From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineChina’s Green Steel Transition Advances Amidst Fluctuating Regional Steel Plant Activity

China’s steel industry is progressing in green steel initiatives, as highlighted in multiple reports titled “Gerber Steel: EU falling behind in green steel transition as China surges ahead” and “Gerber Steel: The EU is lagging behind in the transition to “green steel”, while China is ahead of it“. While these news articles discuss China’s overall progress in adopting low-emission methods and forming partnerships like HBIS Group and BMW, a direct relationship to the specific satellite-observed changes in activity at Baowu Group Echeng Iron and Steel, Ningbo Iron & Steel, and Shiheng Special Steel cannot be explicitly established from the given information.

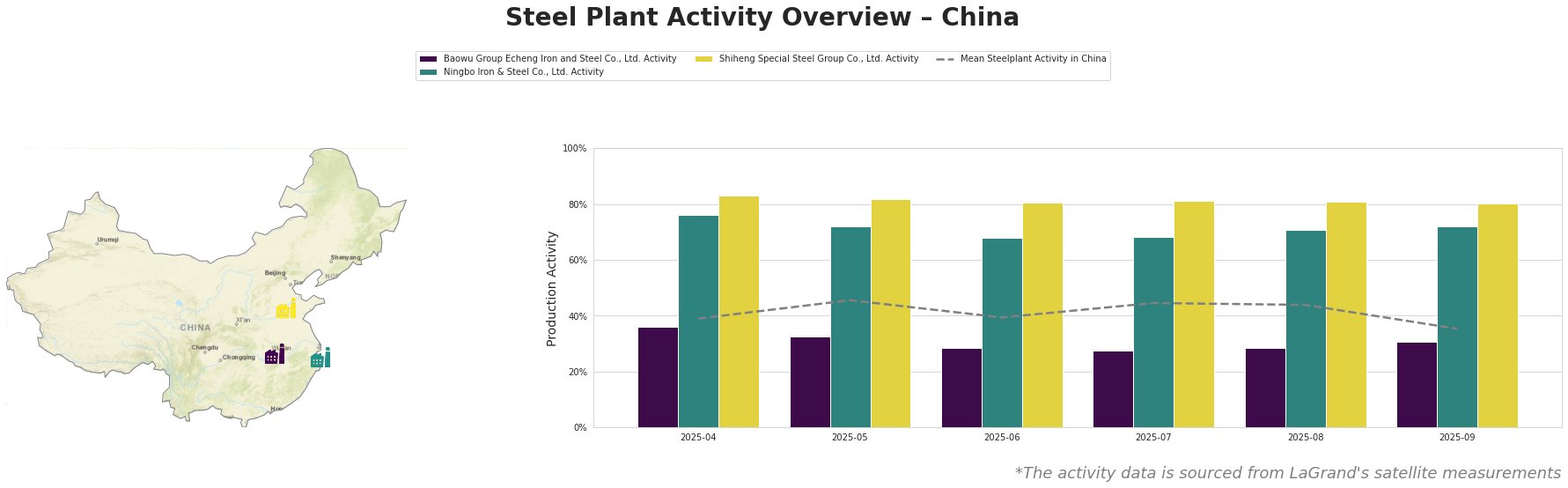

The mean steel plant activity across China fluctuated, peaking at 46.0% in May and then dropping to 35.0% in September. Baowu Group Echeng Iron and Steel consistently operated below the mean, with activity declining from 36.0% in April to 28.0% in July, followed by a slight increase to 31.0% in September. Ningbo Iron & Steel consistently operated well above the mean, ranging from 68.0% to 76.0%. Shiheng Special Steel Group also maintained high activity levels, varying only slightly between 80.0% and 83.0%.

Baowu Group Echeng Iron and Steel Co., Ltd., located in Hubei province, has a crude steel capacity of 4.4 million tonnes per annum (mtpa), utilizing basic oxygen furnace (BOF) technology. Its product range includes spring steel, high-strength ring chain steel, and various wire rods. Observed activity at this plant decreased from 36.0% in April to 28.0% in July, with a slight recovery to 31.0% by September. However, based on the available information, no direct connection can be made between this activity trend and the news articles discussing China’s green steel transition.

Ningbo Iron & Steel Co., Ltd., situated in Zhejiang province, possesses a 4.0 mtpa crude steel capacity, also relying on BOF technology. Its product focus includes carbon, low-alloy, and automotive structural steel. This plant maintained high activity levels, fluctuating between 68.0% and 76.0% throughout the observed period. No explicit link can be established between these activity levels and the mentioned news articles.

Shiheng Special Steel Group Co., Ltd., based in Shandong province, has a crude steel capacity of 4.65 mtpa, using BOF technology. Its product portfolio includes construction steel, anchor rod reinforcement, and various finished rolled products. The plant demonstrated consistently high activity, remaining between 80.0% and 83.0%. As with the other plants, no direct link can be made between these observed activity trends and the provided news articles regarding China’s green steel transition.

Evaluated Market Implications:

While the news articles “Gerber Steel: EU falling behind in green steel transition as China surges ahead” and “Gerber Steel: The EU is lagging behind in the transition to “green steel”, while China is ahead of it” highlight China’s broader advancements in green steel, the satellite-observed activity data does not offer concrete evidence of direct impact on the three specific steel plants being monitored.

-

Potential Supply Disruptions: The observed fluctuations in activity at Baowu Group Echeng Iron and Steel, specifically the drop from 36% to 28% between April and July, could potentially lead to localized supply disruptions for their specific product lines (spring steel, wire rods etc.). However, without further information, the severity and duration of these potential disruptions are difficult to assess.

-

Recommended Procurement Actions: Steel buyers reliant on Baowu Group Echeng Iron and Steel for their supply of specialized steel products should:

- Monitor Production Levels: Closely monitor the Baowu Group Echeng Iron and Steel output, using available production data and direct communication with the supplier.

- Diversify Supply: Explore alternative suppliers for spring steel and wire rods to mitigate potential disruptions.

It’s important to acknowledge that there is no direct relationship between the observed trends in the satellite activity data and the Gerber Steel reports. The overall sentiment remains neutral due to a lack of substantial fluctuations.