From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineChina Steel Market Update: Stability Amid Regulatory Changes and Declining Production

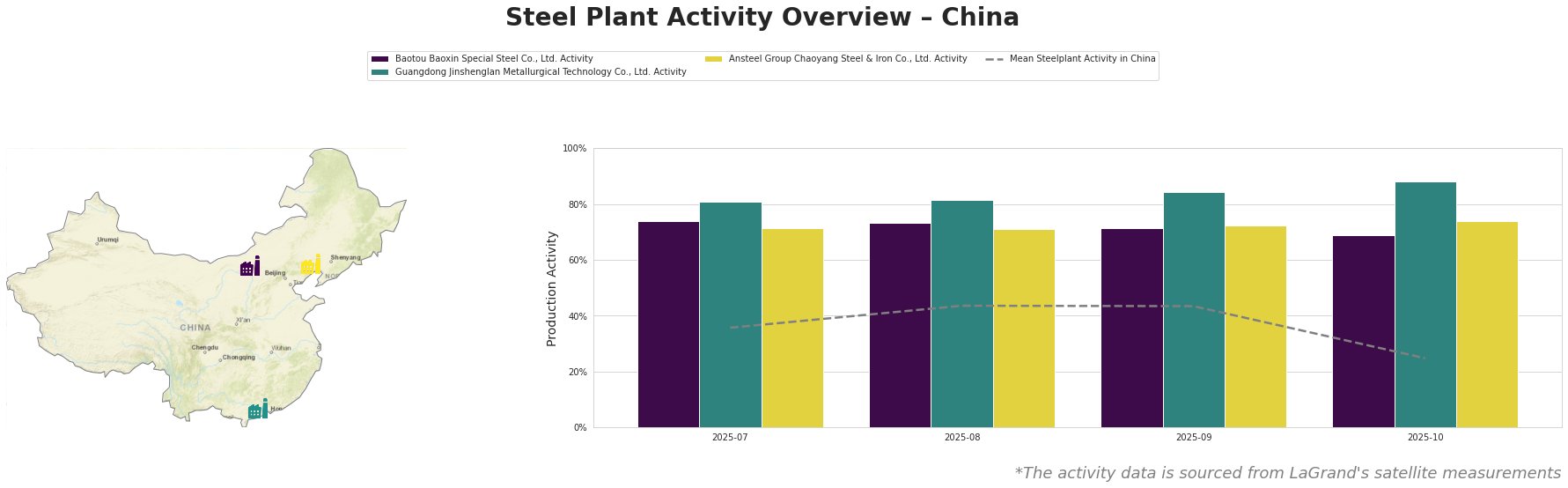

Recent insights into China’s steel market reveal a stable yet cautious atmosphere as the government enforces regulatory measures and observes a decline in production levels. Articles titled “China will maintain control over steel production and exports in 2026-2030“ and “China Implements Export Licensing for 300 Steel Products from Jan 1 Sparking Cautious Optimism in Asian Markets“ provide context for these developments. Satellite data indicates a continued reduction in activity in key plants, aligning with these regulatory interventions.

Baotou Baoxin Special Steel Co., Ltd. has witnessed a gradual decline in activity from 74% in July to 69% by October 2025, suggesting an adjustment to the tightened market regulations mentioned in “China will maintain control over steel production and exports in 2026-2030”. This decline reflects broader market pressures as local demand diminishes.

Conversely, Guangdong Jinshenglan Metallurgical Technology Co., Ltd. reported more stable activity levels, increasing slightly to 88% in October, which, despite the overall market trend, possibly indicates a strategic alignment with specialized product offerings as highlighted in “China Implements Export Licensing for 300 Steel Products from Jan 1 Sparking Cautious Optimism in Asian Markets.”

Ansteel Group Chaoyang Steel & Iron Co., Ltd. is also experiencing reduced activity, decreasing from 71% in August to 74% in October. This mirrors the market-wide declines and suggests that larger integrated producers like Ansteel are adjusting to both domestic demand shifts and regulatory environments.

Procurers should consider potential supply disruptions stemming from the tightening government controls and export restrictions. Buyers should focus on securing contracts with suppliers like Guangdong Jinshenglan, which may benefit from restrictions on conventional steel exports due to their specialized production capacity. Active monitoring of the evolving regulatory landscape, particularly licensing requirements for specific steel products, will be essential for informed procurement strategies as prices may fluctuate due to these restrictions.

Overall, while the sentiment remains neutral, the evidence indicates careful procurement planning is essential to navigate potential supply challenges.