From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineChina Steel: Output Fluctuations Amid Price Declines – Procurement Strategies Emerge

China’s steel sector is showing mixed signals as output fluctuates and prices decline. “CISA mills’ daily crude steel output up 7.5% in early October 2025, stocks also up” points to a short-term production increase. However, this contrasts with the overall trend reported in “China’s crude steel output totals 73.49 million mt in Sept, down 2.9% in Jan-Sept 2025” and “China cuts steel production to 73 million tons in September,” highlighting output reductions attributed to seasonal factors and weak demand. The connection between decreased production in September and a PPI decrease reported in “China’s steel industry PPI down 8.6 percent in January-September 2025” is not explicitly stated, but logically implies a price correction following lower output. Despite the decrease in steel production, “Industrial output of China’s steel sector up 5.7 percent in Jan-Sept 2025” demonstrates overall growth when compared to the same period last year.

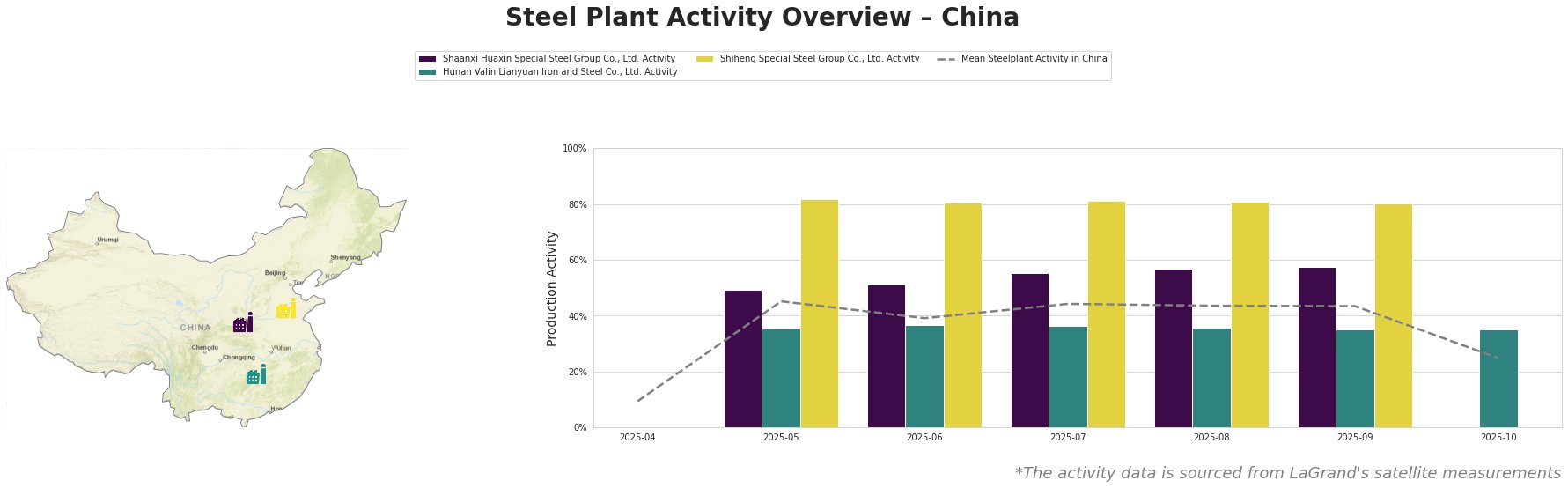

Observed activity across the monitored steel plants showed an overall increase between April and August 2025, followed by a slight dip in September and a more significant drop in October, as the Mean Steelplant Activity in China declined to 25.0. Shiheng Special Steel Group Co., Ltd. maintained high activity levels between May and September at around 81%, while Hunan Valin Lianyuan Iron and Steel Co., Ltd. showed consistently lower activity levels during the same period, fluctuating narrowly between 35% and 37%. Shaanxi Huaxin Special Steel Group Co., Ltd. also demonstrated consistently higher activity than the mean. The marked decrease of the mean activity level in October cannot be explicitly linked to any of the provided news articles, as there is no direct mention of widespread plant shutdowns or specific events explaining this decline.

Shaanxi Huaxin Special Steel Group Co., Ltd., an electric arc furnace (EAF) steel plant with a 1.2 million tonne crude steel capacity, primarily produces finished rolled products. Its activity steadily increased from May (49%) to September (58%). While this trend aligns with the “Industrial output of China’s steel sector up 5.7 percent in Jan-Sept 2025,” no direct relationship can be definitively established, as the news article reports on a broader sectoral trend, and the plant activity data ends one month prior to the report.

Hunan Valin Lianyuan Iron and Steel Co., Ltd., an integrated BF-BOF steel plant with a 9 million tonne crude steel capacity, produces a variety of finished rolled products including automotive steel and pipeline steel. Its activity remained relatively stable between May and September, fluctuating between 35% and 37%. The stability in activity for Hunan Valin Lianyuan Iron and Steel Co., Ltd. does not directly correlate with the crude steel output decline reported in “China’s crude steel output totals 73.49 million mt in Sept, down 2.9% in Jan-Sept 2025”. However, its activity was maintained on a low level.

Shiheng Special Steel Group Co., Ltd., an integrated BF-BOF steel plant with a 4.65 million tonne crude steel capacity, primarily produces construction steel. This plant consistently operated at high activity levels, between 80% and 82% from May to September. This sustained high activity is in contrast to the reported overall output declines, but it’s important to note that “China’s crude steel output totals 73.49 million mt in Sept, down 2.9% in Jan-Sept 2025” refers to a national aggregate, whereas Shiheng’s performance reflects localized dynamics. No explicit connection between the news articles and this plants activity can be established.

The news articles indicate that the steel sector experiences output fluctuations and price declines. The rise of coke production is demonstrated in “China’s coke output rises by 3.5 percent in January-September 2025“. The observation from satellite data highlights that Shaanxi Huaxin Special Steel Group Co., Ltd.’s activity increased over the observed period, and Hunan Valin Lianyuan Iron and Steel Co., Ltd.’s activity remained relatively stable. Shiheng Special Steel Group Co., Ltd’s activity remained on a high level.

Given the reported increase in steel inventories “CISA mills’ daily crude steel output up 7.5% in early October 2025, stocks also up” and the PPI decrease “China’s steel industry PPI down 8.6 percent in January-September 2025”, steel buyers should leverage their negotiation power to secure favorable pricing on spot purchases, particularly from suppliers showing high inventory. Procurement professionals should carefully monitor the output of plants like Hunan Valin Lianyuan Iron and Steel Co., Ltd. in the Hunan province, as its consistently lower activity levels, when compared to the national mean, could indicate a potential supply bottleneck within its specific product categories (automotive and pipeline steel). Buyers relying on these specific steel grades may need to diversify their supplier base or secure longer-term contracts to mitigate potential disruptions. Given that “China’s coke output rises by 3.5 percent in January-September 2025”, procurement analysts should closely monitor coke prices.