From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineChina Steel Market Under Pressure: Production Cuts and Plant Activity Decline

China’s steel sector faces headwinds as evidenced by falling production figures and fluctuating plant activity. According to “China’s crude steel production fell 7% in April, m-o-m” and “China reduced steel production by 7% m/m in April“, crude steel production saw a significant decrease in April. However, no direct connection could be established between these reports and the specific satellite-observed plant activity.

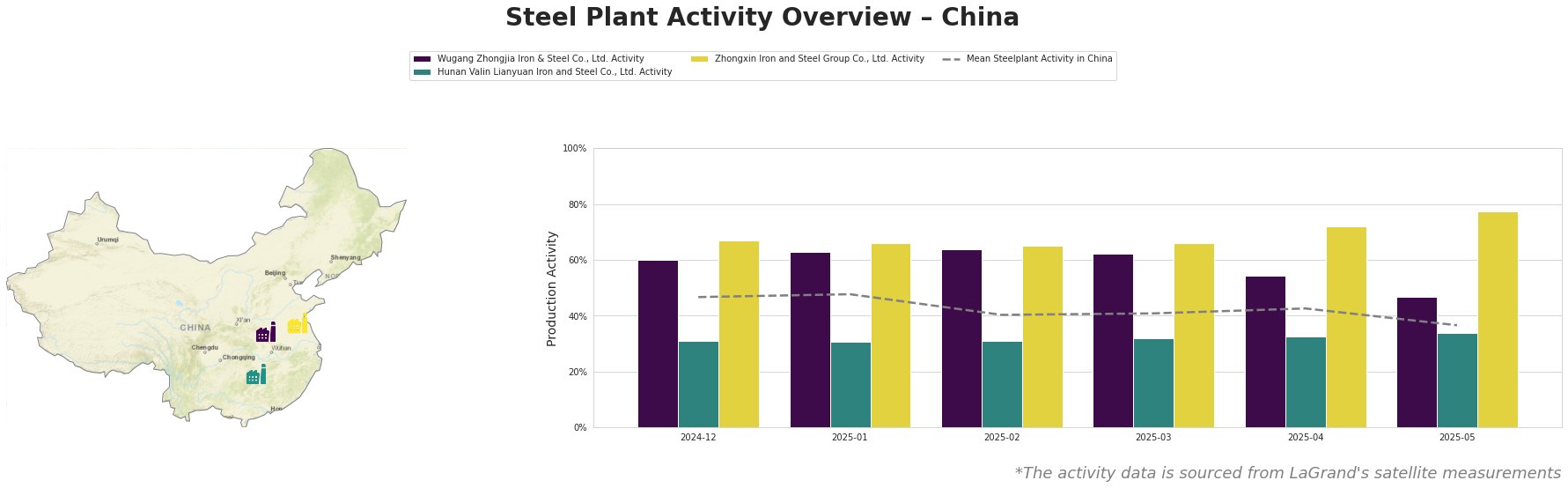

Overall, the mean steel plant activity in China shows a declining trend, dropping from 47.0% in December 2024 to 37.0% in May 2025, with a notable decrease in the most recent month. This general trend reflects the sentiments expressed in the article “China has reduced steel production,” although a direct causal link cannot be confirmed due to missing geographical production details.

Wugang Zhongjia Iron & Steel Co., Ltd., located in Henan, focuses on ironmaking using blast furnaces (BF). Its activity level experienced a consistent decline from a peak of 64.0% in February 2025 to 47.0% in May 2025, which is significantly below its level in December 2024 (60%) and the mean activity level across all plants. The decline of 7% of the plant activity level between April and May cannot be directly linked to any of the provided news articles.

Hunan Valin Lianyuan Iron and Steel Co., Ltd., an integrated steel plant in Hunan with a crude steel capacity of 9,000 thousand tonnes per annum (ttpa), primarily utilizes basic oxygen furnaces (BOF). Its activity level shows a slight increase, reaching 34.0% in May 2025, but remains considerably lower than the national average. No direct correlation to recent news articles can be established.

Zhongxin Iron and Steel Group Co., Ltd., based in Jiangsu, operates as an integrated steel plant with a crude steel capacity of 5,700 ttpa, using BOF technology. Its activity level shows a consistent upward trend, reaching 77.0% in May 2025, significantly exceeding the mean and suggesting a potential divergence in operational strategy compared to other plants. This cannot be directly linked to any of the provided news articles.

Given the overall negative market sentiment (“China’s crude steel production fell 7% in April, m-o-m”) and the declining average plant activity, coupled with the lack of specific details regarding the implementation of production restrictions, steel buyers should consider the following:

- Potential Supply Constraints: Wugang Zhongjia’s declining activity (a drop of 7% between April and May) could lead to localized supply shortages in Henan. Steel buyers relying on this specific producer should proactively explore alternative sourcing options to mitigate risks.

- Monitor Regional Production: Due to the varying activity trends among steel plants, with Zhongxin showing an increasing trend, procurement strategies should be adapted based on regional supply dynamics. Buyers should diversify sourcing from regions less affected by potential production cuts to ensure consistent supply.