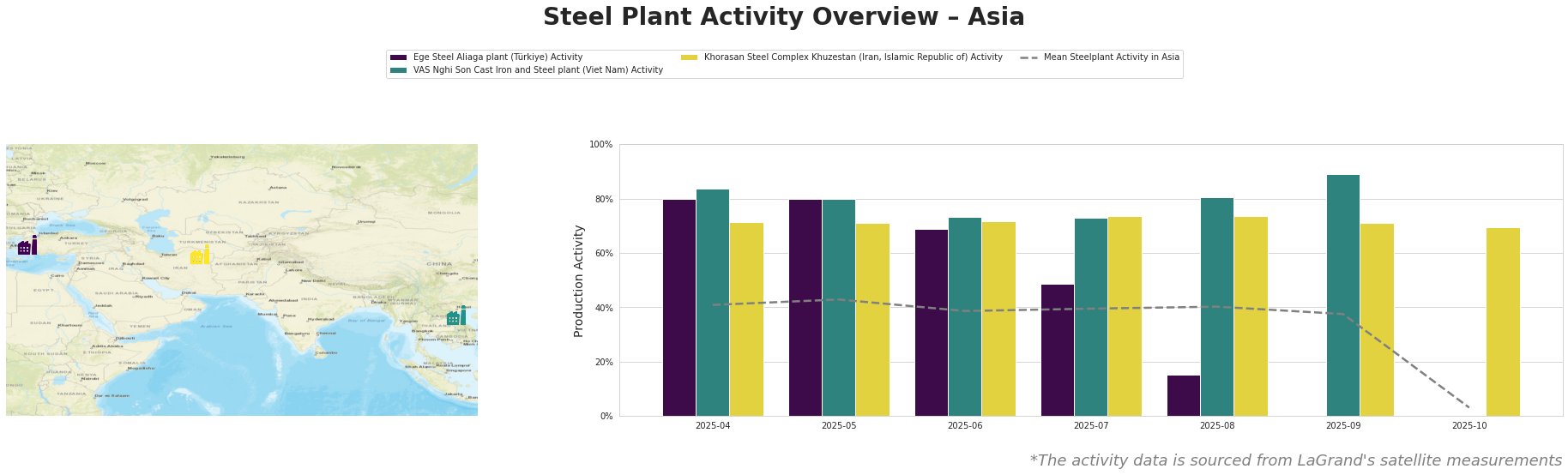

The mean steel plant activity in Asia shows a sharp decline in October 2025 to 3%, with generally stable activity with fluctuations around the 40% level in prior months. Ege Steel Aliaga plant experienced a significant drop in activity from 80% in April and May to 0% in September. VAS Nghi Son Cast Iron and Steel plant has shown relatively high and increasing activity levels, peaking at 89% in September. Khorasan Steel Complex Khuzestan maintained relatively stable activity around 71-74% throughout the observed period. The significant drop in the mean activity in Asia in October is driven by the drop for Khorasan Steel Complex Khuzestan, and lack of data for the other two plants.

Ege Steel Aliaga plant

Ege Steel Aliaga, located in İzmir, Türkiye, operates with a 2 million tonne per annum (ttpa) capacity using electric arc furnaces (EAF) to produce semi-finished and finished rolled products, specifically rebar and wire rod. The plant holds Responsible Steel certification and relies on the nearby İzdemir Enerji power station. Satellite data reveals a dramatic decline in activity, from 80% in April-May to a complete halt (0%) in September 2025. This sharp decline could potentially be linked to the challenges faced by Turkish steelmakers as mentioned in “IREPAS chairman: Global longs market faces ongoing challenges of competition and tariff uncertainty,” where the chairman notes that Turkish steelmakers are operating unprofitably and struggling to compete globally. However, without further data, a direct causal relationship cannot be definitively established.

VAS Nghi Son Cast Iron and Steel plant

VAS Nghi Son, situated in Thanh Hoa, Viet Nam, possesses a 3.15 million ttpa capacity, utilizing EAF technology for its production of billet, rebar, and wire rod. The plant is ResponsibleSteel certified. The observed satellite data shows steadily high activity levels, peaking at 89% in September 2025. This increase potentially reflects the strong growth in emerging Asian countries mentioned in the article “IREPAS Meeting: 2025 set to be record year for China’s steel exports,” although a direct link remains unconfirmed.

Khorasan Steel Complex Khuzestan

Khorasan Steel Complex Khuzestan, located in Razavi Khorasan, Iran, operates as an integrated DRI facility with a 1.5 million ttpa crude steel capacity and 1.8 million ttpa DRI capacity. It utilizes DRI and EAF technologies to produce rebar, billets, DRI, and HBI. Satellite observations indicate a relatively stable activity level, fluctuating between 71% and 74% from April to August, followed by a slight decrease to 69% in October. This stability does not directly correlate with any of the provided news articles; therefore, no explicit connection can be established.

Evaluated Market Implications

The rising Chinese steel exports, as highlighted in “IREPAS Meeting: 2025 set to be record year for China’s steel exports” and “Producers at IREPAS: Chinese exports and protectionism squeeze global steel industry,” coupled with the observed production halt at Ege Steel Aliaga plant, a rebar and wire rod producer, could signal potential supply disruptions, particularly for long steel products in regions traditionally served by Turkish mills.

Recommended Procurement Actions:

- Steel Buyers: Given the potential for supply disruptions stemming from reduced Turkish output and increased Chinese export pressure, steel buyers should consider diversifying their supplier base and exploring alternative sources, particularly from regions less affected by Chinese competition and trade barriers. Review existing contracts to assess potential exposure to price volatility driven by Chinese exports.

- Market Analysts: Closely monitor Turkish steel production and export data to assess the impact of profitability challenges on domestic mills, particularly focusing on Ege Steel Aliaga’s recovery. Analyze the correlation between Chinese export volumes, prices, and their impact on regional steel markets to refine forecasting models.