From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineChina Steel: Output Cuts Loom, Exports Strong, Prices Mixed – Procurement Strategies for 2025

China’s steel market faces a complex landscape in late 2025. Government-mandated production cuts are on the horizon, while exports remain robust. News articles “China issues work plan for steel industry, over 25 million mt output cut expected in 2025” and “China to cut steel production by at least 25 million tons in 2025” directly address planned capacity reductions. Satellite data from specific steel plants shows varied activity levels, but no immediate correlation to the announced output cuts is apparent.

Here’s a table presenting recent monthly activity trends as a markdown table with a date column for each row:

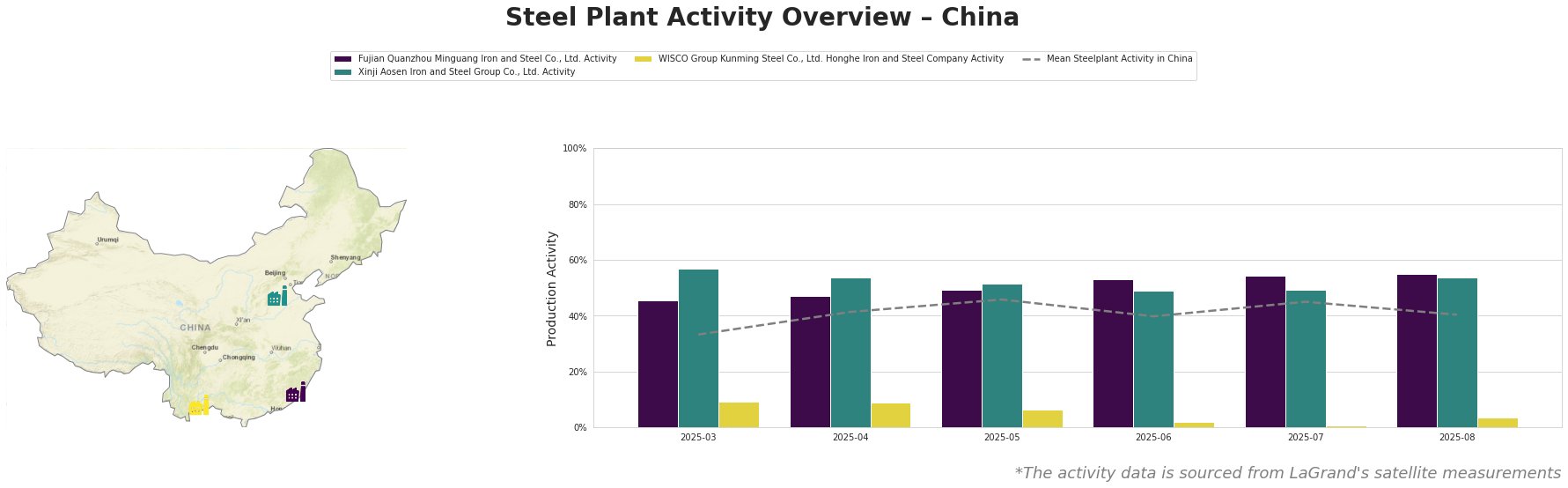

Overall, the mean steel plant activity in China fluctuated, peaking in May at 46% and subsequently declining to 40% by August.

Fujian Quanzhou Minguang Iron and Steel Co., Ltd., an integrated steel plant with a 2550 ttpa crude steel capacity, primarily produces finished rolled products like rebar and wire rod using BF/BOF technology. Its activity consistently outperformed the national average, reaching 55% in August. There’s no immediate correlation between its stable activity and the broader production cut announcements.

Xinji Aosen Iron and Steel Group Co., Ltd., another integrated plant with 3600 ttpa crude steel capacity focused on semi-finished and finished rolled products, showed activity levels generally above the national average. Xinji Aosen Iron and Steel Group Co., Ltd.’s activity reached 54% in August. The data does not show an immediate response to production cut announcements.

WISCO Group Kunming Steel Co., Ltd. Honghe Iron and Steel Company, a smaller integrated plant with 1150 ttpa crude steel capacity, exhibited significantly lower activity compared to the national average. Its activity level remained below 10% throughout the observed period, reaching only 4% in August. This persistently low activity, particularly in light of the overall market dynamics, warrants further investigation, but no direct link to the named news articles can be established.

The news article “MOC: Average rebar prices in China down 1.1 percent in August 18-24 2025” indicates price pressure on finished steel products, contrasting with the expectation of price increases mentioned in “China’s steel sector PMI declines to 49.8 percent in August 2025.” “China’s steel exports will exceed 100 million tons in 2025 – Baosteel” highlights strong export performance, potentially offsetting some domestic production cuts. Baosteel’s focus on international investment, especially in Asia, the Middle East, and North Africa, signals a long-term shift in China’s steel strategy.

Based on the combined information, potential supply disruptions are expected primarily due to governmentaly regulated, scheduled output cuts.

Procurement Actions:

- Rebar Buyers: Given the news of declining rebar prices (“MOC: Average rebar prices in China down 1.1 percent in August 18-24 2025”), buyers should leverage this price pressure in negotiations for near-term contracts.

- Export-Oriented Businesses: The expectation of continued strong exports, as noted in “China’s steel exports will exceed 100 million tons in 2025 – Baosteel,” provides assurance of supply for export-oriented businesses. However, monitor policy changes related to export tariffs or quotas, which could impact pricing and availability.

- Buyers Relying on WISCO Group Kunming Steel Co., Ltd. Honghe Iron and Steel Company: Consider diversifying supply sources due to persistently low activity levels at this plant, as indicated by satellite data.