From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineChina Steel Market: Strong Exports Offset Production Cuts, Offering Procurement Opportunities

China’s steel market presents a mixed picture, with robust export demand balancing domestic production cuts. The news article “China’s steel exports again above 10 million mt in Sept, up 9.2 percent in Jan-Sept” highlights strong export performance driven by weak domestic demand. This contrasts with “China’s crude steel output totals 73.49 million mt in Sept, down 2.9% in Jan-Sept 2025” and “China cuts steel production to 73 million tons in September,” which detail production decreases influenced by holidays and weak market sentiment. These production cuts do not seem to be linked to plant-level activity as suggested by satellite observations.

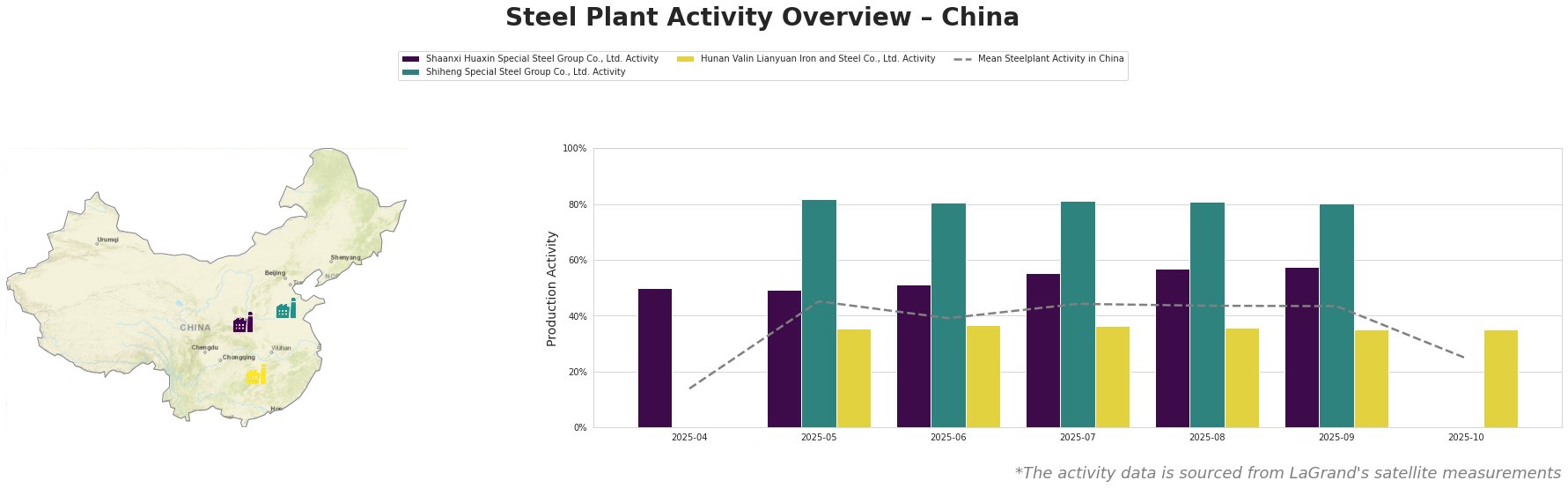

The mean steel plant activity in China peaked in May at 45% and then stabilized between 43-44% from July to September. There was a significant drop to 25% in October, potentially indicating a broader slowdown, though data is limited to a single plant that month.

Shaanxi Huaxin Special Steel Group Co., Ltd., an EAF-based plant with a capacity of 1.2 million tons producing rolled round steel plate and hot-rolled rebar, shows consistently above-average activity. Activity increased steadily from 50% in April to 58% in September. No data is available for October. No direct connection between these activity levels and the provided news articles can be established.

Shiheng Special Steel Group Co., Ltd., an integrated BF/BOF plant with a capacity of 4.65 million tons, specializing in construction steel, exhibited very high and stable activity from May to September (80-82%). No data is available for April or October. No direct connection between these activity levels and the provided news articles can be established.

Hunan Valin Lianyuan Iron and Steel Co., Ltd., an integrated BF/BOF plant with a large 9 million ton capacity and producing high-end products like automotive and pipeline steel, saw relatively low activity from May to September, ranging from 35% to 37%. In October, the activity remained at 35%. No direct connection between these activity levels and the provided news articles can be established.

The article “China’s iron ore imports hit record high in Sept, almost stable in Jan-Sept” highlights the availability of raw materials, despite decreased steel production, but it is unclear to what extent this excess ore is influencing the price of finished products. The PPI decline reported in “China’s steel industry PPI down 8.6 percent in January-September 2025” suggests that demand may not be keeping pace with supply.

Evaluated Market Implications:

The high export volumes coupled with reduced domestic production suggest potential oversupply in certain product segments. The significantly reduced domestic production, as highlighted in “China’s crude steel output totals 73.49 million mt in Sept, down 2.9% in Jan-Sept 2025,” may lead to supply disruptions within China.

- Procurement Action: Steel buyers should capitalize on export opportunities, particularly for products like construction steel where domestic demand is weak. Closely monitor the price fluctuations as reported by the PPI, as further decreases could indicate additional buying opportunities. However, buyers should be wary of relying on Chinese steel if needed for domestic projects in China.