From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineChina Steel Production Dips Amidst EU Price Concerns: Procurement Strategies for Buyers

China’s steel market faces headwinds as production dips and European markets brace for price declines. According to “China’s crude steel production fell 7% in April, m-o-m” and “China reduced steel production by 7% m/m in April,” Chinese steel output contracted, although year-to-date figures remain slightly positive. While these reports detail production decreases, no direct link can be established to the EU market dynamics reported in “EU stainless prices to continue to fall: Assofermet“.

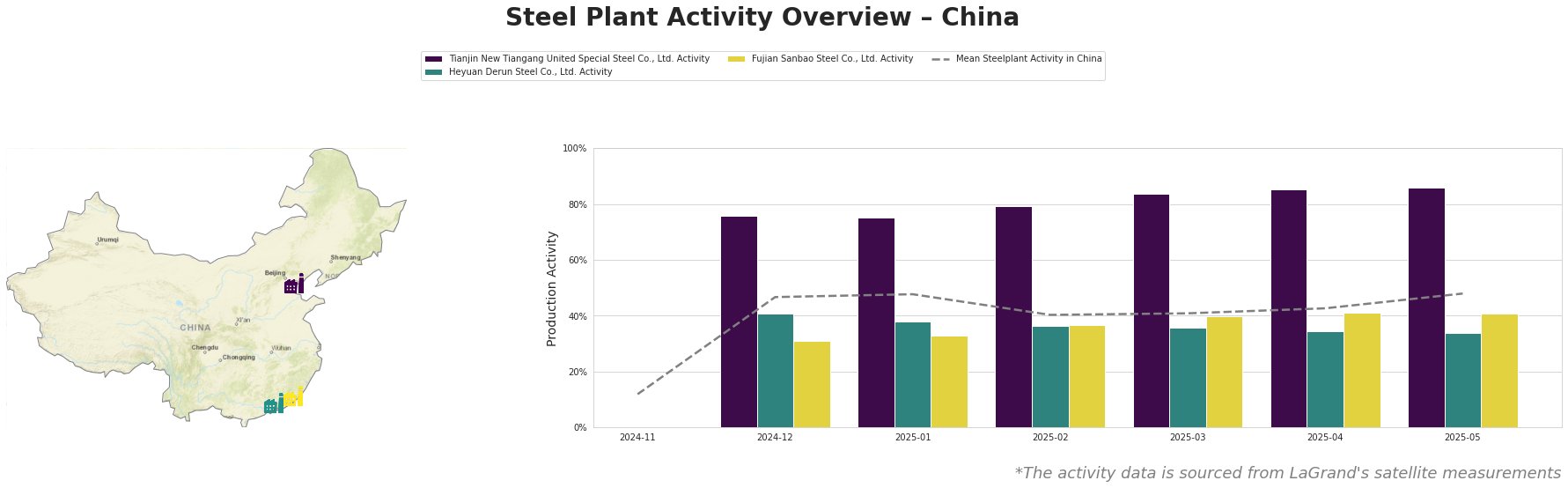

The mean steel plant activity in China shows an increase from November 2024 (12%) to May 2025 (48%), with fluctuations in between. Tianjin New Tiangang United Special Steel Co., Ltd. consistently operates well above the mean, reaching 86% activity in May 2025. Heyuan Derun Steel Co., Ltd. shows a slight decrease from 41% in December 2024 to 34% in May 2025, consistently operating below the mean. Fujian Sanbao Steel Co., Ltd. shows a gradual increase from 31% in December 2024 to 41% in May 2025, generally operating below the mean. There is no direct connection between these observed activity levels and the news articles provided.

Tianjin New Tiangang United Special Steel Co., Ltd., located in Tianjin, is an integrated steel plant with a crude steel capacity of 4.5 million tonnes, primarily utilizing Basic Oxygen Furnaces (BOF). Satellite data reveals consistently high activity levels, peaking at 86% in May 2025, significantly exceeding the national average. These sustained levels do not immediately reflect the overall production dip reported in “China’s crude steel production fell 7% in April, m-o-m” and “China reduced steel production by 7% m/m in April”, and no explicit connection between activity and the news can be established.

Heyuan Derun Steel Co., Ltd., situated in Guangdong, operates an electric arc furnace (EAF) based steel plant with a crude steel capacity of 1.2 million tonnes, focusing on hot-rolled rebar and billet production. Its activity levels, observed via satellite, have remained relatively stable but below the national average, dropping to 34% in May 2025. This relative stability, while below average, does not provide a direct link to the reported national production decreases or European stainless steel price pressures.

Fujian Sanbao Steel Co., Ltd., based in Fujian, is an integrated steel plant with a crude steel capacity of 4.62 million tonnes, utilizing both BOF and EAF technologies. Satellite data shows its activity gradually increasing to 41% in May 2025, but still below the national average. Although the plant produces corrosion-resistant hot-rolled coils, potentially relevant to the stainless steel market discussed in “EU stainless prices to continue to fall: Assofermet”, no direct impact on activity levels can be confirmed based on the available data and news.

Given the 7% month-on-month decrease in Chinese steel production reported in “China’s crude steel production fell 7% in April, m-o-m” and “China reduced steel production by 7% m/m in April”, coupled with observed activity inconsistencies across different plants, steel buyers should:

-

Diversify Sourcing: Given the overall negative trend, consider diversifying steel sourcing options to mitigate potential supply disruptions. Focus on suppliers outside of China, especially considering the potential for increased competitiveness from European producers as highlighted in “EU stainless prices to continue to fall: Assofermet.”

-

Monitor Tianjin New Tiangang: The consistently high activity at Tianjin New Tiangang United Special Steel Co., Ltd. may indicate a reliable source of supply, offering a potential counterweight to the overall production decline. Therefore, procurement professionals should monitor production from this plant.

-

Negotiate Contract Terms: Given expected price decreases in Europe as noted in “EU stainless prices to continue to fall: Assofermet”, and potential production uncertainties in China, seek flexible contract terms that allow for price adjustments based on market fluctuations. Consider short-term contracts to capitalize on potential price declines.