From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineChina Steel Market Shows Production Gains Despite Global Slowdown; Angang Steel Ramps Up Output

China’s steel market presents a mixed outlook as production increases contrast with global declines. According to the news article “Global crude steel production decreased 0.3% year-on-year in April,” China increased crude steel production by 0.4% in the first four months of the year. Satellite data indicates rising activity at Angang Steel Co., Ltd. Bayuquan branch, potentially reflecting this increase, while a concurrent rise in emissions is reported in “Emissions in China’s steel industry increased by 18.3% y/y in April“, though this article does not mention specific producers. No direct relationship could be established between satellite-observed changes in activity at Wugang Zhongjia Iron & Steel and Xiwang Metal Science Technology and any of the provided news articles.

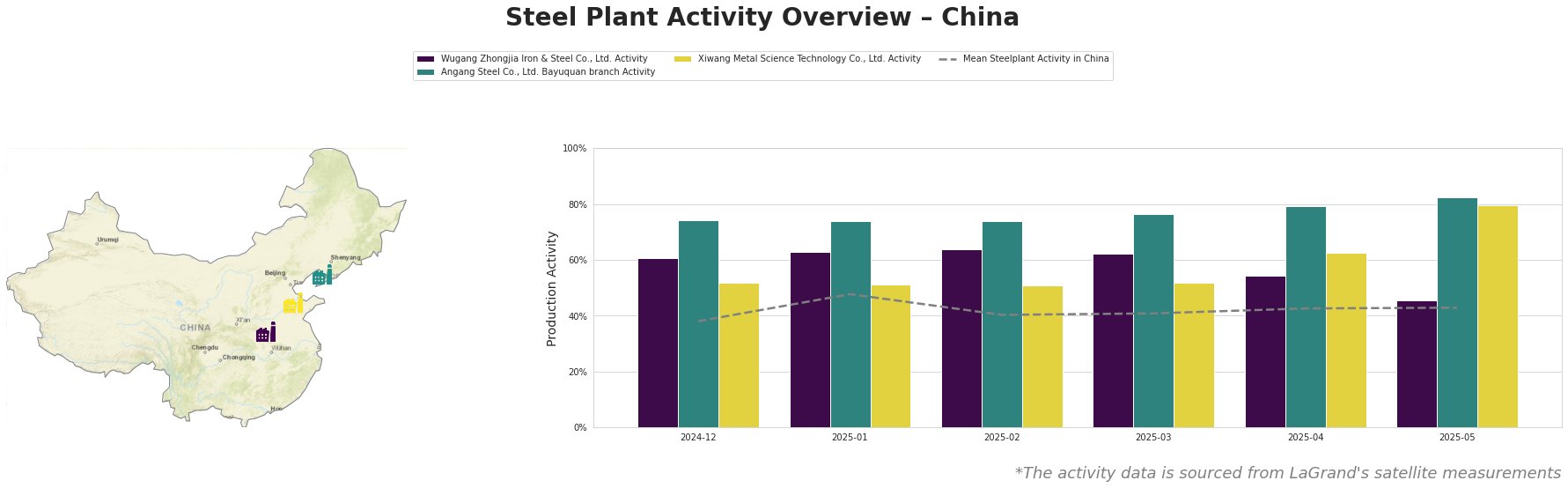

The mean steel plant activity in China fluctuated, reaching a high of 48% in January 2025 and settling at 43% for both April and May 2025. Wugang Zhongjia Iron & Steel Co., Ltd. activity decreased significantly from 64% in February 2025 to 46% in May 2025. Angang Steel Co., Ltd. Bayuquan branch consistently operated at high levels, peaking at 83% in May 2025, substantially above the mean. Xiwang Metal Science Technology Co., Ltd. saw a notable increase in activity, reaching 80% in May 2025, up from around 51% in previous months.

Wugang Zhongjia Iron & Steel Co., Ltd., based in Henan, primarily focuses on ironmaking using blast furnaces, with a capacity of 1220 thousand tons per annum (ttpa). Satellite data shows a decrease in activity, dropping from 61% in December 2024 to 46% in May 2025. Considering the news article “Global pig iron production in April decreased to 117.3 million tons” reported that total pig iron production rose 0.08% year-over-year for January-April, it is possible that localized factors or planned maintenance at Wugang Zhongjia contributed to the observed slowdown. However, no direct connection can be established between the decrease in activity and the provided news articles.

Angang Steel Co., Ltd. Bayuquan branch, located in Liaoning, is an integrated steel plant with a crude steel capacity of 6500 ttpa and iron capacity of 5900 ttpa, utilizing both blast furnaces and BOF. Activity at Angang Steel consistently increased, reaching 83% in May 2025, significantly above the Chinese mean. This increase potentially reflects China’s overall rise in crude steel production as stated in the article “Global crude steel production decreased 0.3% year-on-year in April“.

Xiwang Metal Science Technology Co., Ltd., located in Shandong, has an iron capacity of 2286 ttpa. This plant, using both BOF and EAF processes, produces finished rolled products, including special steel ingots and construction steel. Activity increased substantially to 80% in May 2025 from around 51% in previous months. No direct connection can be established between this rise in activity and the provided news articles.

The observed increase in activity at Angang Steel, coupled with reports of rising emissions as per “Emissions in China’s steel industry increased by 18.3% y/y in April,” suggests a potential surge in production of container steel, pipeline steel and ship plate. Steel buyers should explore opportunities to secure supply contracts with Angang Steel, given its increasing output. Analysts should closely monitor emission trends and potential policy changes in Liaoning Province that might affect Angang’s production in the medium term. The decrease in activity at Wugang Zhongjia may lead to localized supply constraints for crude steel. Buyers reliant on this plant should diversify their sourcing to mitigate potential disruptions.