From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineChina’s Semi-Finished Steel Exports Surge Amidst Coke Decline: Plant Activity Analysis (September 2025)

China’s steel market presents a mixed picture, with surging semi-finished steel exports contrasting with declining coke exports. The news article “China’s semi-finished steel exports up 292% in January-August 2025” directly explains the observed focus on billet production at Shanxi Tongde Xinghua Special Steel Co., Ltd., potentially driven by export demand. The impact of the coke export decline (China’s coke exports decrease by 20 percent in January-August 2025) on integrated steel producers in China requires close monitoring.

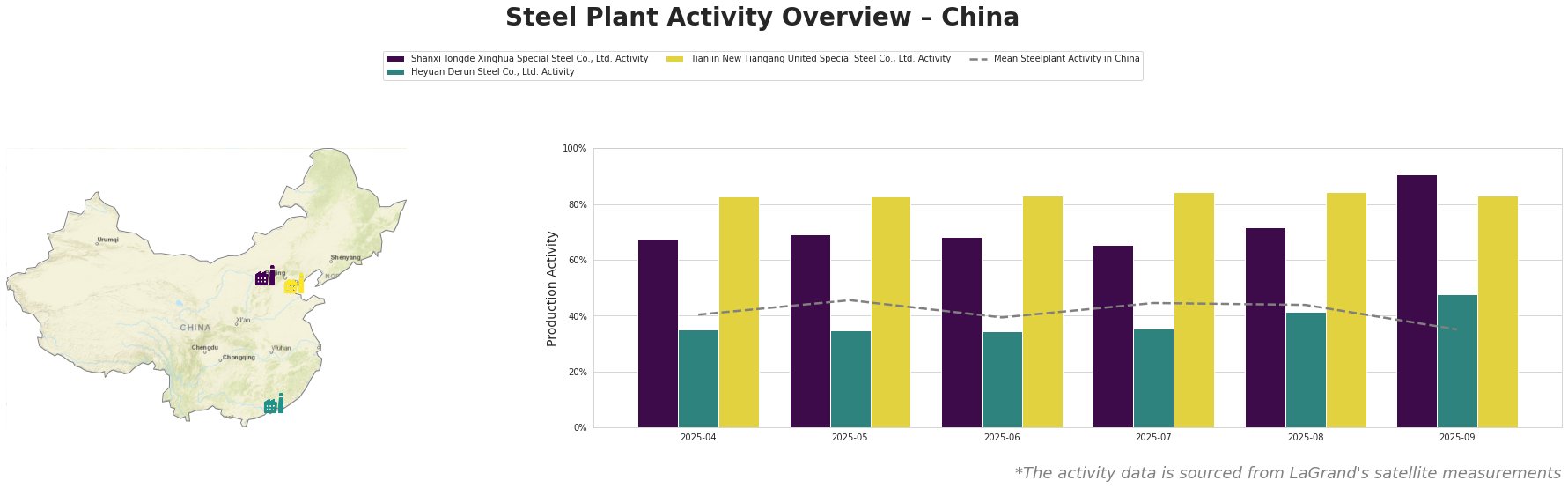

Mean steel plant activity in China fluctuated between 39% and 46% from April to August 2025, then dropped significantly to 35% in September. Shanxi Tongde Xinghua Special Steel Co., Ltd. consistently operated above the mean, reaching a high of 91% in September, a substantial increase that could be tied to the reported surge in semi-finished steel exports as mentioned in “China’s semis exports up 12% in August from July, up 292% in Jan-Aug 2025“. Heyuan Derun Steel Co., Ltd. operated below the mean, with activity gradually increasing from 35% in April to 48% in September. Tianjin New Tiangang United Special Steel Co., Ltd. maintained a consistently high activity level, ranging from 83% to 84%, significantly above the national average.

Shanxi Tongde Xinghua Special Steel Co., Ltd., located in Shanxi province, is an integrated steel plant with a crude steel capacity of 2.5 million tonnes per annum (ttpa), primarily utilizing BOF technology. The plant’s activity increased significantly in September to 91%, up from 72% in August. This increase could be directly linked to the surge in semi-finished steel exports described in “China’s semi-finished steel exports up 292% in January-August 2025“, especially given that this plant produces billet, a key export product. Heyuan Derun Steel Co., Ltd., an electric arc furnace (EAF) steel plant in Guangdong with a capacity of 1.2 million ttpa, primarily produces rebar and billet. The plant’s activity increased gradually, reaching 48% in September, possibly reflecting increased domestic demand for rebar, however, no direct link to news articles can be established. Tianjin New Tiangang United Special Steel Co., Ltd., based in Tianjin, is an integrated plant with a 4.5 million ttpa crude steel capacity, focusing on angle steel and continuous casting billet. Its consistently high activity levels suggest stable demand for its products, but no direct link to the provided news could be found.

The surge in semi-finished steel exports, as highlighted in “China’s semi-finished steel exports up 292% in January-August 2025,” combined with increased activity at Shanxi Tongde Xinghua Special Steel Co., Ltd. suggests increased export focus. However, the decline in coke exports (China’s coke exports decrease by 20 percent in January-August 2025) and the overall drop in mean steel plant activity in September may indicate future production constraints, specifically for plants relying on coke.

Procurement Actions:

* Billet Buyers: Given the surge in semi-finished steel exports, monitor export prices closely. Secure billet supply promptly, as export demand may tighten domestic availability, especially from producers like Shanxi Tongde Xinghua Special Steel Co., Ltd..

* Rebar Buyers: Monitor Heyuan Derun Steel Co., Ltd.’s activity for signals of supply changes in the regional rebar market. The gradual increase in activity may indicate stable supply.

* Integrated Steel Producers (BOF) & Coke Buyers: Closely monitor coke prices and supply availability due to declining coke exports, and its potential impact on integrated steel producers, particularly those relying on blast furnace (BF) technology. Diversify supply sources if possible, but no recommendation on specific action can be derived from the provided data.