From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineChina Steel Market Shows Mixed Signals: Output Up, Prices Down, Rebar Production Declines

China’s steel market presents a complex picture in June 2025. While crude steel production rose, finished steel prices saw slight declines. According to “China’s crude steel production and stocks rose 3.2% in early June,” average daily crude steel output increased. This rise contrasts with reports of decreasing prices, as noted in “MOC: Average steel prices in China decline slightly in Jun 2-8“, showing a downward trend. The activity level of Guangdong Yuebei United Steel Co., Ltd. aligns with “China’s crude steel production and stocks rose 3.2% in early June,” suggesting this plant contributed to the overall increase in national steel production, especially during May.

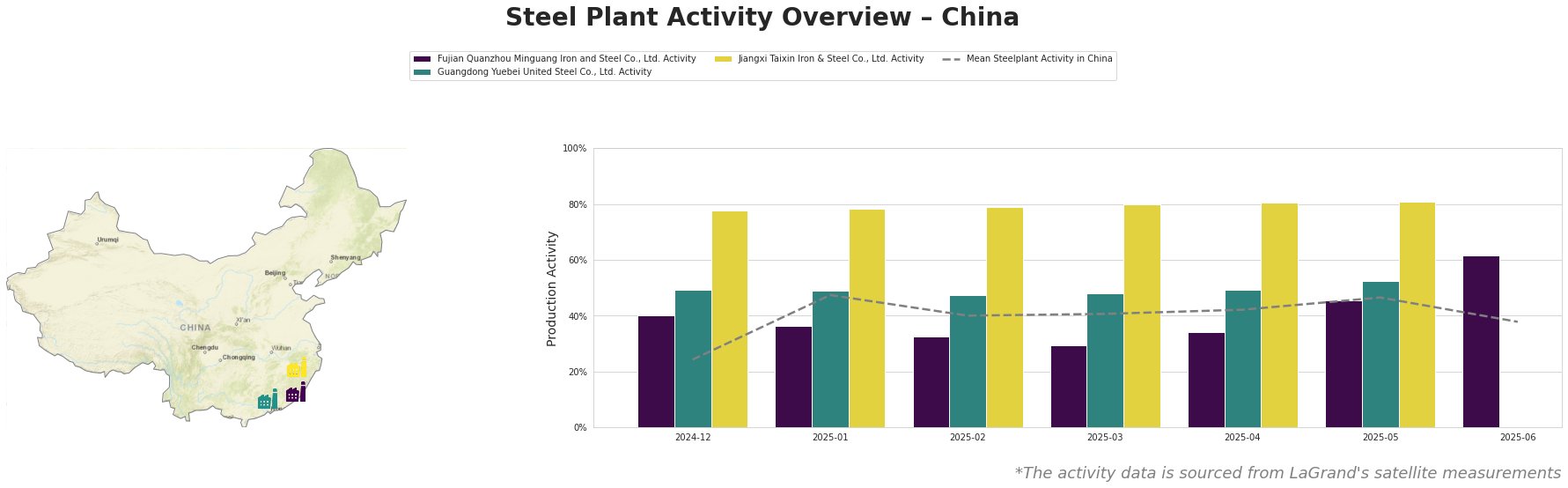

The mean steel plant activity in China fluctuated between 24.0% in December 2024 and 47.0% in January and May 2025. In June 2025, the mean activity dropped to 38.0%. Fujian Quanzhou Minguang Iron and Steel Co., Ltd. saw a significant increase in activity in June, reaching 62.0%, up from 45.0% in May. Guangdong Yuebei United Steel Co., Ltd.’s activity remained relatively stable, fluctuating between 47.0% and 53.0% from February to May, but data is missing for June. Jiangxi Taixin Iron & Steel Co., Ltd. maintained high activity levels, ranging from 78.0% to 81.0% throughout the observed period.

Fujian Quanzhou Minguang Iron and Steel Co., Ltd., an integrated BF-based plant with a crude steel capacity of 2.55 million tons, produces finished rolled products like round bar, high-speed bar, coiled rebar, and wire rod. The plant’s activity increased substantially to 62% in June 2025 from 45% in May. This increase does not seem directly correlated with any of the provided news articles; however, this rise in activity could be a reaction to the drop of “Stocks of main finished steel products in China down 1.0% in early June,” to ensure a high steel output.

Guangdong Yuebei United Steel Co., Ltd., another integrated BF-based plant but with both BOF and EAF processes and a crude steel capacity of 2 million tons, focuses on rebar production for the building and infrastructure sectors. Its activity remained steady from February to May, hovering around 47% to 53%. The lack of data for June prevents direct analysis of its current operational status.

Jiangxi Taixin Iron & Steel Co., Ltd., an EAF-based plant with a crude steel capacity of 1 million tons, specializes in wire and rod production. The plant consistently operated at high activity levels (78% to 81%) throughout the observed period, indicating stable production. No direct correlation with the provided news articles can be established for this specific plant’s sustained high activity.

Given the decrease of rebar production reported in “China’s rebar output down 1.6 percent in January-May,” steel buyers should closely monitor the output of plants like Guangdong Yuebei United Steel Co., Ltd. Procurement professionals should prioritize securing rebar supplies from alternative sources to mitigate potential shortages, especially because the activity level for Guangdong Yuebei United Steel Co., Ltd. is unknown for June. Since “NBS: Local Chinese rebar prices down 1.0 percent in early June” shows a decrease in rebar prices, this would be the time to procure more stock of rebar. The rise in activity at Fujian Quanzhou Minguang Iron and Steel Co., Ltd. indicates a potential increase in supply of other finished rolled products such as round bars and wire rods.