From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineChina Steel Market Weakness Confirmed: Plant Activity Declines Amid Global Uncertainty

China’s steel sector faces increasing headwinds, with recent satellite data indicating a significant drop in activity levels coinciding with global economic anxieties. The overall negative sentiment mirrors concerns raised in the article “Assofermet: Italian steel market remains uncertain in May amid growing concerns,” which cites China’s economic struggles as a contributing factor to broader market instability. While the news article focuses on Italy, its mention of China’s economic struggles provides context for potential demand-side pressures impacting Chinese steel production, although a direct, immediate link between this article and specific activity changes at Chinese plants cannot be definitively established based on the provided information alone.

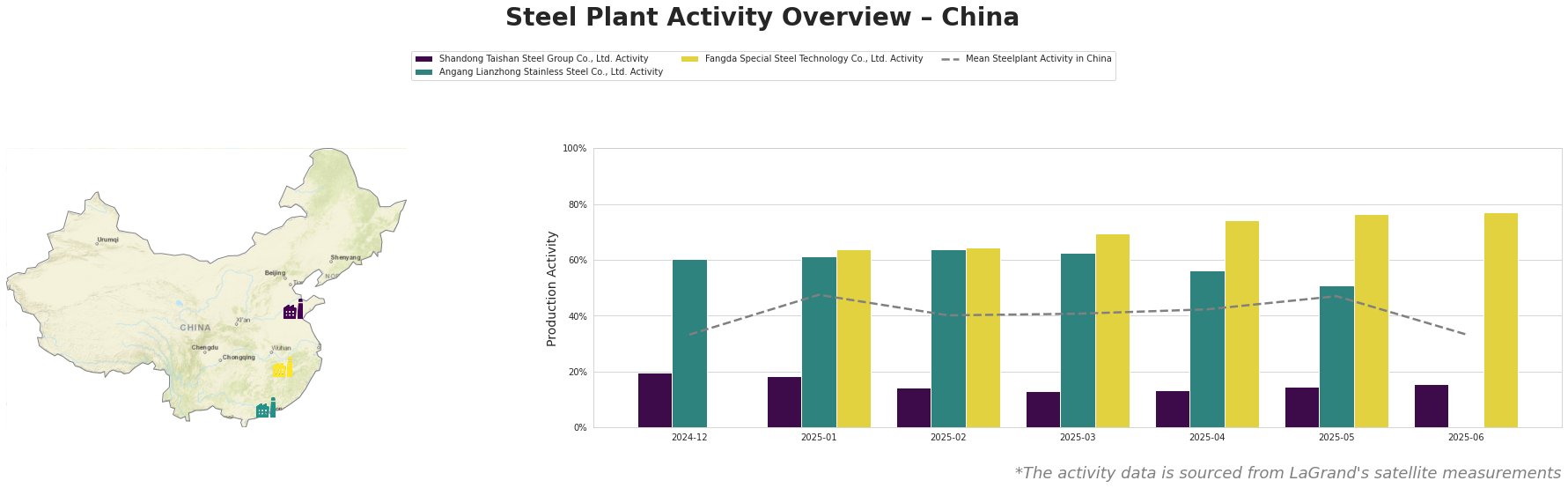

The data reveals a recent downturn in overall Chinese steel plant activity. The mean activity level across observed plants in China dropped significantly to 33% in June 2025, a sharp decline from 47% in the previous month and significantly below the peak of 48% in January 2025. This decline is a significant downward shift in the market activity and confirms the negative sentiment. Shandong Taishan Steel Group Co., Ltd. consistently operated below the mean Chinese activity level. Its activity has slightly risen from 14% to 16% in June 2025, but this increase is insignificant and still indicates very low utilization rates. Activity at Angang Lianzhong Stainless Steel Co., Ltd. steadily decreased from 64% in February 2025 to 51% in May 2025, before no data was provided for June. Fangda Special Steel Technology Co., Ltd., in contrast, showed a consistent increase in activity throughout the observed period, reaching 77% in May and June 2025,significantly above the mean activity level in China.

Shandong Taishan Steel Group Co., Ltd., an integrated steel plant with a crude steel capacity of 5000ktpa, relying on BF/BOF processes alongside an EAF, has consistently shown activity levels far below the Chinese average. The plant’s activity remained very low, fluctuating between 13% and 20% throughout the observed period, and reached 16% in June. The company produces finished rolled products, including hot and cold-rolled coil and stainless steel. Given the consistently low activity, a direct connection to the general market uncertainty discussed in “Assofermet: Italian steel market remains uncertain in May amid growing concerns” is plausible, though not definitively provable based solely on the provided data. This could be due to low demand for hot/cold rolled coil and stainless steel.

Angang Lianzhong Stainless Steel Co., Ltd., an electric arc furnace (EAF) based steel plant in Guangdong with a crude steel capacity of 3219 ktpa, produces stainless steel flat billets, plates, and coils. Its activity decreased from 64% in February 2025 to 51% in May 2025, before data collection ceased. Given the plant’s focus on stainless steel, a potential contributing factor to this decline could be the “weak demand in stainless steel flats” mentioned in “Assofermet: Italian steel market remains uncertain in May amid growing concerns“. However, the news article pertains to the Italian market, and a definite connection to Angang Lianzhong’s production is not verifiable based on the information provided.

Fangda Special Steel Technology Co., Ltd., an integrated steel plant with a crude steel capacity of 3600 ktpa, utilizes BF/BOF processes. This plant consistently increased production up to 77% in May and June 2025, bucking the general negative trend. It produces finished rolled products, including spring flat steel, alloy structural round steel, and hot-rolled ribbed steel bar. There is no direct linkage to the article provided.

Evaluated Market Implications:

The decline in mean steel plant activity in China, particularly contrasted with the increasing activity seen in Fangda Special Steel Technology Co., Ltd., suggests a possible shift in regional demand or product specialization within the Chinese steel market. Given the consistently low activity at Shandong Taishan Steel Group Co., Ltd. and the downturn at Angang Lianzhong Stainless Steel Co., Ltd., coupled with general market anxieties as noted in “Assofermet: Italian steel market remains uncertain in May amid growing concerns“, the following procurement actions are recommended:

- Steel Buyers: Diversify sources for hot/cold rolled coil and stainless steel, considering suppliers beyond Shandong Taishan Steel Group and Angang Lianzhong Stainless Steel Co. due to their decreased plant activity. Actively explore alternative suppliers for these products to mitigate potential supply disruptions.

- Market Analysts: Closely monitor the performance of Fangda Special Steel Technology Co., Ltd. and similar plants specializing in specific product categories (spring flat steel, alloy structural round steel, and hot-rolled ribbed steel bar) to identify potential investment opportunities or emerging market trends. Analyze regional demand shifts within China.

- Closely monitor the stainless steel flat products market, as the “weak demand in stainless steel flats” discussed in Assofermet: Italian steel market remains uncertain in May amid growing concerns could lead to further production cuts and price volatility.