From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineChina Steel: Production Adjustments Amidst Fluctuating Iron Ore Output – Monitor Key Plants

China’s steel sector is undergoing adjustments as iron ore production decreases while crude steel output remains relatively stable. According to “China reduced iron ore production by 12% y/y in January-April” and “China’s iron ore output down 12.2 percent in Jan-Apr,” domestic iron ore production has seen a significant decline. This coincides with the news that “China has reduced steel production,” which reports a 7% month-on-month decrease in steel production in April, although year-to-date production rose slightly. While these production adjustments are taking place, the activity levels of key steel plants show varying trends, as detailed below.

Steel Plant Activity Analysis

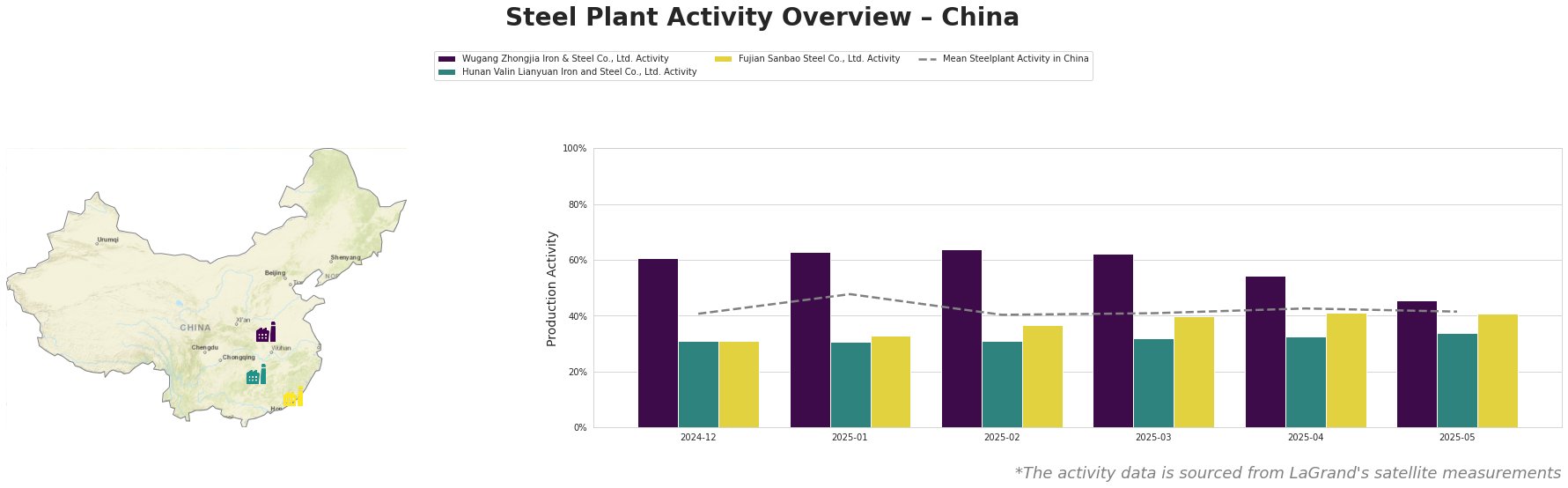

The mean steel plant activity in China has fluctuated, starting at 41.0% at the end of 2024 and reaching a peak of 48.0% in January 2025, before stabilizing around 42-43% in April and May.

Wugang Zhongjia Iron & Steel Co., Ltd., an iron producer in Henan with a BF capacity of 1220 ttpa, exhibited consistently higher activity than the national average until recently. However, the satellite data indicates a notable decrease in activity from 64.0% in February to 46.0% in May. Although a direct causal link cannot be confirmed, this decline could be related to the reported decrease in domestic iron ore production described in “China reduced iron ore production by 12% y/y in January-April.”

Hunan Valin Lianyuan Iron and Steel Co., Ltd., a major integrated steel producer in Hunan with 9000 ttpa crude steel capacity (BOF) and 7300 ttpa iron capacity (BF), has shown a stable activity level around 31-34% throughout the observed period, significantly below the national average. Given its reliance on BF and BOF technologies, and its focus on finished rolled products, this stability doesn’t appear to be directly correlated with the news articles about overall crude steel production adjustments.

Fujian Sanbao Steel Co., Ltd., an integrated steel plant in Fujian with a crude steel capacity of 4620 ttpa (BOF) and iron capacity of 2660 ttpa (BF), has seen a steady increase in activity, reaching 41.0% in April and remaining stable in May. This plant’s performance seems decoupled from the national trend reported in “China has reduced steel production,” and no explicit connection can be established based on available information.

Evaluated Market Implications

The observed decrease in activity at Wugang Zhongjia Iron & Steel Co., Ltd., potentially linked to reduced domestic iron ore production (“China reduced iron ore production by 12% y/y in January-April“), may indicate localized supply constraints for iron. Steel buyers should:

- Monitor Wugang Zhongjia’s Output: Closely track the production levels of Wugang Zhongjia. A prolonged period of reduced activity could impact the availability of iron and potentially increase prices in the region.

- Diversify Iron Sources: Given the uncertainty surrounding domestic iron ore production, steel buyers relying on Wugang Zhongjia should consider diversifying their iron ore sourcing to mitigate potential supply disruptions.

These recommendations are directly linked to the observed activity changes at a specific plant and the reported decline in domestic iron ore production. No broad speculation about the overall market is implied.