From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineChina Steel Market Strong Despite EU Trade Measures: Baosteel Desheng Activity Surges

China’s steel market remains robust, exhibiting high average plant activity despite new EU trade protection measures. Recent news of “EU Commission introduces anti-dumping measures against two steel derivatives,” “Excess production capacity and protectionism affect European metallurgy,” “Overcapacity, protectionism impact European steel,” “European Commission Unveils Major New Trade Measure to Shield EU Steelmakers Amid Global Overcapacity and Accelerate Green Transition,” “EU underestimates new safeguard measure price impact” and “The market reflects on the EU’s tough trade protection proposal” highlight increasing pressure on the European steel industry. However, satellite data reveals only a limited immediate impact on Chinese steel production levels, suggesting a strong domestic market and alternative export destinations. No direct connection can be established between the EU trade measures and the overall activity levels during the period.

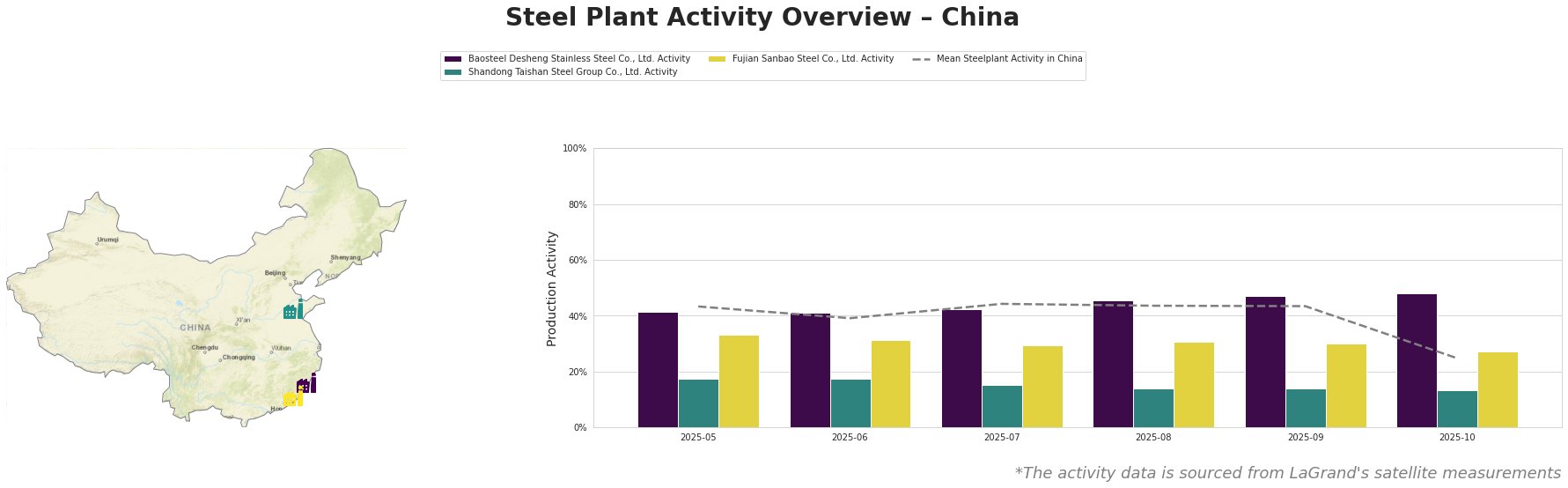

Overall, average steel plant activity in China showed relative stability between May and September 2025, ranging from 39.0% to 44.0%. However, October saw a substantial drop to 25.0%. Baosteel Desheng’s activity increased from 41.0% in May to 48.0% in October. Shandong Taishan Steel Group consistently showed low activity, fluctuating between 13.0% and 18.0%. Fujian Sanbao Steel’s activity ranged from 27.0% to 33.0%.

Baosteel Desheng Stainless Steel Co., Ltd., located in Fujian, operates as an integrated steel plant with a crude steel capacity of 3.41 million tonnes, primarily using BF/BOF technology. The plant’s activity increased throughout the observed period, reaching 48.0% in October, a significant rise from 41.0% in May. Given its focus on stainless steel production, this increased activity may reflect a strategic response to anticipated disruptions in European stainless steel markets, potentially diverting exports or increasing domestic supply. This surge, however, can not be directly connected to the named news articles.

Shandong Taishan Steel Group Co., Ltd., based in Shandong, has a crude steel capacity of 5 million tonnes, operating as an integrated BF/BOF facility, along with EAF capacity. Its activity levels remained consistently low, ranging between 13.0% and 18.0% throughout the observed period. The low activity suggests potential operational adjustments or market shifts, which can not be directly connected to the named news articles.

Fujian Sanbao Steel Co., Ltd., also in Fujian, has a crude steel capacity of 4.62 million tonnes, utilizing BF/BOF technology alongside EAF. Its activity levels remained relatively stable, fluctuating between 27.0% and 33.0%. Given its focus on corrosion-resistant hot-rolled coils and other products for infrastructure and automotive sectors, this stability might reflect consistent demand in these sectors, but has no explicit link to the provided news.

Evaluated Market Implications:

The news articles highlight the increasing protectionism in the European market. The satellite data shows that Baosteel Desheng’s activity increased even as overall Chinese steel plant activity decreased, indicating a possible shift in production focus or market strategy. Given the potential for EU safeguard measures to impact stainless steel supplies, as highlighted in “The market reflects on the EU’s tough trade protection proposal“, steel buyers should secure stainless steel supply contracts from Baosteel Desheng to mitigate risks associated with European market instability. Buyers reliant on Shandong Taishan Steel should explore alternative suppliers due to their sustained low activity. Consider diversified sourcing strategies that incorporate steel producers like Fujian Sanbao Steel, whose consistent activity suggests reliable supply for products like corrosion-resistant coils.